The legislature yesterday passed an amendment to the Real Estate Securitization Act (不動產證券化條例) that would expand the options for securitizing real estate, answering a longstanding call by the construction industry to energize the sector.

The amendment to the Act allows development real estate and real-estate-related rights to be securitized. It also increases protection of investors’ rights, promotes the development of real estate securitization and simplifies administrative procedures for securization.

According to the Financial Supervisory Committee (FSC), since the Act came into force in July 2003, nine applications for real estate asset trusts had been approved, with a total worth of NT$21.682 billion (US$655.3 million). Eight applications for real estate investment trusts were approved for a total value of NT$56.1 billion.

The amendment will help channel private funds and Chinese capital to the nearly NT$4 trillion “i-Taiwan” 12 infrastructure projects, one of President Ma Ying-jeou’s (馬英九) campaign pledges, Chinese Nationalist Party (KMT) Legislator Lo Shu-lei (羅淑蕾) said.

Real estate securitization involves selling shares in the ownership of property.

Meanwhile, the legislature passed an amendment to the Income Tax Act (所得稅法) that it said would help 60,000 businesses currently making losses weather economic difficulties.

The Act stated that the losses incurred in a tax year by an enterprise may be offset against income earned the following tax year over a period not exceeding five years.

Legislators across party lines agreed to extend the period to 10 years.

KMT Legislator Lu Shiow-yen (盧秀燕) said the amendment was tantamount to a tax cut for businesses and would help sectors such as the dynamic random access memory (DRAM) industry and flat-panel manufacturers, which have been hard hit by the global slowdown.

Also yesterday, the legislature abolished the Anti-Hoodlum Act (檢肅流氓條例), which had been ruled unconstitutional by the Council of Grand Justices based on human rights concerns.

The Act, enacted in 1985, will become invalid on Feb. 1.

An amendment to the Tax Collection Act (稅捐稽徵法) was also passed yesterday to remove a time limit on claiming tax refunds for overpayment if a mistake has been made by the government.

Current regulations allowed taxpayers to claim a refund within five years of the mistake.

The legislature had yet to pass an amendment to the Corporation Law (公司法) that would have required firms that receive more than NT$1 billion in aid from the government to submit their restructuring plans to the legislature for review and would have allowed government agencies that oversee the bailout funds to impose limits on compensation for corporate executives.

KMT Legislator Daniel Hwang (黃義交) said the amendment was expected to pass the legislature on Friday, as the KMT caucus yesterday cleared the doubts of the Council of Economic Planning Development.

“The council officials worry that businesses might be forced to reveal their business secrets during a legislative review, but in fact, they would still be allowed to hold back vital information,” Hwang said.

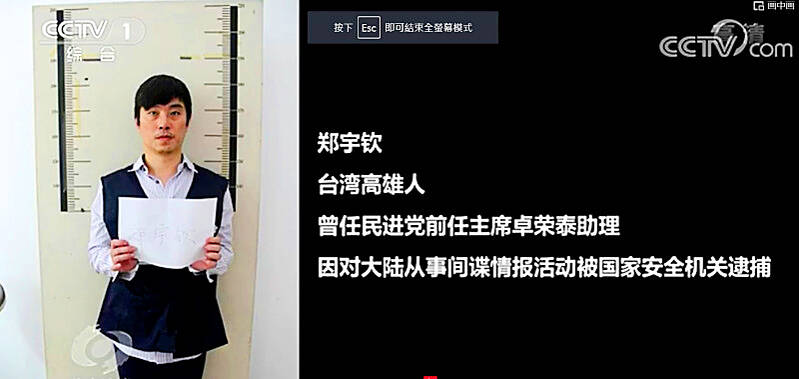

Former Czech Republic-based Taiwanese researcher Cheng Yu-chin (鄭宇欽) has been sentenced to seven years in prison on espionage-related charges, China’s Ministry of State Security announced yesterday. China said Cheng was a spy for Taiwan who “masqueraded as a professor” and that he was previously an assistant to former Cabinet secretary-general Cho Jung-tai (卓榮泰). President-elect William Lai (賴清德) on Wednesday last week announced Cho would be his premier when Lai is inaugurated next month. Today is China’s “National Security Education Day.” The Chinese ministry yesterday released a video online showing arrests over the past 10 years of people alleged to be

THE HAWAII FACTOR: While a 1965 opinion said an attack on Hawaii would not trigger Article 5, the text of the treaty suggests the state is covered, the report says NATO could be drawn into a conflict in the Taiwan Strait if Chinese forces attacked the US mainland or Hawaii, a NATO Defense College report published on Monday says. The report, written by James Lee, an assistant research fellow at Academia Sinica’s Institute of European and American Studies, states that under certain conditions a Taiwan contingency could trigger Article 5 of NATO, under which an attack against any member of the alliance is considered an attack against all members, necessitating a response. Article 6 of the North Atlantic Treaty specifies that an armed attack in the territory of any member in Europe,

LIKE FAMILY: People now treat dogs and cats as family members. They receive the same medical treatments and tests as humans do, a veterinary association official said The number of pet dogs and cats in Taiwan has officially outnumbered the number of human newborns last year, data from the Ministry of Agriculture’s pet registration information system showed. As of last year, Taiwan had 94,544 registered pet dogs and 137,652 pet cats, the data showed. By contrast, 135,571 babies were born last year. Demand for medical care for pet animals has also risen. As of Feb. 29, there were 5,773 veterinarians in Taiwan, 3,993 of whom were for pet animals, statistics from the Animal and Plant Health Inspection Agency showed. In 2022, the nation had 3,077 pediatricians. As of last

XINJIANG: Officials are conducting a report into amending an existing law or to enact a special law to prohibit goods using forced labor Taiwan is mulling an amendment prohibiting the importation of goods using forced labor, similar to the Uyghur Forced Labor Prevention Act (UFLPA) passed by the US Congress in 2021 that imposed limits on goods produced using forced labor in China’s Xinjiang region. A government official who wished to remain anonymous said yesterday that as the US customs law explicitly prohibits the importation of goods made using forced labor, in 2021 it passed the specialized UFLPA to limit the importation of cotton and other goods from China’s Xinjiang Uyghur region. Taiwan does not have the legal basis to prohibit the importation of goods