United Microelectronics Corp (UMC,

"While the government is suffering from financial difficulties, high-tech companies spend NT$2 million or NT$5 million to hold year-end banquets and give out tens of millions in prize money," said Democratic Progressive Party (DPP) lawmaker Lin Wei-chou (

PHOTO: CHEN TSE-MING, TAIPEI TIMES

According to Lin, the government collects a total of NT$50 billion less in tax revenues through implementing the Statute for Upgrading Industries (促進產業升級條例).

That legislation provides industry-preferential taxation to stimulate investment, as well as incentives to boost the nation's service industries.

Focusing on UMC as an example, Lin said the company was supposed to pay NT$30.2 billion in tax from 1997 to the third quarter of last year, but actually ended up receiving an extra NT$2.8 billion because of the decree. In other words, the company's net after-tax revenue was about NT$2.8 billion more than its net before-tax revenue over the past eight years.

During the same period, while TSMC was supposed to pay about NT$68 billion in income tax, it actually received NT$85.7 million extra because of the statute. In other words, the company's net after-tax revenue was about NT$85.7 million more than its net before-tax revenue.

Together, the government would have collected NT$3 billion more in income tax from the two companies over the past eight years, if they had paid the same tax as the traditional industries.

Unlike the high-tech industry, Lin said, such traditional industries as the China Steel Corp (

Lin called on the government to amend the statute, and said that his caucus will propose a revised version during the upcoming legislative session.

"While we support the idea of upgrading the nation's industries, we think that lucrative industries such as semiconductor or electronics should contribute more in taxes," he said.

Taiwan Solidarity Union (TSU) caucus whip Mark Ho (

Ho also called on the government to reconsider further relaxing rules on China-bound investment.

"We think it will be cowardly and spineless if the government decides to further liberalize its policy on China-bound investment before the UMC case is thoroughly investigated and settled," he said. "It is only fair to make lawbreakers pay for their wrongdoings."

Ho and David Huang (黃適卓), as well as other TSU lawmakers, also visited Minister of Justice Morley Shih (施茂林) yesterday afternoon, asking Shih to continue the ministry's pursuit of the case and resist pressure and political interference.

Shih stressed that there was no political meddling in the case whatsoever and that the case was purely a legal one, rather than political.

The People First Party (PFP) caucus held a round-table meeting yesterday morning to discuss the issue with government officials and industry representatives.

PFP lawmakers requested further relaxation of rules for China-bound investment. Government officials responded that the policy was constantly being reviewed.

A group of Taiwanese-American and Tibetan-American students at Harvard University on Saturday disrupted Chinese Ambassador to the US Xie Feng’s (謝鋒) speech at the school, accusing him of being responsible for numerous human rights violations. Four students — two Taiwanese Americans and two from Tibet — held up banners inside a conference hall where Xie was delivering a speech at the opening ceremony of the Harvard Kennedy School China Conference 2024. In a video clip provided by the Coalition of Students Resisting the CCP (Chinese Communist Party), Taiwanese-American Cosette Wu (吳亭樺) and Tibetan-American Tsering Yangchen are seen holding banners that together read:

UNAWARE: Many people sit for long hours every day and eat unhealthy foods, putting them at greater risk of developing one of the ‘three highs,’ an expert said More than 30 percent of adults aged 40 or older who underwent a government-funded health exam were unaware they had at least one of the “three highs” — high blood pressure, high blood lipids or high blood sugar, the Health Promotion Administration (HPA) said yesterday. Among adults aged 40 or older who said they did not have any of the “three highs” before taking the health exam, more than 30 percent were found to have at least one of them, Adult Preventive Health Examination Service data from 2022 showed. People with long-term medical conditions such as hypertension or diabetes usually do not

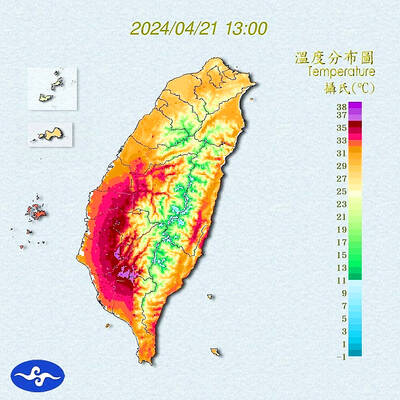

Heat advisories were in effect for nine administrative regions yesterday afternoon as warm southwesterly winds pushed temperatures above 38°C in parts of southern Taiwan, the Central Weather Administration (CWA) said. As of 3:30pm yesterday, Tainan’s Yujing District (玉井) had recorded the day’s highest temperature of 39.7°C, though the measurement will not be included in Taiwan’s official heat records since Yujing is an automatic rather than manually operated weather station, the CWA said. Highs recorded in other areas were 38.7°C in Kaohsiung’s Neimen District (內門), 38.2°C in Chiayi City and 38.1°C in Pingtung’s Sandimen Township (三地門), CWA data showed. The spell of scorching

POLICE INVESTIGATING: A man said he quit his job as a nurse at Taipei Tzu Chi Hospital as he had been ‘disgusted’ by the behavior of his colleagues A man yesterday morning wrote online that he had witnessed nurses taking photographs and touching anesthetized patients inappropriately in Taipei Tzu Chi Hospital’s operating theaters. The man surnamed Huang (黃) wrote on the Professional Technology Temple bulletin board that during his six-month stint as a nurse at the hospital, he had seen nurses taking pictures of patients, including of their private parts, after they were anesthetized. Some nurses had also touched patients inappropriately and children were among those photographed, he said. Huang said this “disgusted” him “so much” that “he felt the need to reveal these unethical acts in the operating theater