Seven-year-old Sheng Chao-zen (

As if this tragedy was not enough for his family, they are now involved in a David and Goliath struggle against the insurance giant, Cathay Life Insurance Corp (

Since April last year, the Sheng family paid an insurance premium of NT$80,000 for the then-healthy boy. Seven months later, Chao-zen was diagnosed with lymphoma. The Shengs spent about NT$1 million in attempting to halt the cancer's spread in the child's body. When they asked Cathay Life to recompense them, however, they were indicted for insurance fraud.

"They said that we insured Chao-zen when he was already sick," said the boy's sister, Sheng Hui-yi (

Now Hui-yi takes her little brother to hospital once a week, paying about NT$1,000 for a CT scan and NT$3,000 for a bone marrow biopsy whenever necessary. The huge medical expense may soon bankrupt the family, she said.

Chao-zen is only one of some 19,652 cases referred to the Chou Ta-kuan Cultural and Educational Foundation for the Concern of Human Life (

During the past two years, the foundation has been flooded with complaint calls from ailing children's families who felt duped by insurance companies. According to the foundation's analysis, 35 percent of the ailing children eligible for compensation miss the two-year time frame to apply because the families are not well-informed at the time of signing the insurance contract. Some 62 percent of the families are either refused by their insurance companies or forced to put their request on hold for a bewilderingly array of pretexts.

The foundation's data shows that only a paltry 3 percent of the total cases succeed in gaining compensation, though only after these families also sign an agreement with their insurance companies to rule out further compensation.

"The insurance companies had all kinds of strategies at their disposal to make things difficult for the families," said the foundation's vice chief executive Sun Hsin-yi (

For instance, Sun said, the companies persist in asking for more medical records than are needed in an effort to deter their customers from making claims.

"An ordinary family stands little chance of outwitting an insurance corporation backed by an army of lawyers," said the foundation's president Kuo Yin-lan (

FLU SEASON: Twenty-six severe cases were reported from Tuesday last week to Monday, including a seven-year-old girl diagnosed with influenza-associated encephalopathy Nearly 140,000 people sought medical assistance for diarrhea last week, the Centers for Disease Control (CDC) said on Tuesday. From April 7 to Saturday last week, 139,848 people sought medical help for diarrhea-related illness, a 15.7 percent increase from last week’s 120,868 reports, CDC Epidemic Intelligence Center Deputy Director Lee Chia-lin (李佳琳) said. The number of people who reported diarrhea-related illness last week was the fourth highest in the same time period over the past decade, Lee said. Over the past four weeks, 203 mass illness cases had been reported, nearly four times higher than the 54 cases documented in the same period

A group of Taiwanese-American and Tibetan-American students at Harvard University on Saturday disrupted Chinese Ambassador to the US Xie Feng’s (謝鋒) speech at the school, accusing him of being responsible for numerous human rights violations. Four students — two Taiwanese Americans and two from Tibet — held up banners inside a conference hall where Xie was delivering a speech at the opening ceremony of the Harvard Kennedy School China Conference 2024. In a video clip provided by the Coalition of Students Resisting the CCP (Chinese Communist Party), Taiwanese-American Cosette Wu (吳亭樺) and Tibetan-American Tsering Yangchen are seen holding banners that together read:

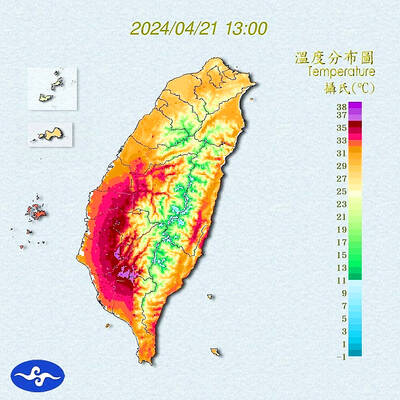

Heat advisories were in effect for nine administrative regions yesterday afternoon as warm southwesterly winds pushed temperatures above 38°C in parts of southern Taiwan, the Central Weather Administration (CWA) said. As of 3:30pm yesterday, Tainan’s Yujing District (玉井) had recorded the day’s highest temperature of 39.7°C, though the measurement will not be included in Taiwan’s official heat records since Yujing is an automatic rather than manually operated weather station, the CWA said. Highs recorded in other areas were 38.7°C in Kaohsiung’s Neimen District (內門), 38.2°C in Chiayi City and 38.1°C in Pingtung’s Sandimen Township (三地門), CWA data showed. The spell of scorching

UNAWARE: Many people sit for long hours every day and eat unhealthy foods, putting them at greater risk of developing one of the ‘three highs,’ an expert said More than 30 percent of adults aged 40 or older who underwent a government-funded health exam were unaware they had at least one of the “three highs” — high blood pressure, high blood lipids or high blood sugar, the Health Promotion Administration (HPA) said yesterday. Among adults aged 40 or older who said they did not have any of the “three highs” before taking the health exam, more than 30 percent were found to have at least one of them, Adult Preventive Health Examination Service data from 2022 showed. People with long-term medical conditions such as hypertension or diabetes usually do not