The Consumers’ Foundation yesterday said the deposit agreements at eight out of 10 banks it surveyed were unfair to depositors because they set overly high minimum deposits for accrued interest.

The foundation said it conducted a survey of the application documents for opening deposit accounts at 10 banks last month, and discovered that eight of the deposit agreements contained several rules that are unfavorable to depositors and beneficial to the banks.

The foundation’s report revealed that these eight banks required depositors to have at least NT$10,000 (US$333) in their savings accounts to receive interest, while one bank required NT$5,000. Five banks also stipulated that interest would be given based on units of NT$100.

The two rules are unfair to depositors, the foundation said, adding that although the loss to individual depositors is small, the total benefits for banks is huge.

For example, if a depositor has only NT$9,999 in their savings account, they would not get any interest on their deposit if the minimum amount to collect interest is set at NT$10,000, the foundation said. In addition, if a customer has NT$10,099 in the savings account, they would not be receiving interest from the additional NT$99 because the interest is calculated in units of NT$100.

Foundation chairwoman Joann Su (蘇錦霞) said banks should set a lower level for minimum deposits.

In addition, the foundation said seven of the banks surveyed would render savings accounts inactive if the amount deposited falls below the minimum requirement, while three banks would also not inform depositors if they did so.

The foundation also found six banks to have rules that are unfavorable to depositors on accounting errors. In the case of a dispute between a customer and the bank, two banks require that depositors provide evidence of the bank’s mistake or else the bank will be regarded as faultless, while four banks require that depositors address an objection within seven to 14 days or else the bank will admit no error.

Such unfair agreements should be invalid, because according to the Consumer Protection Act (消費者保護法), banks have an obligation to prove their service has been error free instead of asking depositors to give proof of a mistake, Su said, adding that giving a limited window for depositors to raise an objection is too harsh.

The foundation urged the Financial Supervisory Commission’s Banking Bureau to strengthen rules to protect consumers, and urged banks to modify their application agreements.

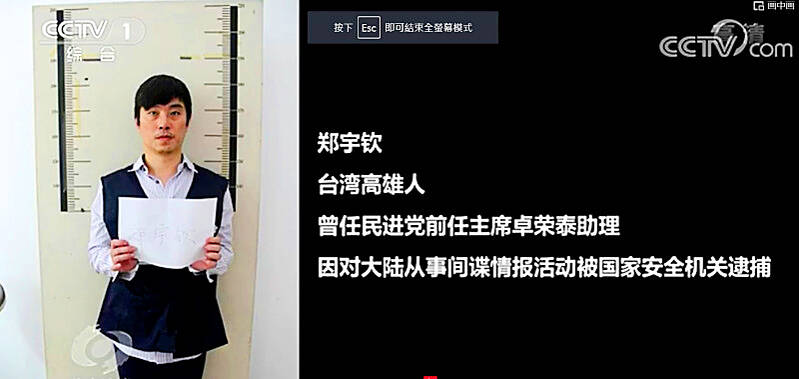

Former Czech Republic-based Taiwanese researcher Cheng Yu-chin (鄭宇欽) has been sentenced to seven years in prison on espionage-related charges, China’s Ministry of State Security announced yesterday. China said Cheng was a spy for Taiwan who “masqueraded as a professor” and that he was previously an assistant to former Cabinet secretary-general Cho Jung-tai (卓榮泰). President-elect William Lai (賴清德) on Wednesday last week announced Cho would be his premier when Lai is inaugurated next month. Today is China’s “National Security Education Day.” The Chinese ministry yesterday released a video online showing arrests over the past 10 years of people alleged to be

THE HAWAII FACTOR: While a 1965 opinion said an attack on Hawaii would not trigger Article 5, the text of the treaty suggests the state is covered, the report says NATO could be drawn into a conflict in the Taiwan Strait if Chinese forces attacked the US mainland or Hawaii, a NATO Defense College report published on Monday says. The report, written by James Lee, an assistant research fellow at Academia Sinica’s Institute of European and American Studies, states that under certain conditions a Taiwan contingency could trigger Article 5 of NATO, under which an attack against any member of the alliance is considered an attack against all members, necessitating a response. Article 6 of the North Atlantic Treaty specifies that an armed attack in the territory of any member in Europe,

LIKE FAMILY: People now treat dogs and cats as family members. They receive the same medical treatments and tests as humans do, a veterinary association official said The number of pet dogs and cats in Taiwan has officially outnumbered the number of human newborns last year, data from the Ministry of Agriculture’s pet registration information system showed. As of last year, Taiwan had 94,544 registered pet dogs and 137,652 pet cats, the data showed. By contrast, 135,571 babies were born last year. Demand for medical care for pet animals has also risen. As of Feb. 29, there were 5,773 veterinarians in Taiwan, 3,993 of whom were for pet animals, statistics from the Animal and Plant Health Inspection Agency showed. In 2022, the nation had 3,077 pediatricians. As of last

XINJIANG: Officials are conducting a report into amending an existing law or to enact a special law to prohibit goods using forced labor Taiwan is mulling an amendment prohibiting the importation of goods using forced labor, similar to the Uyghur Forced Labor Prevention Act (UFLPA) passed by the US Congress in 2021 that imposed limits on goods produced using forced labor in China’s Xinjiang region. A government official who wished to remain anonymous said yesterday that as the US customs law explicitly prohibits the importation of goods made using forced labor, in 2021 it passed the specialized UFLPA to limit the importation of cotton and other goods from China’s Xinjiang Uyghur region. Taiwan does not have the legal basis to prohibit the importation of goods