A proposed luxury tax that the Cabinet hopes to implement on July 1 will not fix the unjust tax system, and the government should tax capital gains by rich people while alleviating the burden on ordinary wage earners, who account for more than 70 percent of tax revenue, academics said yesterday.

Cheng Li-chun (鄭麗君), executive director of Taiwan Thinktank, which organized the event, said that while Taiwan’s economy had undergone a “miracle,” globalization had had a structural impact on industries, employment and the population.

“Among the many problems is the widening gap between rich and poor,” she said. “While rich people spend money on expensive cars and mansions, children from the lower [economic] stratum of society cannot afford school lunches.”

Facing a widening wealth gap, the administration of President Ma Ying-jeou (馬英九) recently proposed a luxury tax as a means to redress the inequality.

Cheng had doubts about the effectiveness of such a measure.

“This is like trying to kill a bull with a Swiss Army knife,” she said. “The biggest problem with this government is that it cannot get rich people to pay taxes. Unless it can find a way to make them pay more, the tax system will remain unfair.”

In addition to having their capital gains taxed, the nation’s wealthiest should shoulder the social responsibility of taking care of those who are less fortunate, Cheng said, adding that rich people should pay more taxes to ease the burden of ordinary wage earners.

Finally, the money collected from the rich could be used for investment in human resources and social welfare, she said.

Lue Jen-der (呂建德), a professor of social welfare at National Chung Cheng University, called the luxury tax a policy of “shame-kindness.”

Su Jain-rong (蘇建榮), a professor of public finance at National Taipei University, said the luxury tax was a front the Ma administration used to conceal a failure to deliver on its political promise of tax reform.

The administration said only those buying expensive items such as yachts and private jets exceeding NT$500,000 (US$16,800) would be taxed, but Su said those who can afford those luxuries usually buy them abroad and therefore would not submit to taxation.

Wang Jung-chang (王榮璋), convener of the Alliance for a Fair Tax Reform, said that while the money made by the nation’s 9 million wage earners makes up only 44.5 percent of GDP, they are paying 72.34 percent of the overall taxes.

“Does the administration really think they are unhappy because they see rich people buy expensive cars or fur coats?” he asked. “They are unhappy because the rich people are not paying taxes.”

While Ma said he would address the wealth gap with tax reform and social welfare, Wang said he has not seen any concrete or effective measure.

“On tax reform, he has proposed only the luxury tax,” he said. “Stupid. That is not the reform we want.”

Wang also expressed concern over increasing public debt, saying the government was estimated to have outstanding debt of NT$4.96 trillion this year and a potential debt of NT$19 trillion.

The administration continues to cut taxes and borrow more money, he said, adding that the interest accrued from public debt this year was about NT$132 billion, which accounts for 7.4 percent of the government’s annual expenditure.

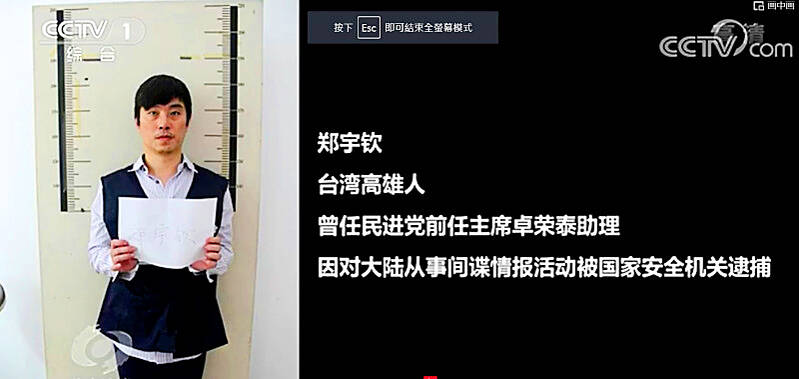

Former Czech Republic-based Taiwanese researcher Cheng Yu-chin (鄭宇欽) has been sentenced to seven years in prison on espionage-related charges, China’s Ministry of State Security announced yesterday. China said Cheng was a spy for Taiwan who “masqueraded as a professor” and that he was previously an assistant to former Cabinet secretary-general Cho Jung-tai (卓榮泰). President-elect William Lai (賴清德) on Wednesday last week announced Cho would be his premier when Lai is inaugurated next month. Today is China’s “National Security Education Day.” The Chinese ministry yesterday released a video online showing arrests over the past 10 years of people alleged to be

THE HAWAII FACTOR: While a 1965 opinion said an attack on Hawaii would not trigger Article 5, the text of the treaty suggests the state is covered, the report says NATO could be drawn into a conflict in the Taiwan Strait if Chinese forces attacked the US mainland or Hawaii, a NATO Defense College report published on Monday says. The report, written by James Lee, an assistant research fellow at Academia Sinica’s Institute of European and American Studies, states that under certain conditions a Taiwan contingency could trigger Article 5 of NATO, under which an attack against any member of the alliance is considered an attack against all members, necessitating a response. Article 6 of the North Atlantic Treaty specifies that an armed attack in the territory of any member in Europe,

LIKE FAMILY: People now treat dogs and cats as family members. They receive the same medical treatments and tests as humans do, a veterinary association official said The number of pet dogs and cats in Taiwan has officially outnumbered the number of human newborns last year, data from the Ministry of Agriculture’s pet registration information system showed. As of last year, Taiwan had 94,544 registered pet dogs and 137,652 pet cats, the data showed. By contrast, 135,571 babies were born last year. Demand for medical care for pet animals has also risen. As of Feb. 29, there were 5,773 veterinarians in Taiwan, 3,993 of whom were for pet animals, statistics from the Animal and Plant Health Inspection Agency showed. In 2022, the nation had 3,077 pediatricians. As of last

XINJIANG: Officials are conducting a report into amending an existing law or to enact a special law to prohibit goods using forced labor Taiwan is mulling an amendment prohibiting the importation of goods using forced labor, similar to the Uyghur Forced Labor Prevention Act (UFLPA) passed by the US Congress in 2021 that imposed limits on goods produced using forced labor in China’s Xinjiang region. A government official who wished to remain anonymous said yesterday that as the US customs law explicitly prohibits the importation of goods made using forced labor, in 2021 it passed the specialized UFLPA to limit the importation of cotton and other goods from China’s Xinjiang Uyghur region. Taiwan does not have the legal basis to prohibit the importation of goods