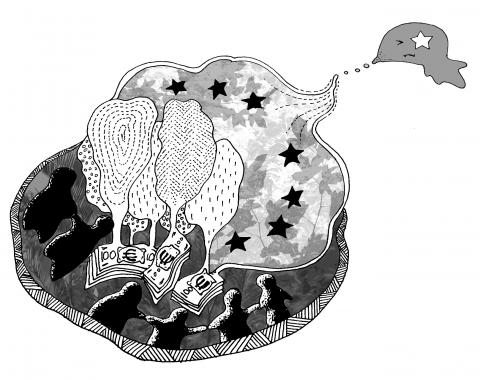

Underpinning European integration is the belief that unity between nations should bring shared prosperity instead of social, political and economic turmoil. However, today’s debt crisis has exposed a fundamental weakness in the eurozone’s architecture: insufficient integration.

This adds another layer of complexity, compared to the US or Japan, to the economic challenges that the EU faces. To paraphrase Leo Tolstoy, the European family is unhappy in its own way.

The European Monetary Union acted as a powerful catalyst for European integration, rapidly bringing together 17 diverse economies in a single monetary union — but without fiscal solidarity, a way to enforce fiscal discipline, or an established lender of last resort. This facilitated massive capital inflows and unsustainable borrowing in the peripheral countries — most notably Greece, but also Portugal, Spain and Italy — shrouding and thereby accelerating their increasing loss of competitiveness. When the global financial crisis hit, the house of cards collapsed.

Now, troubled countries do not have the option of reducing their debt burdens and increasing external competitiveness by devaluing their currencies. Integration is thus incomplete with eurozone countries having abrogated monetary sovereignty, while rejecting the stabilizing mechanisms of shared fiscal and economic policy.

With the single currency on the precipice, the necessity of greater fiscal and economic coordination is clear. However, such a move would require profound treaty changes and thus would take time. Still, more can be done to smooth the fiscal and economic adjustments taking place in the eurozone’s troubled periphery.

The current focus on austerity and structural reform carries severe social and economic risks, in part because disenchanted electorates are fertile ground for extremist parties. Indeed, in Greece’s recent elections, after five years of recession and 20 percent unemployment, extremist parties from both ends of the political spectrum made substantial electoral gains. Likewise, in the first round of France’s presidential elections last month, extremist parties from the right and left won more than 30 percent of the vote.

Europe needs a new plan to ensure sustainable and shared prosperity, based in part on rebalancing growth and competitiveness within the eurozone. Although Germany’s recent indication that it may consider wage increases for its workers is an encouraging start, a consumption-based recovery is clearly not sustainable.

Peripheral countries must undertake structural reforms, while recognizing that such changes will not bear fruit overnight and that internal economic rebalancing will be painful. To facilitate this economic rebalancing and ameliorate its social consequences, they also need targeted public investments, cofinanced at the European level.

The green sector provides a key opportunity for European investment, owing to its scale and long-term growth potential. After all, real resource prices have reached record levels and, on average, the oil intensity of GDP in Spain, Greece and Portugal is 60 percent higher than the European average. Investing in the green sector would contribute to Europe’s long-term productivity, while providing productive cross-border capital flows to complement structural rebalancing within peripheral countries.

Europe’s leaders should therefore agree on a large-scale recapitalization of the European Investment Bank (EIB). During the crisis, the EIB has played a pivotal role in financing large-scale infrastructure projects, but it is now curtailing its lending — and private banks cannot pick up the slack. Options for raising new capital include requesting a 10 billion euros (US$13 billion) contribution from member states, using the 12 billion euros left over from the European Financial Stability Mechanism, or reallocating the tens of billions of euros of unallocated funds from the EU budget.

Furthermore, the European Commission’s proposal that the EIB support privately financed infrastructure projects through guarantees for corporate bonds, called “project bonds,” must be accelerated and expanded. However, there is not yet much demand for such bonds in Europe and the initiative’s development will take time.

Therefore, eurozone members, possibly through the EIB, should guarantee “green covered bonds,” securitized by revenue from existing green-sector assets, such as renewable energy. This would allow banks to refinance green-sector investments, thus freeing up bank capital for further lending. Banks’ experience and the diversity of products offered in the sector mean that freeing up their balance-sheet capacities could swiftly inject funds into the real economy.

Thus far, Europe’s response to the debt crisis has been impeded by a false juxtaposition of austerity and stimulus. Productive investments in areas such as infrastructure and knowledge can not only stimulate growth and employment in the short term, but are also a necessary condition for long-term prosperity.

Solvent countries can currently borrow at near-zero interest rates, so the time is right to invest in long-term productive assets in the peripheral countries, thus helping to facilitate the structural reforms that Europe needs to claw its way out of crisis and into a sustainable, prosperous future.

This is a European crisis, so all of Europe must share the burden of adjustment. That means coming together to provide the resources needed to restore competitiveness, revive growth and prepare to face the challenges of tomorrow.

Laurence Tubiana is director of the Institute for Sustainable Development and International Relations at Sciences Po in Paris and a professor at Columbia University. Emmanuel Guerin is director of the Energy and Climate Department at the institute and a visiting fellow at the London School of Economics.

Copyright: Project Syndicate

Could Asia be on the verge of a new wave of nuclear proliferation? A look back at the early history of the North Atlantic Treaty Organization (NATO), which recently celebrated its 75th anniversary, illuminates some reasons for concern in the Indo-Pacific today. US Secretary of Defense Lloyd Austin recently described NATO as “the most powerful and successful alliance in history,” but the organization’s early years were not without challenges. At its inception, the signing of the North Atlantic Treaty marked a sea change in American strategic thinking. The United States had been intent on withdrawing from Europe in the years following

For fans of the aesthetic, Taiwan is hailed as a pilgrimage destination for all things cute. Not just Hello Kitty, but cutesy characters of all kinds are just as common in the alleys of Taipei’s trendy Ximending (西門町) area as on the desk of a bank employee. Visitors are sometimes taken aback by its ubiquity, especially in the hallowed halls of business or government, but the cognitive dissonance resonant in the minds of many Westerners appears to be absent in Taiwan. The aesthetic of cuteness seems entwined into the nation’s very fabric. The trend is by no means exclusive to Taiwan. Neighbor

My wife and I spent the week in the interior of Taiwan where Shuyuan spent her childhood. In that town there is a street that functions as an open farmer’s market. Walk along that street, as Shuyuan did yesterday, and it is next to impossible to come home empty-handed. Some mangoes that looked vaguely like others we had seen around here ended up on our table. Shuyuan told how she had bought them from a little old farmer woman from the countryside who said the mangoes were from a very old tree she had on her property. The big surprise

Ursula K. le Guin in The Ones Who Walked Away from Omelas proposed a thought experiment of a utopian city whose existence depended on one child held captive in a dungeon. When taken to extremes, Le Guin suggests, utilitarian logic violates some of our deepest moral intuitions. Even the greatest social goods — peace, harmony and prosperity — are not worth the sacrifice of an innocent person. Former president Chen Shui-bian (陳水扁), since leaving office, has lived an odyssey that has brought him to lows like Le Guin’s dungeon. From late 2008 to 2015 he was imprisoned, much of this