Remember the German economic boom of last year?

Germany’s economic growth surged in the middle of last year, causing commentators both there and here to proclaim that US stimulus had failed and German austerity had worked. Germany’s announced budget cuts, the commentators said, had given private companies enough confidence in the government to begin spending their own money again.

Well, it turns out the German boom didn’t last long. With its modest stimulus winding down, Germany’s growth slowed sharply late last year, and its economic output still has not recovered to its prerecession peak. Output in the US — where the stimulus program has been bigger and longer lasting — has recovered. This country would now need to suffer through a double-dip recession for its GDP to be in the same condition as Germany’s.

Yet many members of the US Congress continue to insist that budget cuts are the path to prosperity. The only question in Washington seems to be how deeply to cut federal spending this year.

If the economy were at a different point in the cycle — not emerging from a financial crisis — the coming fight over spending could actually be quite productive. Republicans could force Democrats to make government more efficient, which Democrats rarely do on their own. Democrats could force Republicans to abandon the worst of their proposed cuts, like those to medical research, law enforcement, college financial aid and preschools. And maybe such a benevolent compromise can still occur over the next several years.

The immediate problem, however, is the fragility of the economy. GDP may have surpassed its previous peak, but it’s still growing too slowly for companies to be doing much hiring. States, of course, are making major cuts. A big round of federal cuts will only make things worse.

So if the opponents of deep federal cuts, starting with US President Barack Obama, are trying to decide how hard to fight, they may want to err on the side of toughness. Both logic and history make this case.

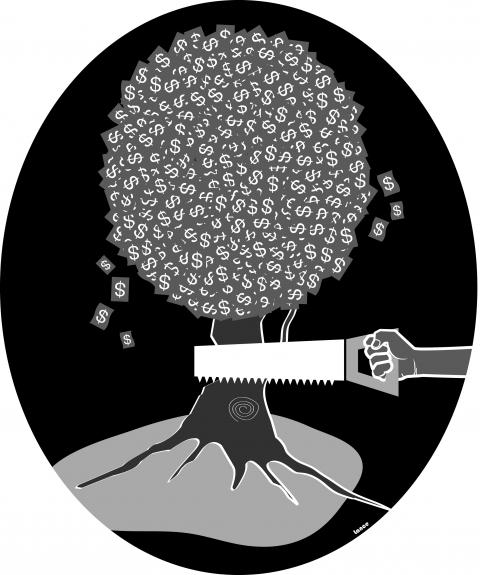

Let’s start with the logic. The austerity crowd argues that government cuts will lead to more activity by the private sector. How could that be? The main way would be if the government were using up so many resources that it was driving up their price and making it harder for companies to use them.

In the early 1990s, for instance, government borrowing was pushing up interest rates. When the deficit began to fall, interest rates did too. Projects that had not previously been profitable for companies suddenly began to make sense. The resulting economic boom brought in more tax revenue and further reduced the deficit.

However, this virtuous cycle can’t happen today. Interest rates are already very low. They’re low because the financial crisis and recession caused a huge drop in the private sector’s demand for loans. Even with all the government spending to fight the recession, overall demand for loans has remained historically low, the data shows.

Similarly, there is no evidence that the government is gobbling up too many workers and keeping them from the private sector. When Speaker of the House John Boehner said last week that federal payrolls had grown by 200,000 people since Obama took office, he was simply wrong. The federal government has added only 58,000 workers, largely in national security, since January 2009. State and local governments have cut 405,000 jobs over the same span.

The fundamental problem after a financial crisis is that businesses and households stop spending money, and they remain skittish for years afterward. Consider that new-vehicle sales, which peaked at 17 million in 2005, recovered to only 12 million last year. Single-family home sales, which peaked at 7.5 million in 2005, continued falling last year, to 4.6 million. No wonder so many businesses are uncertain about the future.

Without the government spending of the past two years — including tax cuts — the economy would be in vastly worse shape. Likewise, if the federal government begins laying off tens of thousands of workers now, the economy will clearly suffer.

