Retired junior high school teacher, Mrs Lin (林) watches TV every day and depends heavily on her cable TV service, so imagine her frustration when the cable service, for which she pays NT$550 a month, suddenly stopped working.

“I called the company and complained about the problem,” said Lin, a resident in Taipei City’s Shihlin (士林) District. “I dialed into this complicated voice system, where you had to listen to the instructions very carefully. If you missed one step, you had to do it all over again. It took me a while before I could talk to a customer service representative.”

Her cable service was not restored until the next day, she said.

“If there were more cable television operators in our district, we could compare prices and services,” she said. “So far, this service is the only one available to us.”

Mrs Kuo (郭) in Taoyuan County had a similar experience when she needed to call the cable operator to ask for information.

“Nowadays, I spend more time downloading movies or TV series online than watching programs on TV,” she said. “There is really not much to watch on TV.”

The issues facing Lin and Kuo, as well as the nation’s other 5 million cable TV subscribers could soon be addressed because the National Communications Commission (NCC) is planning to redefine cable TV service areas and give interested new players an opportunity to enter the market.

According to the NCC, its plan to amend the Cable Television Act (有線廣播電視法) would enable cable service providers to expand their operations nationwide, provided that the number of subscribers does not exceed one-third of the total nationwide.

The main reason for redefining the service area and amending the act is to end existing monopolies in nearly all service areas across the nation, it said.

Two small service areas could become one big new service area with two or more competitors in the field, making it difficult for any single player to monopolize the market, the NCC added.

In November last year, the NCC approved Dafu Media’s (大富媒體) -purchase of cable systems owned by the multiple system operator (MSO) Kbro Co (凱擘).

Dafu was created by Richard Tsai (蔡明興) and Daniel Tsai (蔡明忠), who also serve as chairman and president of Taiwan Mobile Co (台灣大哥大), the second-largest telecom carrier in Taiwan. National Communications Commission (NCC) spokesperson Chen Jeng-chang (陳正倉) said the NCC granted approval after Dafu set the goal of having 50 percent of its subscribers use digital cable service by 2015, the same goal that the Executive Yuan has set for the nation, he said.

“The commission hoped that Dafu would take the lead in the industry to encourage more cable system operators to offer digital cable service,” Chen said.

In addition to the Dafu-Kbro deal, media reports indicate that Want Want Group (旺旺集團) has purchased China Network Systems (CNS, 中嘉), the second-largest MSO in the nation. CNS will have to apply to the NCC for a change of ownership before it can finalize the deal.

Roy Lee (李淳), an associate research fellow at the Taiwan WTO Center at the Chunghwa Institution for Economic Research, said it is “very possible” that the NCC would use the two guiding principles outlined in Dafu’s commitments as it reviews the CNS buyout — that Dafu would not abuse its status as a dominant market player by putting up obstacles to competition among different communication platforms and that it would make specific promises on the provision of digital cable TV service.

Although the NCC lacks the legal tools to impose these principles on Dafu, it suggested the company make those commitments voluntarily to secure approval for the deal, he said.

The Dafu-Kbro deal also sheds light on how little progress the nation has made in terms of introducing a digital cable service, despite the huge amount of capital that has been brought to the nation by private equity funds since 2005.

Over the past five years, the cable service market has been dominated by five major MSOs, including Kbro, CNS, Taiwan Broadband Communications (台灣寬頻, TBC), Taiwan Fixed Network (台固媒體) and the Taiwan Infrastructure Technology Company (台灣數位光訊).

Kbro, CNS and TBC are backed by foreign investors, who hold about 60 percent of the subscribers nationwide.

Statistics from NCC indciate that the penetration rate of the digital cable service is about 7 percent. When examining the data year by year, the penetration rate was 3.59 percent in 2007, 4.06 percent in 2008, and 4.5 percent in 2009.

Luo Shih-hung (羅世宏) of National Chung Cheng University said it was never the intention of these overseas investors to raise the penetration rate.

“They were hunting around the world for potential targets to invest in,” Luo said. “Unfortunately, Taiwan’s cable service market appeared on their radar screen and eventually became their prey.”

Luo said the return on the investment in the nation’s cable service market is estimated to be between 20 and 30 percent.

“This is essentially a profit--guaranteed business,” he said. “You start by borrowing money from the bank and use the money to invest in cable operators, who have a steady cash flow from the monthly subscription fees. What’s even better is that virtually all the operators enjoy a monopoly in their service areas. There is no need to upgrade the facilities because there is no competition.”

A former NCC official, who spoke on condition of anonymity, said that allowing foreign investors to enter the cable service market was a big mistake. It was almost impossible to ask them to offer digital service, he said.

Other than terminating the service area monpolies, the fact that the commission asked Kbro and CNS in 2008 to reduce the endorsed guarantees borne by cable operators in their systems by 20 percent within two years as an important condition of license renewal could also be another reason why foreign investors want to withdraw, he said. These policy changes will not only reduce their profits it will alter their capital structures, he said.

“In the long run, you want someone who is serious about having a sustainable business rather than someone who is good at using leverage,” he said.

Lee, however, argued that simply blaming foreign investors for the low penetration rate of digital service is rash.

“Five years ago, none of the local conglomerates were interested in entering the cable service market because of the complicated dealings between cable operators and the channels,” Lee said. “These foreign investors came, brought in corporate management styles and changed the environment. Local conglomerates want to take over because the operational risks are relatively lower now.”

Lee added there is another structural factor explaining why the penetration rate was so low.

