The art world is watching to see the fate of billionaire hedge-fund owner Steven A. Cohen.

Cohen’s US$14 billion SAC Capital Advisors LP is facing an insider-trading case. The US Securities and Exchange Commission has told the hedge fund it is considering suing SAC for alleged insider trading. Federal prosecutors have charged Mathew Martoma, a former SAC Capital portfolio manager, and the SEC sued him civilly the same day.

Cohen, 56, is worth US$9.5 billion, according to the Bloomberg Billionaires Index. He is also one of the world’s biggest art collectors, with works by Van Gogh, Manet, de Kooning, Picasso, Cezanne, Warhol, Johns and Richter.

Photo: REUTERS

His purchases have helped boost prices of artists such as Damien Hirst, whose shark-in-formaldehyde he bought for US$8 million.

“He is known for his willingness to pay top prices for the best work,” Todd Levin, director of New York-based Levin Art Group, said in an interview. “In the worst case scenario, he might not be able to buy going forward and there will be some disappointed gallerists.”

Since he started his hedge fund in 1992, Cohen has achieved average annual returns of 30 percent, with just one money-losing year: 2008, when his main fund tumbled 19 percent.

Photo: REUTERS

Cohen started collecting art in about 2001. His taste has shifted from Impressionist to contemporary works.

An early purchase was Edouard Manet’s 1878 Self Portrait with a Palette which came from the collection of Las Vegas casino developer Steve Wynn. It probably cost Cohen between US$35 million and US$40 million, according to dealers with knowledge of the matter.

He sold it for US$33.2 million at Christie’s International, London, in June 2010, setting a record for the artist at auction.

Cohen often favors discreet, privately-brokered purchases, though he’s become a more visible presence on the gallery circuit.

In June, he made the rounds at the Art Basel fair wearing a baseball cap with the logo NERO above his trademark wire-rimmed glasses and zip-neck jersey. Dealers identified him as the buyer of Gerhard Richter’s 1986 abstract, A.B. Courbet which was on view in the booth of New York’s Pace Gallery, priced between $20 million and US$25 million.

A few selections suggest Cohen has a taste for the dark. He bought one of Francis Bacon’s screaming Pope canvases for about US$16 million, according to dealers.

The other creepy work, Hirst’s shark piece, The Physical Impossibility of Death in the Mind of Someone Living required a new shark when it became evident that the old one was definitely not only dead but obviously rotting.

He also owns the original version of Marc Quinn’s most famous creation: a head called Self and fashioned from the artist’s frozen blood.

In 2009, Cohen lent 20 artworks featuring women from his collection for an exhibition at Sotheby’s. Willem de Kooning’s Woman III (cost: US$137 million) joined pieces by Picasso, Cezanne and contemporary artists Marlene Dumas and Lisa Yuskavage. At the time, Bloomberg reported that the group was estimated to be worth about US$450 million.

Recently, Cohen sent another Richter abstract, Prag 1883 to a Christie’s auction on Nov. 14. Estimated at US$9 million to US$12 million, it failed to sell.

This was before the latest headlines started to break on insider-trading inquiries. Curiosity will grow if a question mark hangs over the future of his collection.

“Whether Steve Cohen owned the work neither adds nor detracts from its value,” Levin said of the Richter. “Provenance is a function of time and vision. And Cohen has been collecting seriously for about a decade. If he were to sell, he might take a loss depending on market timing.”

Jonathan Gasthalter, a spokesman for SAC, returned a telephone query from Bloomberg News on Nov. 30 by declining to comment on Cohen’s plans to buy or sell art.

“The market can absorb the loss of one collector,” said the London-based dealer Kenny Schachter. “It’s more a case of the vultures circling over what he’s bought. Cohen was always pruning and improving his collection. If he has to sell, his name isn’t a celebrity provenance that adds 25 percent to prices. The premium comes from knowing he always bought top quality.”

In late October of 1873 the government of Japan decided against sending a military expedition to Korea to force that nation to open trade relations. Across the government supporters of the expedition resigned immediately. The spectacle of revolt by disaffected samurai began to loom over Japanese politics. In January of 1874 disaffected samurai attacked a senior minister in Tokyo. A month later, a group of pro-Korea expedition and anti-foreign elements from Saga prefecture in Kyushu revolted, driven in part by high food prices stemming from poor harvests. Their leader, according to Edward Drea’s classic Japan’s Imperial Army, was a samurai

The following three paragraphs are just some of what the local Chinese-language press is reporting on breathlessly and following every twist and turn with the eagerness of a soap opera fan. For many English-language readers, it probably comes across as incomprehensibly opaque, so bear with me briefly dear reader: To the surprise of many, former pop singer and Democratic Progressive Party (DPP) ex-lawmaker Yu Tien (余天) of the Taiwan Normal Country Promotion Association (TNCPA) at the last minute dropped out of the running for committee chair of the DPP’s New Taipei City chapter, paving the way for DPP legislator Su

Located down a sideroad in old Wanhua District (萬華區), Waley Art (水谷藝術) has an established reputation for curating some of the more provocative indie art exhibitions in Taipei. And this month is no exception. Beyond the innocuous facade of a shophouse, the full three stories of the gallery space (including the basement) have been taken over by photographs, installation videos and abstract images courtesy of two creatives who hail from the opposite ends of the earth, Taiwan’s Hsu Yi-ting (許懿婷) and Germany’s Benjamin Janzen. “In 2019, I had an art residency in Europe,” Hsu says. “I met Benjamin in the lobby

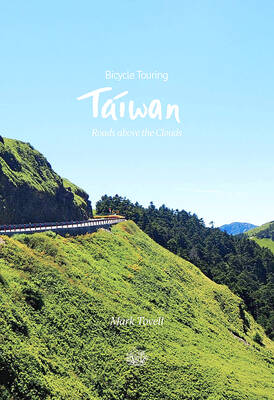

It’s hard to know where to begin with Mark Tovell’s Taiwan: Roads Above the Clouds. Having published a travelogue myself, as well as having contributed to several guidebooks, at first glance Tovell’s book appears to inhabit a middle ground — the kind of hard-to-sell nowheresville publishers detest. Leaf through the pages and you’ll find them suffuse with the purple prose best associated with travel literature: “When the sun is low on a warm, clear morning, and with the heat already rising, we stand at the riverside bike path leading south from Sanxia’s old cobble streets.” Hardly the stuff of your