The fallow plots of farmland on the edge of the artists’ village of Songzhuang (宋莊) are a symbol of Chinese contemporary art’s recent boom and bust cycle.

When prices for Chinese art soared, there were grand plans to build more galleries and studios in this artists’ hamlet near Beijing. Yet today, after art prices plunged by some 60 percent in the past year, the expansion plans have floundered.

After a white-hot stint, the financial crisis has battered China’s art landscape, shrinking investment in grand schemes like Songzhuang, shuttering galleries in Beijing’s pioneering 798 arts district and deflating bloated egos, valuations and excesses.

“The Chinese contemporary market was over-swollen before. I felt it wasn’t very healthy,” said Nan Xi (南溪), a former Chinese army officer turned artist whose works, huge pointillist ink-brush canvasses which he displays in his spacious Songzhuang villa, fetched around half a million yuan (roughly US$70,000) at the peak of the market.

In the good days, ferocious bidding in auction rooms at the market’s peak in 2007 and last year caused prices to spiral skyward with buyers and speculators treating contemporary artwork almost like stocks or tradeable commodities.

What resulted was a glut of average art at inflated prices and a growing community of millionaire artists, some more drawn by the opportunities to make vast amounts of cash than any artistic vision.

“The financial crisis has been a good lesson for us; to better know what the market is, and art’s relationship to it. Having too much money is not good for an artist’s development,” said Nan.

China’s leading auction house, Beijing Poly International Auction, which is famous for its repatriation of looted bronze animal heads from the West, has seen business in Chinese contemporary art plunge over 50 percent in the past year.

“A lot of buyers have been pushed out, including the speculators. The collectors who are left are now able to pay more reasonable money for reasonable things,” said Li Da (李達), Poly’s general manager.

He gives the example of a large Zhang Xiaogang (張曉剛) bloodline painting which fetched US$2.5 million in May and says that painting would have sold for more than twice that amount if it had been auctioned in 2007.

Melancholy canvasses by Zhang, one of China’s A-list artists which includes the likes of Liu Xiaodong (劉小東), Zeng Fanzhi (曾凡志), Fang Lijun (方立均) and Yue Minjun (岳敏君), sold at up to US$6 million a piece at the market peak.

Those valuations have, like many others, since fallen some 66 percent according to an index on Chinese art Web site Artron.net.

Since 2007, the overall market for Chinese contemporary art has shrunk over 54 percent according to Artron. Sotheby’s and Christie’s, which both pared back their sales of Chinese contemporary art in Hong Kong, have struggled to consign outstanding works, with sellers still wary of fragile sentiment.

At Sotheby’s autumn sales, bidding was mixed for contemporary art with Zhang Xiaogang’s Comrade one of few pieces testing the US$1 million dollar mark.

Without an across-the-board recovery in China’s economy and a return to the days of huge wealth creation, Li said she doesn’t see a comeback in Chinese contemporary art prices anytime soon.

Auctioneers and dealers say collectors have become more selective since the crash, spurning lesser works while seeking value in younger artists beyond China in Asia and in the West.

“Through this consolidation, there will be better discernment of good artists and good works and their inherent value” said Li of the Poly Group. “The true connoisseurs of Chinese contemporary art, the collectors are left ... and they will be able to pay reasonable money for reasonable things.”

Misung Shim, the head of Seoul Auction, which sold a large work of British artist Damien Hirst in Hong Kong this month for US$2.2 million, an auction record for the artist in Asia, sees growing opportunities beyond China’s art scene.

“We are trying to open the Western art market in Hong Kong rather than the Chinese paintings market,” she said.

Over the past three decades, Chinese contemporary art has writhed out of the wilderness

of Chairman Mao Zedong’s (毛澤東) Cultural Revolution purges and upheavals like the Tiananmen Square massacre in 1989, later piggy-backing on China’s economic and political rise, to catch the eye of the global art community.

