The facts have changed, now we must change too. For the past 10 years an unlikely coalition of geologists, oil drillers, bankers, military strategists and environmentalists has been warning that peak oil — the decline of global supplies — is just around the corner. We had some strong reasons for doing so: Production had slowed, the price had risen sharply and depletion was widespread and appeared to be escalating. The first of the great resource crunches seemed about to strike.

Among environmentalists it was never clear, even to ourselves, whether or not we wanted it to happen. It had the potential both to shock the world into economic transformation, averting future catastrophes and to generate catastrophes of its own, including a shift into even more damaging technologies, such as bio-fuels and petrol made from coal. Even so, peak oil was a powerful lever. Governments, businesses and voters who seemed impervious to the moral case for cutting the use of fossil fuels might, we hoped, respond to the economic case.

Some of us made vague predictions, others were more specific. In all cases we were wrong. In 1975, M.K. Hubbert, a geoscientist working for Shell who had correctly predicted the decline in US oil production, suggested that global supplies could peak in 1995. In 1997 the petroleum geologist Colin Campbell estimated that it would happen before 2010. In 2003 the geophysicist Kenneth Deffeyes said he was “99 percent confident” that peak oil would occur in 2004. In 2004, the Texas tycoon T. Boone Pickens predicted that “never again will we pump more than 82 million barrels” per day of liquid fuels. (Average daily supply in May was 91 million.) In 2005 the investment banker Matthew Simmons maintained that “Saudi Arabia... cannot materially grow its oil production.” (Since then its output has risen from 9 million barrels a day to 10 million, and it has another 1.5 million in spare capacity.)

Peak oil hasn’t happened, and it’s unlikely to happen for a very long time.

A report by the oil executive Leonardo Maugeri, published by Harvard University, provides compelling evidence that a new oil boom has begun. The constraints on oil supply over the past 10 years appear to have had more to do with money than geology. The low prices before 2003 had discouraged investors from developing difficult fields. The high prices of the past few years have changed that.

Maugeri’s analysis of projects in 23 countries suggests that global oil supplies are likely to rise by a net 17 million barrels per day (to 110 million) by 2020. This, he says, is “the largest potential addition to the world’s oil supply capacity since the 1980s.” The investments required to make this boom happen depend on a long-term price of US$70 a barrel — the current cost of Brent crude is US$95. Money is now flooding into new oil: US$1 trillion has been spent in the past two years; a record US$600 billion is lined up for this year.

The country in which production is likely to rise most is Iraq, into which multinational companies are now sinking their money, and their claws. However, the bigger surprise is that the other great boom is likely to happen in the US. Hubbert’s peak, the famous bell-shaped graph depicting the rise and fall of US oil, is set to become Hubbert’s Rollercoaster.

Investment in Iraq will concentrate on unconventional oil, especially shale oil (which, confusingly, is not the same as oil shale). Shale oil is high-quality crude trapped in rocks through which it doesn’t flow naturally.

There are, we now know, monstrous deposits in the US: One estimate suggests that the Bakken shales in North Dakota contain almost as much oil as Saudi Arabia (though less of it is extractable). This is one of 20 such formations in the US. Extracting shale oil requires horizontal drilling and fracking: a combination of high prices and technological refinements has made them economically viable. Already production in North Dakota has risen from 100,000 barrels a day in 2005 to 550,000 in January this year.

So this is where we are. The automatic correction — resource depletion destroying the machine that was driving it — that many environmentalists foresaw is not going to happen. The problem we face is not that there is too little oil, but that there is too much.

We have confused threats to the living planet with threats to industrial civilization. They are not, in the first instance, the same thing. Industry and consumer capitalism, powered by abundant oil supplies, are more resilient than many of the natural systems they threaten. The great profusion of life in the past — fossilized in the form of flammable carbon — now jeopardizes the great profusion of life in the present.

There is enough oil in the ground to deep-fry the lot of us, and no obvious means to prevail upon governments and industry to leave it in the ground. Twenty years of efforts to prevent climate breakdown through moral persuasion have failed, with the collapse of the multilateral process at Rio de Janeiro last month. The US is again becoming an oil state, and if the political transformation of its northern neighbor is anything to go by, the results will not be pretty.

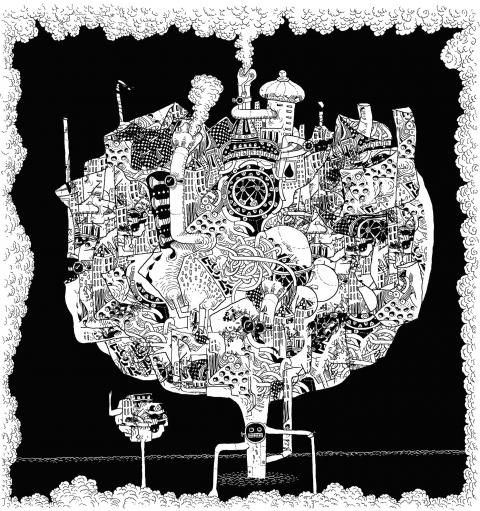

Humanity seems to be like the girl in Guillermo del Toro’s masterpiece Pan’s Labyrinth: She knows that if she eats the exquisite feast laid out in front of her, she too will be consumed, but she cannot help herself. I don’t like raising problems when I cannot see a solution. However, right now I’m not sure how I can look my children in the eyes.

Could Asia be on the verge of a new wave of nuclear proliferation? A look back at the early history of the North Atlantic Treaty Organization (NATO), which recently celebrated its 75th anniversary, illuminates some reasons for concern in the Indo-Pacific today. US Secretary of Defense Lloyd Austin recently described NATO as “the most powerful and successful alliance in history,” but the organization’s early years were not without challenges. At its inception, the signing of the North Atlantic Treaty marked a sea change in American strategic thinking. The United States had been intent on withdrawing from Europe in the years following

My wife and I spent the week in the interior of Taiwan where Shuyuan spent her childhood. In that town there is a street that functions as an open farmer’s market. Walk along that street, as Shuyuan did yesterday, and it is next to impossible to come home empty-handed. Some mangoes that looked vaguely like others we had seen around here ended up on our table. Shuyuan told how she had bought them from a little old farmer woman from the countryside who said the mangoes were from a very old tree she had on her property. The big surprise

The issue of China’s overcapacity has drawn greater global attention recently, with US Secretary of the Treasury Janet Yellen urging Beijing to address its excess production in key industries during her visit to China last week. Meanwhile in Brussels, European Commission President Ursula von der Leyen last week said that Europe must have a tough talk with China on its perceived overcapacity and unfair trade practices. The remarks by Yellen and Von der Leyen come as China’s economy is undergoing a painful transition. Beijing is trying to steer the world’s second-largest economy out of a COVID-19 slump, the property crisis and

As former president Ma Ying-jeou (馬英九) wrapped up his visit to the People’s Republic of China, he received his share of attention. Certainly, the trip must be seen within the full context of Ma’s life, that is, his eight-year presidency, the Sunflower movement and his failed Economic Cooperation Framework Agreement, as well as his eight years as Taipei mayor with its posturing, accusations of money laundering, and ups and downs. Through all that, basic questions stand out: “What drives Ma? What is his end game?” Having observed and commented on Ma for decades, it is all ironically reminiscent of former US president Harry