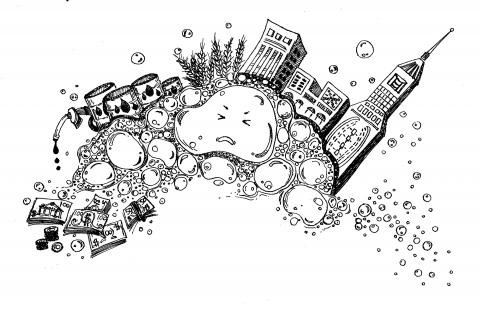

A speculative bubble is a social epidemic whose contagion is mediated by price movements. News of price increases enriches the early investors, creating word-of-mouth stories about their successes, which stir envy and interest. The excitement then lures an increasing number of people into the market, which causes prices to increase further, attracting yet more people and fueling “new era” stories, and so on, in successive feedback loops as the bubble grows. After the bubble bursts, the same contagion fuels a precipitous collapse, as falling prices cause more and more people to exit the market, and to magnify negative stories about the economy.

However, before we conclude that we should now, after the crisis, pursue policies to rein in the markets, we need to consider the alternative. Speculative bubbles are just one example of social epidemics, which can be even worse in the absence of financial markets. In a speculative bubble, the contagion is amplified by people’s reaction to price movements, but social epidemics do not need markets or prices to get public attention and spread quickly.

Some examples of social epidemics unsupported by any speculative markets can be found in Charles MacKay’s 1841 best seller Memoirs of Extraordinary Popular Delusions and the Madness of Crowds. The book made some historical bubbles famous: the Mississippi bubble 1719-1720, the South Sea Company Bubble 1711-1720 and the tulip mania of the 1630s. However, the book contained other, non-market, examples as well.

MacKay gave examples, over the centuries, of social epidemics involving belief in alchemists, prophets of Judgement Day, fortune tellers, astrologers, physicians employing magnets, witch hunters and crusaders. Some of these epidemics had profound economic consequences. The Crusades from the 11th to the 13th century, for example, brought forth what MacKay described as “epidemic frenzy” among would-be crusaders in Europe, accompanied by delusions that God would send armies of saints to fight alongside them. Between 1 million and 3 million people died in the Crusades.

There was no way, of course, for anyone either to invest in or to bet against the success of any of the activities promoted by the social epidemics — no professional opinion or outlet for analysts’ reports on these activities. So there was nothing to stop these social epidemics from attaining ridiculous proportions.

MacKay’s examples may seem a bit remote to us now. Some examples that we might relate to better can be found in the communist centrally planned economies of much of the 20th century, which also had no speculative markets. To be sure, events in these economies might seem attributable simply to their leaders’ commands. However, social contagions took hold in these countries even more powerfully than they have in our “bubble” economies.

China’s Great Leap Forward in 1958-1961 was a marketless investment bubble. The plan involved both agricultural collectivization and aggressive promotion of industry. There were no market prices, no published profit-and-loss statements, and no independent analyses. At first, there was a lot of uninformed enthusiasm for the new plan. Steel production was promoted by primitive backyard furnaces that industry analysts would consider laughable, but people who understood that had no influence in China then. Of course, there was no way to short the Great Leap Forward. The result was that agricultural labor and resources were rapidly diverted to industry, resulting in a famine that killed tens of millions.

The Great Leap Forward had aspects of a Ponzi scheme, an investment fraud which attempts to draw in successive rounds of investors through word-of-mouth tales of outsize returns. Ponzi schemes have managed to produce great profits for their promoters, at least for a while, by encouraging a social contagion of enthusiasm. Then-Chinese leader Mao Zedong (毛澤東), on visiting and talking to experts at a modern steel plant in Manchuria, is reported to have lost confidence that the backyard furnaces were a good idea after all, but feared the effects of a loss of momentum. He appears to have been worried, like the manager of a Ponzi scheme, that any hint of doubt could cause the whole movement to crash. The Great Leap Forward, and the Cultural Revolution that followed it, was a calculated effort to create a social contagion of ideas.

Some might object that these events were not really social epidemics like speculative bubbles, because a totalitarian government ordered them and the resulting deaths reflect government mismanagement more than investment error. Still, they do have aspects of bubbles: Collectivization was indeed a plan for prosperity with a contagion of popular excitement, however misguided it looks in retrospect.

The recent and ongoing world financial crisis pales in comparison with these events. And it is important to appreciate why. Modern economies have free markets, along with business analysts with their recommendations, ratings agencies with their classifications of securities and accountants with their balance sheets and income statements. And then, too, there are auditors, lawyers and regulators.

All of these groups have their respective professional associations, which hold regular meetings and establish certification standards that keep the information up-to-date and the practitioners ethical in their work. The full development of these institutions renders really serious economic catastrophes — the kind that dwarf the 2008 crisis — virtually impossible.

Robert Shiller is a professor of economics at Yale University.

Copyright: Project Syndicate

Could Asia be on the verge of a new wave of nuclear proliferation? A look back at the early history of the North Atlantic Treaty Organization (NATO), which recently celebrated its 75th anniversary, illuminates some reasons for concern in the Indo-Pacific today. US Secretary of Defense Lloyd Austin recently described NATO as “the most powerful and successful alliance in history,” but the organization’s early years were not without challenges. At its inception, the signing of the North Atlantic Treaty marked a sea change in American strategic thinking. The United States had been intent on withdrawing from Europe in the years following

My wife and I spent the week in the interior of Taiwan where Shuyuan spent her childhood. In that town there is a street that functions as an open farmer’s market. Walk along that street, as Shuyuan did yesterday, and it is next to impossible to come home empty-handed. Some mangoes that looked vaguely like others we had seen around here ended up on our table. Shuyuan told how she had bought them from a little old farmer woman from the countryside who said the mangoes were from a very old tree she had on her property. The big surprise

The issue of China’s overcapacity has drawn greater global attention recently, with US Secretary of the Treasury Janet Yellen urging Beijing to address its excess production in key industries during her visit to China last week. Meanwhile in Brussels, European Commission President Ursula von der Leyen last week said that Europe must have a tough talk with China on its perceived overcapacity and unfair trade practices. The remarks by Yellen and Von der Leyen come as China’s economy is undergoing a painful transition. Beijing is trying to steer the world’s second-largest economy out of a COVID-19 slump, the property crisis and

Ursula K. le Guin in The Ones Who Walked Away from Omelas proposed a thought experiment of a utopian city whose existence depended on one child held captive in a dungeon. When taken to extremes, Le Guin suggests, utilitarian logic violates some of our deepest moral intuitions. Even the greatest social goods — peace, harmony and prosperity — are not worth the sacrifice of an innocent person. Former president Chen Shui-bian (陳水扁), since leaving office, has lived an odyssey that has brought him to lows like Le Guin’s dungeon. From late 2008 to 2015 he was imprisoned, much of this