Negotiations between Taiwan and China on the signing of three financial memorandums of understanding (MOUs) are nearly complete, Mainland Affairs Council Chairwoman Lai Shin-yuan (賴幸媛) said.

Establishing MOUs on cross-strait cooperation in the supervision and regulation of banking, insurance, securities and futures has been a main focus for Taiwan’s financial authorities since a financial cooperation agreement with China was signed in Nanjing on April 26 during the third round of talks between Straits Exchange Foundation Chairman Chiang Pin-kung (江丙坤) and his Chinese counterpart, Association for Relations Across the Taiwan Strait Chairman Chen Yunlin (陳雲林).

The MOUs are essential before qualified domestic institutional investors from China can invest in Taiwanese stocks.

In an interview with the Central News Agency on Thursday, Lai said the two sides had made significant progress in their discussions on the MOUs over the past months, making it likely the documents will be signed soon.

Lai said the two sides had not decided on the date and venue for the next round of Chiang-Chen talks, but they were expected to take place before the end of the year.

Issues expected to be on the agenda of the fourth round of talks are fishery cooperation; agricultural quarantine inspections; standards, inspections and certification for industrial products; and preventing double taxation, Lai said.

Other issues that might be included are investment protection, intellectual property rights protection, trade dispute mediation and express customs clearance, she said, adding that the proposal to sign a cross-strait economic cooperation framework agreement might also be raised for discussion if the necessary preparatory work is completed before the talks begin.

On the opening of Chinese investment in Taiwan, Lai said that since June 30, the government has liberalized 192 areas for investment in the manufacturing, service and public construction sectors. These sectors make up 25 percent of the total areas targeted for liberalization.

So far, seven Chinese airline companies and one computer firm have obtained the government’s approval to invest in Taiwan, she said.

Lai said that the areas open to Chinese capital are non-sensitive and that Chinese investors are not allowed to bid for public construction projects.

To prevent property speculation, Chinese investors who buy residential property in Taiwan are forbidden from transferring the property within three years of purchase, Lai said.

Addressing objections by the Democratic Progressive Party to the liberalization policy, she said that the government had not sacrificed the country’s sovereignty when promoting relations with China.

Former president Ma Ying-jeou’s (馬英九) mention of Taiwan’s official name during a meeting with Chinese President Xi Jinping (習近平) on Wednesday was likely a deliberate political play, academics said. “As I see it, it was intentional,” National Chengchi University Graduate Institute of East Asian Studies professor Wang Hsin-hsien (王信賢) said of Ma’s initial use of the “Republic of China” (ROC) to refer to the wider concept of “the Chinese nation.” Ma quickly corrected himself, and his office later described his use of the two similar-sounding yet politically distinct terms as “purely a gaffe.” Given Ma was reading from a script, the supposed slipup

The bodies of two individuals were recovered and three additional bodies were discovered on the Shakadang Trail (砂卡礑) in Taroko National Park, eight days after the devastating earthquake in Hualien County, search-and-rescue personnel said. The rescuers reported that they retrieved the bodies of a man and a girl, suspected to be the father and daughter from the Yu (游) family, 500m from the entrance of the trail on Wednesday. The rescue team added that despite the discovery of the two bodies on Friday last week, they had been unable to retrieve them until Wednesday due to the heavy equipment needed to lift

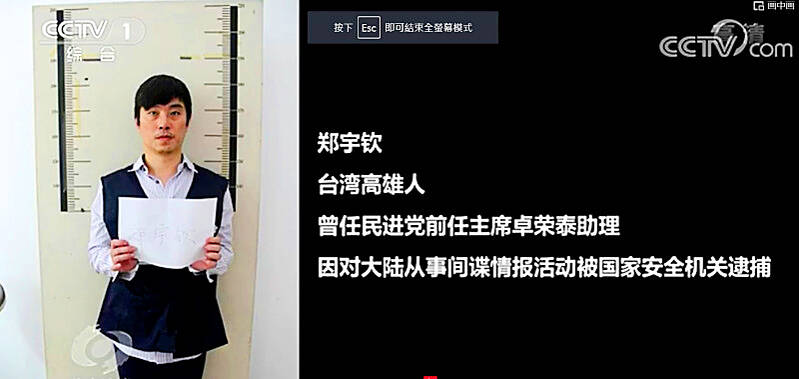

Former Czech Republic-based Taiwanese researcher Cheng Yu-chin (鄭宇欽) has been sentenced to seven years in prison on espionage-related charges, China’s Ministry of State Security announced yesterday. China said Cheng was a spy for Taiwan who “masqueraded as a professor” and that he was previously an assistant to former Cabinet secretary-general Cho Jung-tai (卓榮泰). President-elect William Lai (賴清德) on Wednesday last week announced Cho would be his premier when Lai is inaugurated next month. Today is China’s “National Security Education Day.” The Chinese ministry yesterday released a video online showing arrests over the past 10 years of people alleged to be

MIX-UP: Kaohsiung Municipal Min-Sheng Hospital director Yen Chia-chi was suspended from his duties after surgeons operated on the wrong patient last week The Kaohsiung Department of Health yesterday fined Kaohsiung Municipal Min-Sheng Hospital NT$500,0000 for misidentifying two patients and consequently causing one of them to undergo the wrong surgery last week. The hospital’s director Yen Chia-chi (顏家祺) was suspended from his duties. The surgeon who was scheduled to operate on the patient was given a major demerit and is subject to subsequent disciplinary actions. Demerits were given to the anesthesiologist, the nurse in the operation room, the nurse in the ward and the worker who helped transfer the patient from the ward to the operation room for having failed to verify the patient’s identity. Meanwhile, the