I have been following the financial markets for more than 30 years. Crises have come and gone, but the one unfolding since August and which intensified last week is the most serious. It is not just that its impact is cascading around the world because of the new interconnectedness of global finance, it is that the authorities, particularly in Britain and the US, have lost control and do not have the means to regain it as quickly as we might hope. With an oil price approaching US$100 a barrel, we are in an uncharted and dangerous place.

After more than 15 years of extraordinarily benevolent economic conditions worldwide -- cheap oil, cheap money, growing trade, the Asia boom, rising house prices -- things are unraveling at a bewildering speed. The system might be able to handle one shock; it is undoubtedly too fragile to handle so many simultaneously.

The epicenter is the hegemonic London and New York financial system. No longer are these discrete financial markets; financial deregulation and the global ambitions of US and European banks have made them intertwined. They are one system that operates around the same principles, copying each other's methods, making the same mistakes and exposing themselves to each other's risks.

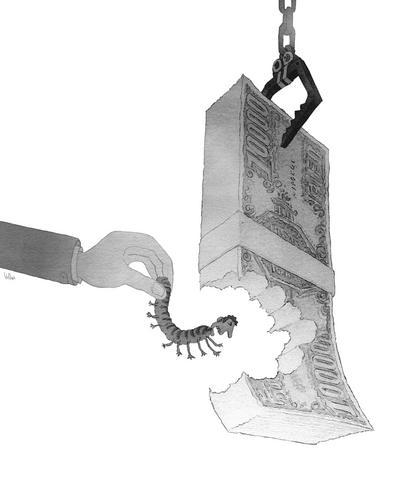

Thus the collapse of the US housing market, the explosive growth of US home repossessions and the discovery that structured investment vehicles (SIVs), the toxic newfangled financial instruments that own as much as US$350 billion of valueless mortgages, are not US problems. They are ours too.

The recent departure of the chief executive officers of two of the biggest investment banks -- UBS and Merrill Lynch -- after unexpected losses and loan write-offs running into many billions of dollars is not just a US problem, it's ours. It is also our problem that Credit Suisse last week announced more billions of write-offs, and Citigroup was rumored to be following suit with even bigger losses. When banks take hits as big as this, it hurts their capacity to lend, because prudence demands they have up to US$8 of their own capital to support every US$100 that they lend. If they don't, they have to lend less -- and that is called a credit crunch.

This crunch is already upon us -- hence the massive selling of bank shares at the end of last week and the extraordinary news that the taxpayer, one way or another, now has supplied ?40 billion (US$83.2 billion) to the stricken British mortgage lender Northern Rock, a sum that could climb to ?50 billion by Christmas. Stunningly, that represents 5 percent of GDP.

The bank got into trouble because it thought, under the chairmanship of free-market fundamentalist Viscount Ridley, that it could escape trivial matters like having savers' deposits to finance its adventurous lending. Instead, it could copy the Americans and sell SIVs to banks in London -- most of them the same banks that bought from New York -- and it could steal a march on its competitors.

But in the London-New York financial system, when things went wrong in the US they immediately went wrong for Northern Rock in Britain. The banks announcing those epic write-offs no longer wanted to buy Northern Rock's loans -- and neither did anybody else. The Bank of England and Treasury hoped to get by with masterly inactivity, but instead, as we know, there was a run on the bank. The government had to step in by guaranteeing ?20 billion of small savers' deposits -- but also, we now learn, by supplying ?30 billion of finance that the financial system will no longer supply itself.

This is testimony to the degree of fear that characterizes today's credit crunch -- and it bodes ill. What is worse, the Ridleyite maxims that got Northern Rock into trouble have also disabled the rescue, protracting rather than limiting the crisis.

What should have happened, of course, is that when the Bank of England found that it could not find a secret buyer for Northern Rock in the summer, it should have done what it did in the 1974 secondary banking crisis. It should have taken Northern Rock into the Bank of England's ownership.

Individual depositors and the City of London institutions alike would have been quickly reassured, and when the crisis passed the bank could have been sold back into the private sector.

But this year, the Ridley view of how to run a bank is also the authorities' view of how to respond to a crisis. There is a prohibition on even short-term public ownership. In a free-market fundamentalist world, this, like regulation, is regarded as wrong. Instead, the most expensive and riskier route has been taken so that Northern Rock remains part of the problem rather than the solution.

For when a central bank supplies rescue finance on this epic scale, it has wider implications. In effect it is printing money to bail out Northern Rock; good for the financial system, but bad for the rest of us because it will make it harder for the Bank of England to cut interest rates.

Already the British property market is in trouble. Given the absurd prices it is all too possible that we could follow the US market, with huge bad debts and mortgage repossessions.

The way Northern Rock has been rescued will make it hard for the Bank of England to cut interest rates and revive the property market, while remaining wedded to its inflation target. And if there are more Northern Rocks rescued in the same way, the dilemma will get worse.

Last week David Cameron, leader of the opposition Conservatives, proudly pronounced that his party was winning the battle of ideas in British politics. He could not be more wrong.

The credit crunch is testimony to the exhaustion of a conservative free-market world-view. To get through this crisis, the US and British governments are going to have to think what hitherto has been unthinkable.

Already the Americans are cutting interest rates careless of the inflationary consequences. Britain may have to follow suit. Both governments will have to do more. Banks may have to be taken into public ownership.

For 30 years we have been suckered into thinking that public authority has no business intervening in the wealth-generating, free-market financial system. This is the year when reality resurfaced with a vengeance.

Could Asia be on the verge of a new wave of nuclear proliferation? A look back at the early history of the North Atlantic Treaty Organization (NATO), which recently celebrated its 75th anniversary, illuminates some reasons for concern in the Indo-Pacific today. US Secretary of Defense Lloyd Austin recently described NATO as “the most powerful and successful alliance in history,” but the organization’s early years were not without challenges. At its inception, the signing of the North Atlantic Treaty marked a sea change in American strategic thinking. The United States had been intent on withdrawing from Europe in the years following

My wife and I spent the week in the interior of Taiwan where Shuyuan spent her childhood. In that town there is a street that functions as an open farmer’s market. Walk along that street, as Shuyuan did yesterday, and it is next to impossible to come home empty-handed. Some mangoes that looked vaguely like others we had seen around here ended up on our table. Shuyuan told how she had bought them from a little old farmer woman from the countryside who said the mangoes were from a very old tree she had on her property. The big surprise

The issue of China’s overcapacity has drawn greater global attention recently, with US Secretary of the Treasury Janet Yellen urging Beijing to address its excess production in key industries during her visit to China last week. Meanwhile in Brussels, European Commission President Ursula von der Leyen last week said that Europe must have a tough talk with China on its perceived overcapacity and unfair trade practices. The remarks by Yellen and Von der Leyen come as China’s economy is undergoing a painful transition. Beijing is trying to steer the world’s second-largest economy out of a COVID-19 slump, the property crisis and

Former president Ma Ying-jeou’s (馬英九) trip to China provides a pertinent reminder of why Taiwanese protested so vociferously against attempts to force through the cross-strait service trade agreement in 2014 and why, since Ma’s presidential election win in 2012, they have not voted in another Chinese Nationalist Party (KMT) candidate. While the nation narrowly avoided tragedy — the treaty would have put Taiwan on the path toward the demobilization of its democracy, which Courtney Donovan Smith wrote about in the Taipei Times in “With the Sunflower movement Taiwan dodged a bullet” — Ma’s political swansong in China, which included fawning dithyrambs