As China is not a normal country, and does not embrace democracy and human rights, it is necessary to restrict China-bound investment rather than promote it, an economist said yesterday.

"In a market economy, I don't think the administration can do much about China's booming economy," said Chang Ching-hsi (張清溪), an economics professor at National Taiwan University. "However, there is at least one thing it can do: Don't promote any further cross-strait economic activities."

Chang made the remarks yesterday in a speech delivered at the monthly Sun Yat-sen memorial meeting at the Presidential Office, which high-ranking officials from the five branches of the government must attend.

Chang was invited to talk about the impact of China's economic rise and the administration's cross-strait economic policy on Taiwan's job environment.

Since most of the economic problems Taiwan faces today derive from the fact that China is not a normal country, Chang said the administration was duty bound to help facilitate China's democratization.

In addition, the administration must provide local industries with correct and detailed information on the risks involved in investing in China, he said.

"A correct decision is based on correct information," he said. "If the US Congress has such information, Taiwan should have more channels by which to obtain information. The more we know about China, the less we will put our businessmen at risk and the less afraid we will be of China."

Such information, Chang said, includes the exact amount of China-bound investment, the success and failure rate of such investments, estimated losses should China's financial system fail as well as its impact on Taiwan's economy.

Statistics released by the Investment Commission show that approved China-bound investment in 2004 reached about US$6 billion (NT$19.2 billion).

The US Congress, however, said China had attracted more than US$562.1 billion in foreign direct investment by the end of 2004 and that about US$281 billion of that, or about 50 percent, came from Taiwan.

Taiwanese investment in China accounted for more than 71 percent of Taiwan's foreign investment last year and about 67 percent in 2004, Chang said, adding that the figure for South Korea was 38 percent in 2004 and 12 percent for Japan, with the US reporting only 1.8 percent of its foreign investment going to China.

Compounding the problem of capital outflow, products made cheaply in China deliver a significant blow to Taiwan's export market, Chang said.

"It's not hard to imagine what will happen if we further open the local market to Chinese goods," Chang said.

While the world may be overwhelmed by the economic rise of China, Chang said this would not last long.

"China's economic development is like walking on a tight rope," he said. "I suspect its domestic and international problems will become so severe that its economy will someday collapse."

Although it remains to be seen whether China's economy will continue to rise, it is certain that Taiwan will bear the brunt if things go wrong with China, he said.

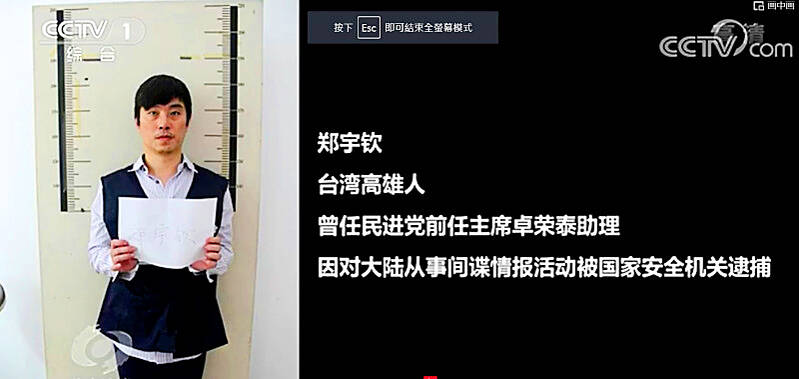

Former Czech Republic-based Taiwanese researcher Cheng Yu-chin (鄭宇欽) has been sentenced to seven years in prison on espionage-related charges, China’s Ministry of State Security announced yesterday. China said Cheng was a spy for Taiwan who “masqueraded as a professor” and that he was previously an assistant to former Cabinet secretary-general Cho Jung-tai (卓榮泰). President-elect William Lai (賴清德) on Wednesday last week announced Cho would be his premier when Lai is inaugurated next month. Today is China’s “National Security Education Day.” The Chinese ministry yesterday released a video online showing arrests over the past 10 years of people alleged to be

THE HAWAII FACTOR: While a 1965 opinion said an attack on Hawaii would not trigger Article 5, the text of the treaty suggests the state is covered, the report says NATO could be drawn into a conflict in the Taiwan Strait if Chinese forces attacked the US mainland or Hawaii, a NATO Defense College report published on Monday says. The report, written by James Lee, an assistant research fellow at Academia Sinica’s Institute of European and American Studies, states that under certain conditions a Taiwan contingency could trigger Article 5 of NATO, under which an attack against any member of the alliance is considered an attack against all members, necessitating a response. Article 6 of the North Atlantic Treaty specifies that an armed attack in the territory of any member in Europe,

LIKE FAMILY: People now treat dogs and cats as family members. They receive the same medical treatments and tests as humans do, a veterinary association official said The number of pet dogs and cats in Taiwan has officially outnumbered the number of human newborns last year, data from the Ministry of Agriculture’s pet registration information system showed. As of last year, Taiwan had 94,544 registered pet dogs and 137,652 pet cats, the data showed. By contrast, 135,571 babies were born last year. Demand for medical care for pet animals has also risen. As of Feb. 29, there were 5,773 veterinarians in Taiwan, 3,993 of whom were for pet animals, statistics from the Animal and Plant Health Inspection Agency showed. In 2022, the nation had 3,077 pediatricians. As of last

XINJIANG: Officials are conducting a report into amending an existing law or to enact a special law to prohibit goods using forced labor Taiwan is mulling an amendment prohibiting the importation of goods using forced labor, similar to the Uyghur Forced Labor Prevention Act (UFLPA) passed by the US Congress in 2021 that imposed limits on goods produced using forced labor in China’s Xinjiang region. A government official who wished to remain anonymous said yesterday that as the US customs law explicitly prohibits the importation of goods made using forced labor, in 2021 it passed the specialized UFLPA to limit the importation of cotton and other goods from China’s Xinjiang Uyghur region. Taiwan does not have the legal basis to prohibit the importation of goods