A pan-blue legislative majority is sure to cloud the Chen Shui-bian (陳水扁) administration's prospects of pushing forward its proposed economic and financial bills in the legislature, forcing the government to adopt practical strategies to overhaul its economic and financial policies, pundits said yesterday.

"The challenge facing the ruling Democratic Progressive Party [DPP] will be to urgently fine-tune its economic and financial policies so that the opposition alliance will give them the go-ahead in the newly elected legislature," said Steve Lin (

Among the DPP government's proposed economic and financial proposals, Chen has prioritized the financial restructuring fund (金融重建基金) bill, the Land Tax Law (土地稅法) and revisions to both the Real Estate Securitization Statute (不動產證券化條例) and the Securities Transaction Law (證券交易法) to be four of his top-10 most-important bills, all of which are stalled in the KMT-led legislature.

Since the ruling and opposition parties had previously reached a consensus to maintain the financial bill's size at NT$320 billion, it may be soon be passed, although the DPP was hoping to expand its size.

"A DPP legislative majority would have increased the room for the Cabinet to expand the fund's size from the current NT$320 to some NT$680 -- a figure on which it had previously insisted," DPP Legislator-at-large Lin Chung-cheng (

Lin said that he sees no reason for the Chinese Nationalist Party (KMT)-led legislature to continue to put these DPP-proposed economic and financial bills on the back burner since disagreements have mostly been ironed out.

After the land tax law's passage, the land value incremental tax will be permanently cut by 20 percent, reducing the top rate from the current 60 percent to 40 percent.

He therefore yesterday urged the newly elected KMT-led legislature to accelerate the bills' passage, which will greatly improve the local financial market's internationalization, as well as the nation's future economic prospects.

But Hsu Chen-min (

Although the likelihood is slim, Hsu said that Chen will face great pressure from the KMT-PFP alliance, which has, before the election, demanded to reshuffle the Cabinet and to nominate Chiang Pin-kun (

Although both Hsu and Lin agreed that Chiang will be a better candidate for the premiership, given his past credential and familiarity with the nation's economic affairs, they both believe Chen will never relinquish his right to nominate a pro-DPP Cabinet.

"Political instability is sure to linger on," both Hsu and Lin said.

Hsu expressed concern that such political instability will be detrimental to the nation's future economic outlook.

The government has forecast economic growth of 4.56 percent next year, down from 5.93 percent for this year.

But Lin said the opposition alliance could do a better job to facilitate an economic blueprint for the nation's development.

"At least, the nation's deficit won't grow so badly under the KMT-PFP alliance's supervision," Lin said, adding the deficit has quickly shot up from NT$2 trillion to an estimated NT$4 trillion in the past four years under the DPP's rule.

Former president Ma Ying-jeou’s (馬英九) mention of Taiwan’s official name during a meeting with Chinese President Xi Jinping (習近平) on Wednesday was likely a deliberate political play, academics said. “As I see it, it was intentional,” National Chengchi University Graduate Institute of East Asian Studies professor Wang Hsin-hsien (王信賢) said of Ma’s initial use of the “Republic of China” (ROC) to refer to the wider concept of “the Chinese nation.” Ma quickly corrected himself, and his office later described his use of the two similar-sounding yet politically distinct terms as “purely a gaffe.” Given Ma was reading from a script, the supposed slipup

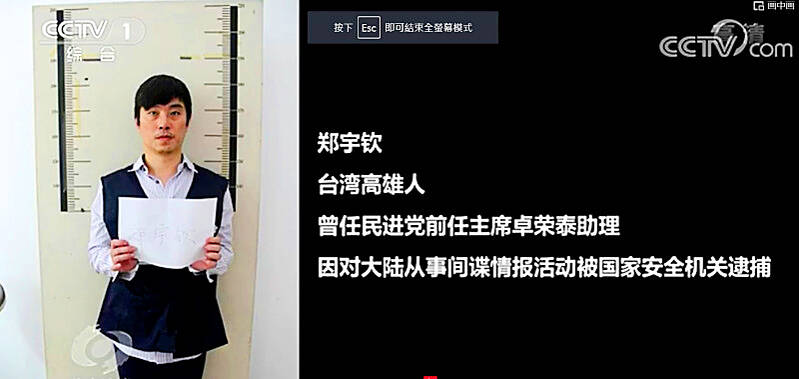

Former Czech Republic-based Taiwanese researcher Cheng Yu-chin (鄭宇欽) has been sentenced to seven years in prison on espionage-related charges, China’s Ministry of State Security announced yesterday. China said Cheng was a spy for Taiwan who “masqueraded as a professor” and that he was previously an assistant to former Cabinet secretary-general Cho Jung-tai (卓榮泰). President-elect William Lai (賴清德) on Wednesday last week announced Cho would be his premier when Lai is inaugurated next month. Today is China’s “National Security Education Day.” The Chinese ministry yesterday released a video online showing arrests over the past 10 years of people alleged to be

THE HAWAII FACTOR: While a 1965 opinion said an attack on Hawaii would not trigger Article 5, the text of the treaty suggests the state is covered, the report says NATO could be drawn into a conflict in the Taiwan Strait if Chinese forces attacked the US mainland or Hawaii, a NATO Defense College report published on Monday says. The report, written by James Lee, an assistant research fellow at Academia Sinica’s Institute of European and American Studies, states that under certain conditions a Taiwan contingency could trigger Article 5 of NATO, under which an attack against any member of the alliance is considered an attack against all members, necessitating a response. Article 6 of the North Atlantic Treaty specifies that an armed attack in the territory of any member in Europe,

The bodies of two individuals were recovered and three additional bodies were discovered on the Shakadang Trail (砂卡礑) in Taroko National Park, eight days after the devastating earthquake in Hualien County, search-and-rescue personnel said. The rescuers reported that they retrieved the bodies of a man and a girl, suspected to be the father and daughter from the Yu (游) family, 500m from the entrance of the trail on Wednesday. The rescue team added that despite the discovery of the two bodies on Friday last week, they had been unable to retrieve them until Wednesday due to the heavy equipment needed to lift