China is running out of options to hit back at the US without hurting its own interests, as Washington intensifies pressure on Beijing to correct trade imbalances in a challenge to China’s state-led economic model.

China this week said that it would impose higher tariffs on most US imports on a revised US$60 billion target list. That is a much shorter list compared with the US$200 billion of Chinese products on which Washington has hiked tariffs.

Washington has also turned up the heat on other fronts, from targeting China’s technology firms such as Huawei Technologies Co and ZTE Corp to sending warships through the strategic Taiwan Strait.

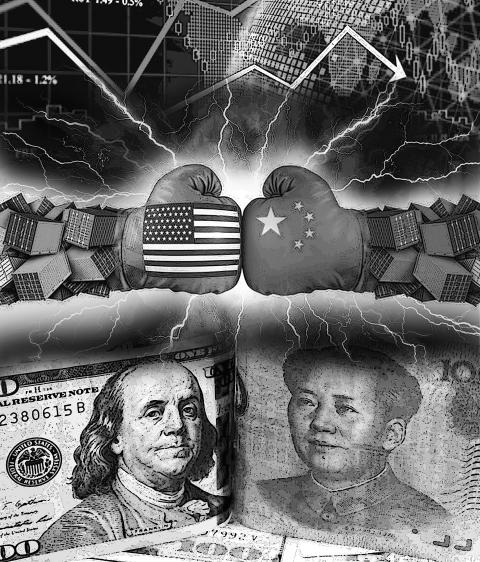

Illustration: Constance Chou

As the pressure mounts, Chinese leaders are pressing ahead to seal a deal and avoid a drawn-out trade dispute that risks stalling the nation’s long-term economic development, according to people familiar with their thinking.

However, Beijing is mindful of a possible nationalistic backlash if it is seen as conceding too much to Washington.

Agreeing to US demands to end subsidies and tax breaks for state-owned firms and strategic sectors would also overturn China’s state-led economic model and weaken the Chinese Communist Party’s grip on the economy, they said.

“We still have ammunition, but we may not use all of it,” said a policy insider, declining to be identified due to the sensitivity of the matter. “The purpose is to reach a deal acceptable to both sides.”

The Chinese State Council Information Office, Ministry of Finance and Ministry of Commerce did not immediately respond to Reuters’ requests for comment.

Of the retaliatory options available to China, none come without potential risks.

Since July last year, China has cumulatively imposed additional retaliatory tariffs of up to 25 percent on about US$110 billion of US goods. Based on last year’s US Census Bureau trade data, China would only have about US$10 billion of US products, such as crude oil and large aircraft, left to levy duties on in retaliation for any future US tariffs.

In contrast, US President Donald Trump is threatening tariffs on a further US$300 billion of Chinese goods.

The only other items Beijing could tax would be imports of US services. The US last year had a services trade surplus with China of US$40.5 billion, but China does not have as much leverage over the US as it might seem because large parts of that surplus are in tourism and education, areas that would be more difficult for the Chinese government to significantly roll back, McLarty Associates senior adviser James Green said.

China is more likely to further erect non-tariff barriers on US goods, such as delaying regulatory approvals for agricultural products, said Green, who until August was the top US Trade Representative official at the US embassy in Beijing.

Trade analysts say China could reward other global companies at the expense of US firms, replacing for example Boeing planes with Airbus jets where possible, but there is considerable risk for China in transitioning its retaliation from tariffs to non-tariffs barriers on US companies because doing so would intensify perceptions of an uneven playing field in China and incentivize some firms to shift sourcing or investment outside the nation, they say.

Trump has called for US firms to move production back to the US.

“The medium to long-term ramifications on supply chains are being deeply underestimated. I would be severely concerned if I was China,” Peterson Institute for International Economics non-resident senior fellow Robert Lawrence told journalists in Beijing, where a group from the think tank met with senior Chinese officials.

