The Presidential Office yesterday said that the first family would donate a total of NT$4 million (US$125,300) to eight charities and disadvantaged groups, hoping to end weeks of controversy caused by the first lady's investments.

Presidential Office Deputy Secretary-General Cho Jung-tai (卓榮泰) said that half of the NT$4 million are profits from the first family's trust fund investments, and the other half is a donation.

Cho made the remark yesterday afternoon when making public the details of the profits first lady Wu Shu-jen (

The first family has been under fire for alleged improprieties with their investments after putting its property in trust in 2004. Chinese Nationalist Party (KMT) Legislator Chiu Yi (

Cho yesterday said that mutual funds are not stocks, but rather another form of trust fund. He added that a measure decreed by the Executive Yuan regulating civil servants' compulsory trust of their property does not include mutual funds.

While some have said that Wu had continued to trade stocks after putting her properties into trust.

Cho said that the first family imposes higher moral standards by choosing the kind of trust fund that they can only sell stocks, not buy more.

Moreover, Cho said, the bank the first family was using in 2004 had not obtained a license to control trust funds on behalf of their customers.

The first family's accountant, Wu Pei-jen (

Although the first family made some NT$2.7 million in gains from Fubon and NT$475,000 from stock investments, it lost about NT$589,000 on Aegis, Wu said.

FLU SEASON: Twenty-six severe cases were reported from Tuesday last week to Monday, including a seven-year-old girl diagnosed with influenza-associated encephalopathy Nearly 140,000 people sought medical assistance for diarrhea last week, the Centers for Disease Control (CDC) said on Tuesday. From April 7 to Saturday last week, 139,848 people sought medical help for diarrhea-related illness, a 15.7 percent increase from last week’s 120,868 reports, CDC Epidemic Intelligence Center Deputy Director Lee Chia-lin (李佳琳) said. The number of people who reported diarrhea-related illness last week was the fourth highest in the same time period over the past decade, Lee said. Over the past four weeks, 203 mass illness cases had been reported, nearly four times higher than the 54 cases documented in the same period

A group of Taiwanese-American and Tibetan-American students at Harvard University on Saturday disrupted Chinese Ambassador to the US Xie Feng’s (謝鋒) speech at the school, accusing him of being responsible for numerous human rights violations. Four students — two Taiwanese Americans and two from Tibet — held up banners inside a conference hall where Xie was delivering a speech at the opening ceremony of the Harvard Kennedy School China Conference 2024. In a video clip provided by the Coalition of Students Resisting the CCP (Chinese Communist Party), Taiwanese-American Cosette Wu (吳亭樺) and Tibetan-American Tsering Yangchen are seen holding banners that together read:

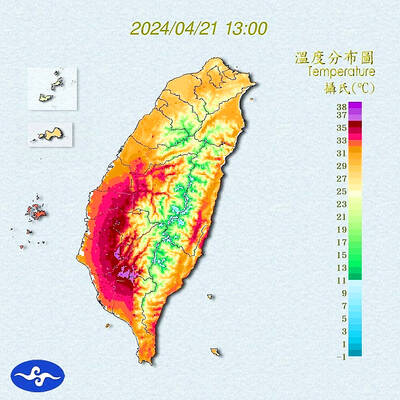

Heat advisories were in effect for nine administrative regions yesterday afternoon as warm southwesterly winds pushed temperatures above 38°C in parts of southern Taiwan, the Central Weather Administration (CWA) said. As of 3:30pm yesterday, Tainan’s Yujing District (玉井) had recorded the day’s highest temperature of 39.7°C, though the measurement will not be included in Taiwan’s official heat records since Yujing is an automatic rather than manually operated weather station, the CWA said. Highs recorded in other areas were 38.7°C in Kaohsiung’s Neimen District (內門), 38.2°C in Chiayi City and 38.1°C in Pingtung’s Sandimen Township (三地門), CWA data showed. The spell of scorching

UNAWARE: Many people sit for long hours every day and eat unhealthy foods, putting them at greater risk of developing one of the ‘three highs,’ an expert said More than 30 percent of adults aged 40 or older who underwent a government-funded health exam were unaware they had at least one of the “three highs” — high blood pressure, high blood lipids or high blood sugar, the Health Promotion Administration (HPA) said yesterday. Among adults aged 40 or older who said they did not have any of the “three highs” before taking the health exam, more than 30 percent were found to have at least one of them, Adult Preventive Health Examination Service data from 2022 showed. People with long-term medical conditions such as hypertension or diabetes usually do not