That’s the historical lesson of postcrisis austerity movements. The history is a rich one, too, because people understandably react to a bubble’s excesses by calling for the reverse. When former US president Franklin Roosevelt was running for the office in 1932, he repeatedly called for a balanced budget.

However, no matter how morally satisfying austerity may be, it’s the wrong answer. Former US president Herbert Hoover’s austere instincts worsened the Depression. Roosevelt’s post-election reversal helped, but he also prolonged the Depression by raising taxes and cutting spending in 1937. Only the giant stimulus program known as World War II finally ended the Depression. When the private sector is hesitant to spend, the government has to or no one will.

Our recent crisis serves up the same lesson. Germany isn’t even the best example. Its response to the crisis has had some successful features, like an hours-reduction program to minimize layoffs, and its turn to austerity has not been radical. Britain’s has been radical, with a tax increase having already taken effect and deep spending cuts coming. Partly as a result, Britain’s economy is now in worse shape than Germany’s.

“It’s really quite striking how well the US is performing relative to the UK, which is tightening aggressively, and relative to Germany, which is tightening more modestly,” said Ian Shepherdson, a Britain-based economist for the research firm High Frequency Economics.

Shepherdson adds that he generally opposes stimulus programs for a normal recession, but that they are crucial after a crisis.

The trick is finding the political will to end the stimulus when the time comes. That is not easy, especially for Democrats, given that stimulus programs tend to include policies they favor. However, the wave of recently elected Republicans, in Congress and at the state level, will no doubt be happy to help summon that political will.

For the sake of the economy, the best compromise in coming weeks would be one that trades short-term spending for medium and long-term cuts. Beef up the cost-control measures in the health care overhaul and add new ones, like malpractice reform. Cut more wasteful military programs, like the F-35 jet engine. Force more social programs to prove they work and cut their funding in future years if they don’t.

By all means, though, don’t follow the path of the Germans and the British just because it feels morally satisfying.

Recently, China launched another diplomatic offensive against Taiwan, improperly linking its “one China principle” with UN General Assembly Resolution 2758 to constrain Taiwan’s diplomatic space. After Taiwan’s presidential election on Jan. 13, China persuaded Nauru to sever diplomatic ties with Taiwan. Nauru cited Resolution 2758 in its declaration of the diplomatic break. Subsequently, during the WHO Executive Board meeting that month, Beijing rallied countries including Venezuela, Zimbabwe, Belarus, Egypt, Nicaragua, Sri Lanka, Laos, Russia, Syria and Pakistan to reiterate the “one China principle” in their statements, and assert that “Resolution 2758 has settled the status of Taiwan” to hinder Taiwan’s

Singaporean Prime Minister Lee Hsien Loong’s (李顯龍) decision to step down after 19 years and hand power to his deputy, Lawrence Wong (黃循財), on May 15 was expected — though, perhaps, not so soon. Most political analysts had been eyeing an end-of-year handover, to ensure more time for Wong to study and shadow the role, ahead of general elections that must be called by November next year. Wong — who is currently both deputy prime minister and minister of finance — would need a combination of fresh ideas, wisdom and experience as he writes the nation’s next chapter. The world that

The past few months have seen tremendous strides in India’s journey to develop a vibrant semiconductor and electronics ecosystem. The nation’s established prowess in information technology (IT) has earned it much-needed revenue and prestige across the globe. Now, through the convergence of engineering talent, supportive government policies, an expanding market and technologically adaptive entrepreneurship, India is striving to become part of global electronics and semiconductor supply chains. Indian Prime Minister Narendra Modi’s Vision of “Make in India” and “Design in India” has been the guiding force behind the government’s incentive schemes that span skilling, design, fabrication, assembly, testing and packaging, and

Can US dialogue and cooperation with the communist dictatorship in Beijing help avert a Taiwan Strait crisis? Or is US President Joe Biden playing into Chinese President Xi Jinping’s (習近平) hands? With America preoccupied with the wars in Europe and the Middle East, Biden is seeking better relations with Xi’s regime. The goal is to responsibly manage US-China competition and prevent unintended conflict, thereby hoping to create greater space for the two countries to work together in areas where their interests align. The existing wars have already stretched US military resources thin, and the last thing Biden wants is yet another war.