The Alliance for Fair Tax Reform (AFTR) yesterday challenged the General Chamber of Commerce of the Republic of China (ROCCOC) and the Chinese National Federation of Industries (CNFI) — both advocates of a tax reform that the alliance considers unfair — to a public debate.

“Large corporations have been advocating tax cuts, saying that tax cuts would save their businesses and help them invest more to turnaround the economy,” alliance convener Wang Jung-chang (王榮璋) told reporters outside the building in Taipei where the ROCCOC and CNFI headquarters are located, while delivering an invitation to the debate to the two organizations.

“A bill to reduce the inheritance tax to 10 percent has already passed [the initial review] in the legislature,” Wang said. “But have these business leaders made any concrete investment plans?”

The tax laws state that inheritance tax may be as much as 50 percent of the value of inherited assets.

Lin Lu-hung (林綠紅), a member of Taiwan Women’s Link, voiced her concern that the tax breaks would result in a cut in welfare spending.

“Since President Ma Ying-jeou [馬英九] took office on May 20, the government has introduced several tax break programs that will lead to a NT$120 billion [US$3.5 billion] loss in annual tax revenues,” Lin said. “I don’t know how this gap will be filled, but this will certainly impact on the government’s welfare spending.”

Chen Poh-chien (陳柏謙), from Youth Labor Union 95, expressed concern that the revenue gap would worsen the national debt, “which we, the younger generation, will have to shoulder in the future.”

AFTR figures show that the national debt has reached NT$13.8 trillion, while the Ministry of Finance’s figures released last month showed only a NT$4.3 billion debt.

“We would like to invite the ROCCOC and CNFI to debate with us in public,” Wang said. “Tell us how much money you’re making, how much tax you’re paying and whether you’re paying the same taxes as ordinary wage earners.”

Representatives from the two business groups accepted the invitations, but the two groups are not likely to join any debate.

“We won’t do anything about it [the invitation],” a high-ranking ROCCOC official, who spoke on condition of anonymity, told the Taipei Times by telephone.

“If they have something to say about tax reform they should tell the Tax Reform Commission — after all, it’s the government, not us, that will make the final decision,” the official said.

A CNFI spokesman surnamed Liu said the group respected everybody’s right to comment on the issue, but “would not likely take part” in the debate, as the group has no decision-making powers.

THE HAWAII FACTOR: While a 1965 opinion said an attack on Hawaii would not trigger Article 5, the text of the treaty suggests the state is covered, the report says NATO could be drawn into a conflict in the Taiwan Strait if Chinese forces attacked the US mainland or Hawaii, a NATO Defense College report published on Monday says. The report, written by James Lee, an assistant research fellow at Academia Sinica’s Institute of European and American Studies, states that under certain conditions a Taiwan contingency could trigger Article 5 of NATO, under which an attack against any member of the alliance is considered an attack against all members, necessitating a response. Article 6 of the North Atlantic Treaty specifies that an armed attack in the territory of any member in Europe,

FLU SEASON: Twenty-six severe cases were reported from Tuesday last week to Monday, including a seven-year-old girl diagnosed with influenza-associated encephalopathy Nearly 140,000 people sought medical assistance for diarrhea last week, the Centers for Disease Control (CDC) said on Tuesday. From April 7 to Saturday last week, 139,848 people sought medical help for diarrhea-related illness, a 15.7 percent increase from last week’s 120,868 reports, CDC Epidemic Intelligence Center Deputy Director Lee Chia-lin (李佳琳) said. The number of people who reported diarrhea-related illness last week was the fourth highest in the same time period over the past decade, Lee said. Over the past four weeks, 203 mass illness cases had been reported, nearly four times higher than the 54 cases documented in the same period

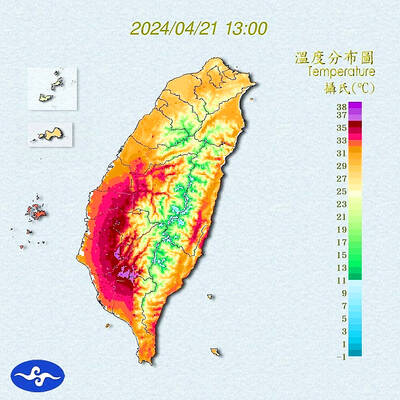

Heat advisories were in effect for nine administrative regions yesterday afternoon as warm southwesterly winds pushed temperatures above 38°C in parts of southern Taiwan, the Central Weather Administration (CWA) said. As of 3:30pm yesterday, Tainan’s Yujing District (玉井) had recorded the day’s highest temperature of 39.7°C, though the measurement will not be included in Taiwan’s official heat records since Yujing is an automatic rather than manually operated weather station, the CWA said. Highs recorded in other areas were 38.7°C in Kaohsiung’s Neimen District (內門), 38.2°C in Chiayi City and 38.1°C in Pingtung’s Sandimen Township (三地門), CWA data showed. The spell of scorching

A group of Taiwanese-American and Tibetan-American students at Harvard University on Saturday disrupted Chinese Ambassador to the US Xie Feng’s (謝鋒) speech at the school, accusing him of being responsible for numerous human rights violations. Four students — two Taiwanese Americans and two from Tibet — held up banners inside a conference hall where Xie was delivering a speech at the opening ceremony of the Harvard Kennedy School China Conference 2024. In a video clip provided by the Coalition of Students Resisting the CCP (Chinese Communist Party), Taiwanese-American Cosette Wu (吳亭樺) and Tibetan-American Tsering Yangchen are seen holding banners that together read: