Approaching the 10th anniversary of the Asian financial crisis, we must brace for a round of self-congratulatory backslapping.

In the months ahead, expect policy makers in the region to wax eloquent about how much more resilient their economies and capital markets have become since those dark days of 1997.

Is Asia really less vulnerable now? We won't know the answer to that question until the money that's betting on Asia's strength has undergone famed investor Warren Buffett's "naked swimmer" test.

The outward signs do support an optimistic appraisal.

The US$1.6 trillion buildup in foreign-exchange reserves in Asia, excluding Japan, in the past decade makes the fortress appear better protected against speculators than in the past.

Yet, it's reasonable to ask if reserve acquisition beyond a point is good use of local taxpayers' money, and whether it can ever be a substitute for prudent economic policies, a strong banking system and the rule of law. It's equally important to query if Asia looks stronger than it is because of a protracted slump in investments.

Asian emerging markets -- with the exception of China -- aren't saving much less than the 30 percent of GDP they were putting away before 1997.

Yet investment rates, which used to be as high as 35 percent of GDP, are about 10 percentage points lower now.

The excess of savings over investments is the current-account surplus, which is responsible for the bulk of the increase in Asian reserves.

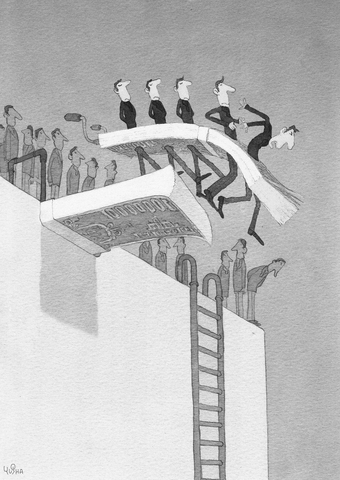

Swimming naked

It's fine if lower investment rates reflect a new-found aversion for dubious projects funded by short-term overseas borrowings. Corporate-governance standards have improved in most parts of Asia, as has the quality of bank supervision.

Correspondingly, however, Asia's openness to global trade and capital flows has intensified. Economies and markets in the region are more closely integrated with the world -- and with each other -- than ever. Shocks emanating in one country can hit another faster and with greater ferocity than in 1997.

"It's only when the tide goes out that you learn who has been swimming naked," Buffett said in his annual chairman's letter to shareholders of Berkshire Hathaway in March 1993.

The much-quoted -- and misquoted -- comment was about inadequate preparedness in the US insurance industry to deal with catastrophes. Those words are also of immense value in making sense of the exuberance in everything from Chinese and Indian equities to Indonesian corporate bonds and Singapore property.

No Dearth of Money

Investors recently offered more than 450 billion yuan (US$58 billion) for the shares of a rail operator in Guangdong Province, China. Guangshen Railway needed only 10 billion yuan.

Six real-estate companies have tapped London's Alternative Investment Market this year to raise money to invest in India. Their pickings? More than ?1.2 billion (US$2.4 billion).

According to Singapore's Today newspaper, an investor who paid about S$14 million (US$9.1 million) last week for an apartment near Singapore's main business district turned down an offer to sell it at a 19 percent profit, or an annualized 1,000 percent profit. He wants more, the paper said.

Structural weaknesses are being brushed aside.

Global investors who snapped up US$2.7 billion in international corporate-bond issuances by Indonesian companies this year aren't at all perturbed about the dubious legality, under Indonesian jurisprudence, of offshore special-purpose vehicles that are routinely used in structuring such deals.

Ten years after the Asian crisis exposed weaknesses in governance, both graft and nepotism remain big headaches. President Chen Shui-bian's (

In Thailand, businesses linked to deposed prime minister Thaksin Shinawatra are being probed by the military junta that overthrew him in September, alleging corruption and cronyism.

Weak Institutions

The legal system in Indonesia is at best a work in progress: The building that will house the all-powerful Constitutional Court, set up in 2003, is still being built.

Malaysia looks both unable and unwilling to stop clinging to an anachronistic racial policy that does nothing to add much-needed dynamism to its economy.

As long as the tide of liquidity runs high and is left undisturbed, investors don't care about anything else.

A nationalistic whiplash against foreign buyout firms in South Korea is being shrugged off as par for the course.

Meanwhile, the Bank of Thailand this week tried to tax the deluge of funds entering the economy and got punished. Stocks collapsed. The move had to be hastily scaled down.

Will sobriety return next year? Will there be a decline in the amount of cash chasing Asian assets? Perhaps not. That's because the investment slump seen in Asian nations since the crisis may actually be part of a more widespread phenomenon.

Shortage of Assets

Behind the surfeit of worldwide liquidity, there's a global shortage of new fixed assets, noted Raghuram Rajan, the outgoing chief economist at the IMF, in a speech earlier this month.

"The glut has spilt over into markets for existing real and financial assets -- real estate, high-risk credit, private equity, art, commodities -- pushing prices higher," he said.

Except for Asian central banks suddenly draining excessive liquidity, skinny-dipping will continue to be all thrills and no embarrassment.

Andy Mukherjee is a Bloomberg News columnist. The opinions expressed are his own.

Could Asia be on the verge of a new wave of nuclear proliferation? A look back at the early history of the North Atlantic Treaty Organization (NATO), which recently celebrated its 75th anniversary, illuminates some reasons for concern in the Indo-Pacific today. US Secretary of Defense Lloyd Austin recently described NATO as “the most powerful and successful alliance in history,” but the organization’s early years were not without challenges. At its inception, the signing of the North Atlantic Treaty marked a sea change in American strategic thinking. The United States had been intent on withdrawing from Europe in the years following

My wife and I spent the week in the interior of Taiwan where Shuyuan spent her childhood. In that town there is a street that functions as an open farmer’s market. Walk along that street, as Shuyuan did yesterday, and it is next to impossible to come home empty-handed. Some mangoes that looked vaguely like others we had seen around here ended up on our table. Shuyuan told how she had bought them from a little old farmer woman from the countryside who said the mangoes were from a very old tree she had on her property. The big surprise

The issue of China’s overcapacity has drawn greater global attention recently, with US Secretary of the Treasury Janet Yellen urging Beijing to address its excess production in key industries during her visit to China last week. Meanwhile in Brussels, European Commission President Ursula von der Leyen last week said that Europe must have a tough talk with China on its perceived overcapacity and unfair trade practices. The remarks by Yellen and Von der Leyen come as China’s economy is undergoing a painful transition. Beijing is trying to steer the world’s second-largest economy out of a COVID-19 slump, the property crisis and

Former president Ma Ying-jeou’s (馬英九) trip to China provides a pertinent reminder of why Taiwanese protested so vociferously against attempts to force through the cross-strait service trade agreement in 2014 and why, since Ma’s presidential election win in 2012, they have not voted in another Chinese Nationalist Party (KMT) candidate. While the nation narrowly avoided tragedy — the treaty would have put Taiwan on the path toward the demobilization of its democracy, which Courtney Donovan Smith wrote about in the Taipei Times in “With the Sunflower movement Taiwan dodged a bullet” — Ma’s political swansong in China, which included fawning dithyrambs