“Consumers in Taiwan are already used to the business model where you can watch 100 or more channels on cable by paying a fixed rate of about NT$500 per month, and that is the biggest obstacle [to raising the penetration rate],” he said, adding that more empirical evidence is needed before concluding that the private equity funds are indeed at fault.

Former Financial Supervisory Commission chairman Shih Jun-ji (施俊吉) has questioned whether Dafu can really live up to its promises to the NCC. According to Shih, Dafu secured a NT$54 billion (US$1.84 billion) loan from the banks. A bulk of the monthly fees that subscribers pay would be used to pay back the loan and the interest, he said, adding that the remaining sum, along with the fees collected from the advertisers and channel operators, is needed to cover content authorization fees as well as the network maintenance and personnel costs. Not much is left to upgrade facilities or buy high-quality programs, he said. Neither can the channel operators benefit from the deal, he added.

“The channels are not likely to obtain more content authorization fees from it [Dafu Media], which the channels needs to produce quality programming,” he said. “And trying to retain subscribers, it [Dafu] will continue all the unfair practices that allow them to control the media platform.”

Despite these concerns, some channel operators remain upbeat about the future of the cable service market.

Cable operators need programs and channel operators need access to reach the audience, said May Chen (陳依玫), chairwoman of the self-disciplinary committee of the Satellite Broadcast Television Association (STBA).

She said some of the MSOs had access to more than 1 million subscribers, which they use as bargaining chips to ask the channels to cut or give discounts on content authorization fees. Channels wanting to reach a bigger audiences have little choice but to accept that arrangement, which explains shrinking content-generated revenues, she said.

Axing content authorization fees will only force channels to produce programs with good TV ratings, which in turn help boost advertising revenues. However, those are not necessarily the high-quality programs people expect, she said.

“The need to increase ratings is behind nearly all the abnormal media practices you see nowadays, which is why we need to have a self--disciplinary committee,” Chen said. “Advertising revenue now accounts for 80 to 90 percent of revenues in TV stations. If we could depend less on advertising revenue and be compensated more from content authorization fees, maybe there would be a way to end this vicious circle.”

Former president Ma Ying-jeou’s (馬英九) mention of Taiwan’s official name during a meeting with Chinese President Xi Jinping (習近平) on Wednesday was likely a deliberate political play, academics said. “As I see it, it was intentional,” National Chengchi University Graduate Institute of East Asian Studies professor Wang Hsin-hsien (王信賢) said of Ma’s initial use of the “Republic of China” (ROC) to refer to the wider concept of “the Chinese nation.” Ma quickly corrected himself, and his office later described his use of the two similar-sounding yet politically distinct terms as “purely a gaffe.” Given Ma was reading from a script, the supposed slipup

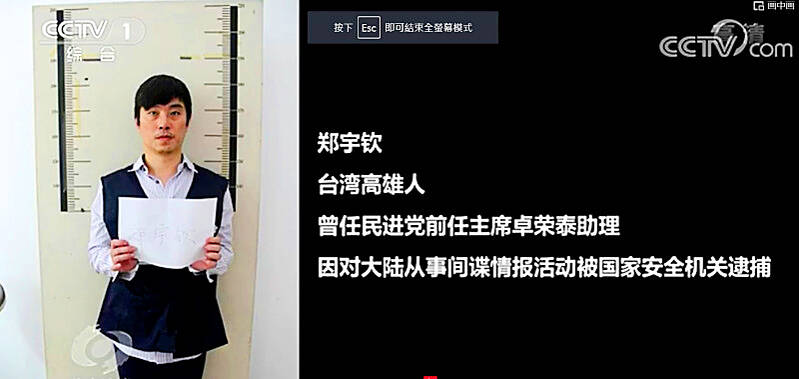

Former Czech Republic-based Taiwanese researcher Cheng Yu-chin (鄭宇欽) has been sentenced to seven years in prison on espionage-related charges, China’s Ministry of State Security announced yesterday. China said Cheng was a spy for Taiwan who “masqueraded as a professor” and that he was previously an assistant to former Cabinet secretary-general Cho Jung-tai (卓榮泰). President-elect William Lai (賴清德) on Wednesday last week announced Cho would be his premier when Lai is inaugurated next month. Today is China’s “National Security Education Day.” The Chinese ministry yesterday released a video online showing arrests over the past 10 years of people alleged to be

The bodies of two individuals were recovered and three additional bodies were discovered on the Shakadang Trail (砂卡礑) in Taroko National Park, eight days after the devastating earthquake in Hualien County, search-and-rescue personnel said. The rescuers reported that they retrieved the bodies of a man and a girl, suspected to be the father and daughter from the Yu (游) family, 500m from the entrance of the trail on Wednesday. The rescue team added that despite the discovery of the two bodies on Friday last week, they had been unable to retrieve them until Wednesday due to the heavy equipment needed to lift

MIX-UP: Kaohsiung Municipal Min-Sheng Hospital director Yen Chia-chi was suspended from his duties after surgeons operated on the wrong patient last week The Kaohsiung Department of Health yesterday fined Kaohsiung Municipal Min-Sheng Hospital NT$500,0000 for misidentifying two patients and consequently causing one of them to undergo the wrong surgery last week. The hospital’s director Yen Chia-chi (顏家祺) was suspended from his duties. The surgeon who was scheduled to operate on the patient was given a major demerit and is subject to subsequent disciplinary actions. Demerits were given to the anesthesiologist, the nurse in the operation room, the nurse in the ward and the worker who helped transfer the patient from the ward to the operation room for having failed to verify the patient’s identity. Meanwhile, the