While plunging prices of avant-garde art worldwide represents a big potential upside, major art investors such as Philip Hoffman of the Fine Art Fund in London are putting their money more in conservative, safer bets, with recent Asian sales in New York and Hong Kong showing strong demand and prices for traditional categories of Chinese art, including classic ink brush paintings, imperial scholars’ objects, and Ming and Qing dynasty ceramics.

“We’ve allocated more to porcelain and ancient art, but we’ve allocated very little to Chinese contemporary,” Hoffman said.

“I’ve been amazed to see how the recession has not been affecting the very best [traditional] Chinese art.”

At its peak, the Chinese contemporary art market was seen by some to be highly manipulated and speculative.

Auction houses were accused of collusion with artists to inflate prices, critics and curators blamed for hyping up artists reputations for hard cash, and artists churned out works straight for auction, production-style with an army of assistants, rather than going through the traditional primary market of art galleries first.

“In a Chinese context, the phenomenon of auctions in the art market is a very new thing,” said Ingrid Dudek, a contemporary Chinese art specialist with Christie’s.

“A lot of the results were driven by private collectors, indicating not necessarily speculation, but of enormous demand ... maybe that did make the correction hurt a little bit more too because you didn’t have a dealer network that was there.”

Now though, galleries and dealers seem to be making a comeback, with artists seeing the worth of being patiently backed and promoted to ensure reputations and valuations are less vulnerable to market volatilities.

“Some other galleries think going to auction is a test of the market value [of an artist] so they can make faster money. But we try to do the opposite,” said Federico Keller of Hong Kong’s Connoisseur Contemporary gallery, which specializes in Asian and younger Chinese artists.

In late October of 1873 the government of Japan decided against sending a military expedition to Korea to force that nation to open trade relations. Across the government supporters of the expedition resigned immediately. The spectacle of revolt by disaffected samurai began to loom over Japanese politics. In January of 1874 disaffected samurai attacked a senior minister in Tokyo. A month later, a group of pro-Korea expedition and anti-foreign elements from Saga prefecture in Kyushu revolted, driven in part by high food prices stemming from poor harvests. Their leader, according to Edward Drea’s classic Japan’s Imperial Army, was a samurai

The following three paragraphs are just some of what the local Chinese-language press is reporting on breathlessly and following every twist and turn with the eagerness of a soap opera fan. For many English-language readers, it probably comes across as incomprehensibly opaque, so bear with me briefly dear reader: To the surprise of many, former pop singer and Democratic Progressive Party (DPP) ex-lawmaker Yu Tien (余天) of the Taiwan Normal Country Promotion Association (TNCPA) at the last minute dropped out of the running for committee chair of the DPP’s New Taipei City chapter, paving the way for DPP legislator Su

Located down a sideroad in old Wanhua District (萬華區), Waley Art (水谷藝術) has an established reputation for curating some of the more provocative indie art exhibitions in Taipei. And this month is no exception. Beyond the innocuous facade of a shophouse, the full three stories of the gallery space (including the basement) have been taken over by photographs, installation videos and abstract images courtesy of two creatives who hail from the opposite ends of the earth, Taiwan’s Hsu Yi-ting (許懿婷) and Germany’s Benjamin Janzen. “In 2019, I had an art residency in Europe,” Hsu says. “I met Benjamin in the lobby

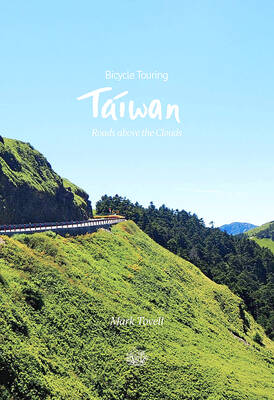

It’s hard to know where to begin with Mark Tovell’s Taiwan: Roads Above the Clouds. Having published a travelogue myself, as well as having contributed to several guidebooks, at first glance Tovell’s book appears to inhabit a middle ground — the kind of hard-to-sell nowheresville publishers detest. Leaf through the pages and you’ll find them suffuse with the purple prose best associated with travel literature: “When the sun is low on a warm, clear morning, and with the heat already rising, we stand at the riverside bike path leading south from Sanxia’s old cobble streets.” Hardly the stuff of your