Stock prices are expected to rebound as political uncertainty dissolved after the opposition parties retained a majority in the legislature, analysts said yesterday.

But investors should expect the rally to be followed by a mild correction next week, said Bill Lan (

"The local bourse may lose support from government funds after the ruling Democratic Progressive Party failed to grab a majority in the legislature," Lan said.

Still, in the long run, stock markets will move higher on better fundamentals, he said.

Intensifying relations with China during the legislative campaigns kept investors on hold ahead of the election, analysts said. Overseas fund managers, who tend to be cautious, have sold a net of NT$32.55 billion in local shares over the past week.

"As the political concerns dissolve, we expect Taiwan's stock market to regain momentum," Lan said.

The TAIEX may advance to around 6,300 by February, as the index has lagged far behind the US stock markets in the past month, Lan said. That would represent a gain of almost 7 percent from the current 5911.63.

The benchmark TAIEX inched 0.31 percent higher last week, bolstered by government funds, he said.

Agreeing with Lan's view, Rocky Chiou (

In the past five legislative and presidential elections since 1995, stock prices gained 7.56 percent on average within a month after results were announced, according to the investment consultancy's tally.

Financial shares are worth investing in due to better fundamentals, since the government is aggressively pushing for more mergers among local financial holding companies to boost competitiveness, Chiou said.

However, financial shares may bear the brunt of a short-term sell-off as the election result dashed investors' hope to see a quick passage of an amendment to expand the size of the depleted Financial Restructuring Fund (

The fund plays a crucial role in the government's efforts to reform Taiwan's financial sector.

On the contrary, the victory of the Chinese Nationalist Party (KMT)-led pan-blue camp will give a boost to China-related stocks, said Wu Pei-wei (吳佩偉), a fund manager who helps oversee a NT$600 million fund for ABN AMRO Asset Management in Taipei.

"The result could herald more relaxed Taiwan-China relations," Wu said. "Overall, we're bullish about the TAIEX. The worst part has passed."

Stock prices of heavyweights including leading semiconductor and liquid-crystal display (LCD) companies are expected to bounce back, as the industries should hit bottom in the first quarter at the earliest, Wu said.

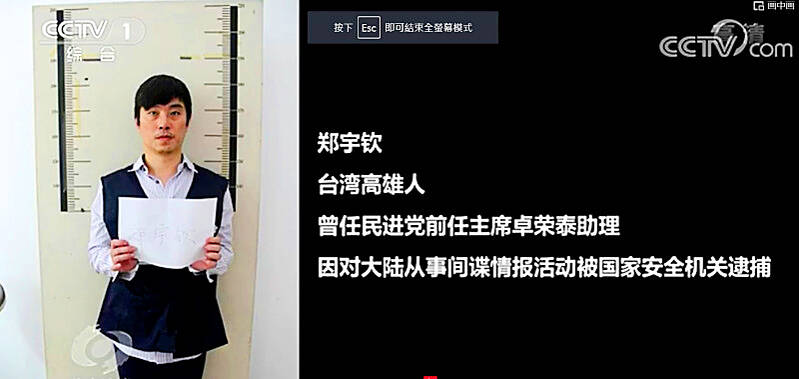

Former Czech Republic-based Taiwanese researcher Cheng Yu-chin (鄭宇欽) has been sentenced to seven years in prison on espionage-related charges, China’s Ministry of State Security announced yesterday. China said Cheng was a spy for Taiwan who “masqueraded as a professor” and that he was previously an assistant to former Cabinet secretary-general Cho Jung-tai (卓榮泰). President-elect William Lai (賴清德) on Wednesday last week announced Cho would be his premier when Lai is inaugurated next month. Today is China’s “National Security Education Day.” The Chinese ministry yesterday released a video online showing arrests over the past 10 years of people alleged to be

THE HAWAII FACTOR: While a 1965 opinion said an attack on Hawaii would not trigger Article 5, the text of the treaty suggests the state is covered, the report says NATO could be drawn into a conflict in the Taiwan Strait if Chinese forces attacked the US mainland or Hawaii, a NATO Defense College report published on Monday says. The report, written by James Lee, an assistant research fellow at Academia Sinica’s Institute of European and American Studies, states that under certain conditions a Taiwan contingency could trigger Article 5 of NATO, under which an attack against any member of the alliance is considered an attack against all members, necessitating a response. Article 6 of the North Atlantic Treaty specifies that an armed attack in the territory of any member in Europe,

LIKE FAMILY: People now treat dogs and cats as family members. They receive the same medical treatments and tests as humans do, a veterinary association official said The number of pet dogs and cats in Taiwan has officially outnumbered the number of human newborns last year, data from the Ministry of Agriculture’s pet registration information system showed. As of last year, Taiwan had 94,544 registered pet dogs and 137,652 pet cats, the data showed. By contrast, 135,571 babies were born last year. Demand for medical care for pet animals has also risen. As of Feb. 29, there were 5,773 veterinarians in Taiwan, 3,993 of whom were for pet animals, statistics from the Animal and Plant Health Inspection Agency showed. In 2022, the nation had 3,077 pediatricians. As of last

XINJIANG: Officials are conducting a report into amending an existing law or to enact a special law to prohibit goods using forced labor Taiwan is mulling an amendment prohibiting the importation of goods using forced labor, similar to the Uyghur Forced Labor Prevention Act (UFLPA) passed by the US Congress in 2021 that imposed limits on goods produced using forced labor in China’s Xinjiang region. A government official who wished to remain anonymous said yesterday that as the US customs law explicitly prohibits the importation of goods made using forced labor, in 2021 it passed the specialized UFLPA to limit the importation of cotton and other goods from China’s Xinjiang Uyghur region. Taiwan does not have the legal basis to prohibit the importation of goods