Political and economic analysts yesterday warned that raising the cap on China-bound investment would be detrimental to the nation's economy.

Panelists taking part at a forum hosted by the Taiwan Advocates yesterday said the recent buyout of Advanced Semiconductor Engineering Inc (ASE) was irrelevant to the issue of whether to raise the investment cap and should not be used by the government or companies to justify such a move.

The government currently caps domestic companies' China-bound investment at 40 percent of their net worth, a restriction that many companies have long wanted changed.

GLOBAL TREND

Taiwan Futures Exchange chairman Wu Rong-i (

He said that ASE's investment in China is less than 10 percent of its net worth.

Therefore, Wu said, he did not think the buyout aimed to break the investment cap.

"The total amount of the buyout cases that the world dealt with in Asia was about US$35 billion last year. We should see that foreign-invested companies showed their confidence in Taiwan and our people should show the same faith in our economy," he said.

Former national policy adviser Huang Tien-lin (

"I think it is a simple merger and it is inappropriate to relate this case to the discussion of the removal of the cap on China-bound investment," Huang said.

CHINA OR BUST

Democratic Progressive Party (DPP) Legislator Wang To-far (

"A high unemployment in Taiwan is an expectable scenario and will deepen the poverty gap in Taiwan," Wang said.

Kenneth Lin (

The Cabinet promoted the "Big Investment, Big Warmth" plan in September.

The plan aimed to create a beneficial investment environment for domestic and international investors within three years.

"The Cabinet should not only make a policy that focuses on promoting the economic growth rate," he said. "It should put more emphasis on the growth of the employment rate."

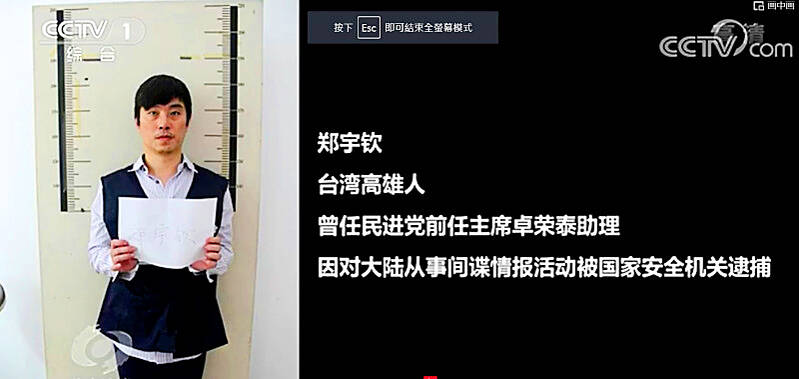

Former Czech Republic-based Taiwanese researcher Cheng Yu-chin (鄭宇欽) has been sentenced to seven years in prison on espionage-related charges, China’s Ministry of State Security announced yesterday. China said Cheng was a spy for Taiwan who “masqueraded as a professor” and that he was previously an assistant to former Cabinet secretary-general Cho Jung-tai (卓榮泰). President-elect William Lai (賴清德) on Wednesday last week announced Cho would be his premier when Lai is inaugurated next month. Today is China’s “National Security Education Day.” The Chinese ministry yesterday released a video online showing arrests over the past 10 years of people alleged to be

THE HAWAII FACTOR: While a 1965 opinion said an attack on Hawaii would not trigger Article 5, the text of the treaty suggests the state is covered, the report says NATO could be drawn into a conflict in the Taiwan Strait if Chinese forces attacked the US mainland or Hawaii, a NATO Defense College report published on Monday says. The report, written by James Lee, an assistant research fellow at Academia Sinica’s Institute of European and American Studies, states that under certain conditions a Taiwan contingency could trigger Article 5 of NATO, under which an attack against any member of the alliance is considered an attack against all members, necessitating a response. Article 6 of the North Atlantic Treaty specifies that an armed attack in the territory of any member in Europe,

LIKE FAMILY: People now treat dogs and cats as family members. They receive the same medical treatments and tests as humans do, a veterinary association official said The number of pet dogs and cats in Taiwan has officially outnumbered the number of human newborns last year, data from the Ministry of Agriculture’s pet registration information system showed. As of last year, Taiwan had 94,544 registered pet dogs and 137,652 pet cats, the data showed. By contrast, 135,571 babies were born last year. Demand for medical care for pet animals has also risen. As of Feb. 29, there were 5,773 veterinarians in Taiwan, 3,993 of whom were for pet animals, statistics from the Animal and Plant Health Inspection Agency showed. In 2022, the nation had 3,077 pediatricians. As of last

XINJIANG: Officials are conducting a report into amending an existing law or to enact a special law to prohibit goods using forced labor Taiwan is mulling an amendment prohibiting the importation of goods using forced labor, similar to the Uyghur Forced Labor Prevention Act (UFLPA) passed by the US Congress in 2021 that imposed limits on goods produced using forced labor in China’s Xinjiang region. A government official who wished to remain anonymous said yesterday that as the US customs law explicitly prohibits the importation of goods made using forced labor, in 2021 it passed the specialized UFLPA to limit the importation of cotton and other goods from China’s Xinjiang Uyghur region. Taiwan does not have the legal basis to prohibit the importation of goods