After trade negotiations hit a wall last week and led to the imposition of new tariffs, Chinese state media has stepped up nationalist rhetoric, vowing that China would not be bullied, but analysts say Beijing, at least for the time being, is trying to keep the trade dispute from seeping into the larger political arena.

“I don’t think they see that as in their interests and are worried that anti-Americanism becomes anti-regime very quickly,” Green said.

A weaker yuan could help mitigate the impact on China’s exports from higher US tariffs, but any sharp yuan depreciation could spur capital flight, analysts say.

Chinese leaders have repeatedly said they would not resort to yuan depreciation to boost exports and the central bank has said it would not use the currency as a tool to cope with trade frictions.

The yuan has lost just over 2 percent against the US dollar so far this month as the trade dispute intensifies, but analysts said the depreciation is likely to be market-driven.

Investors are concerned that China, which is the largest foreign US creditor, could dump US Treasury bonds and send US borrowing costs higher to punish the Trump administration, but most analysts say such an action by China is unlikely as it risks starting a fire sale that would burn its own portfolio, too.

China’s massive US Treasury holdings totaled U$1.131 trillion in February, according to the latest US data.

The near-term shock to China’s economy from higher US tariffs could be mitigated by increased policy stimulus to spur domestic demand.

Chinese exporters are diversifying overseas sales, helped in part by Beijing’s Belt and Road Initiative.

To meet its demand for raw materials, China is also seeking alternative overseas suppliers.

Chinese purchases of US soybeans — once its biggest import item from the US — came to a virtual halt after Beijing slapped 25 percent tariffs on US shipments last year.

Beijing has since scooped up soybeans from Brazil.

Additional reporting by Hallie Gu

Recently, China launched another diplomatic offensive against Taiwan, improperly linking its “one China principle” with UN General Assembly Resolution 2758 to constrain Taiwan’s diplomatic space. After Taiwan’s presidential election on Jan. 13, China persuaded Nauru to sever diplomatic ties with Taiwan. Nauru cited Resolution 2758 in its declaration of the diplomatic break. Subsequently, during the WHO Executive Board meeting that month, Beijing rallied countries including Venezuela, Zimbabwe, Belarus, Egypt, Nicaragua, Sri Lanka, Laos, Russia, Syria and Pakistan to reiterate the “one China principle” in their statements, and assert that “Resolution 2758 has settled the status of Taiwan” to hinder Taiwan’s

Singaporean Prime Minister Lee Hsien Loong’s (李顯龍) decision to step down after 19 years and hand power to his deputy, Lawrence Wong (黃循財), on May 15 was expected — though, perhaps, not so soon. Most political analysts had been eyeing an end-of-year handover, to ensure more time for Wong to study and shadow the role, ahead of general elections that must be called by November next year. Wong — who is currently both deputy prime minister and minister of finance — would need a combination of fresh ideas, wisdom and experience as he writes the nation’s next chapter. The world that

Can US dialogue and cooperation with the communist dictatorship in Beijing help avert a Taiwan Strait crisis? Or is US President Joe Biden playing into Chinese President Xi Jinping’s (習近平) hands? With America preoccupied with the wars in Europe and the Middle East, Biden is seeking better relations with Xi’s regime. The goal is to responsibly manage US-China competition and prevent unintended conflict, thereby hoping to create greater space for the two countries to work together in areas where their interests align. The existing wars have already stretched US military resources thin, and the last thing Biden wants is yet another war.

Since the Russian invasion of Ukraine in February 2022, people have been asking if Taiwan is the next Ukraine. At a G7 meeting of national leaders in January, Japanese Prime Minister Fumio Kishida warned that Taiwan “could be the next Ukraine” if Chinese aggression is not checked. NATO Secretary-General Jens Stoltenberg has said that if Russia is not defeated, then “today, it’s Ukraine, tomorrow it can be Taiwan.” China does not like this rhetoric. Its diplomats ask people to stop saying “Ukraine today, Taiwan tomorrow.” However, the rhetoric and stated ambition of Chinese President Xi Jinping (習近平) on Taiwan shows strong parallels with