By the time the crowd began arriving in Rockefeller Center on Nov. 8 for the big auction at Christie's, rain had already been falling in New York for 19 consecutive hours. It was one of those blustery rains for which umbrellas were no match, so the assembled art lovers were left to peel off their damp overcoats in Christie's lobby and wait in a long coat-check line.

Once inside, a few hundred of the well-appointed attendees were shunted off to one of two side rooms, where they would watch the auction on a video screen, because the 750 seats in the the James Christie Room weren't nearly enough for the crowd.

Yet none of the inconveniences seemed to dull anybody's enthusiasm. Over the next three hours, a mere sketch by Mondrian sold for US$3 million, while a Gauguin painting went for US$40 million and a Klimt for US$88 million. In all, the auction brought in US$491 million, breaking the modern mark of US$435 million set by Sotheby's in 1990, in the last bull market in art.

There is no mystery about the causes of the new boom. The rich have done very well over the last decade and some of them, including hedge fund managers like Steven Cohen, are spending large sums of their money on art. New billionaires in China, India and, above all, Russia, have also entered the market.

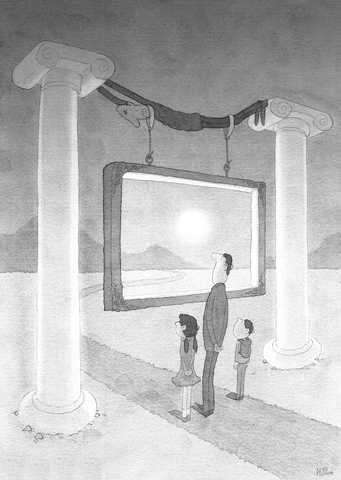

The mysterious part of the current mania lies in figuring out what exactly makes a piece of art worth US$30 million instead of, say, US$1 million. Not even people who make their living selling art claim to have much of a definition of great art. In fact, they take pride in not having one.

"That's where the market becomes magical," Tobias Meyer, Sotheby's chief auctioneer, said.

For the last five years, though, a man named David Galenson, an art lover, modest collector and tenured professor of economics at the University of Chicago, has been trying to change this. He has developed something approaching a unified theory of art, which hasn't won him many fans in the art world but does a surprisingly good job of explaining the relative value of the world's great paintings. Even if you know nothing about art, Galenson can help you understand why Andy Warhol's 1962 Orange Marilyn is expected to sell for more than his 1972 Mao at Christie's postwar auction.

The theory has its roots in a conversation a decade ago between Galenson and an art dealer he knew. He was thinking about buying an old painting by a US artist named Sol LeWitt and asked the dealer what she thought of the price. She told him the work was overpriced, because recent LeWitt works were selling for less. When Galenson asked her if the comparison was relevant, she told him that an artist's age didn't determine the price of his work.

"My whole life I've studied the relationship between age and productivity," Galenson, a slight 55-year-old, said last week before the Christie's auction. "And she's saying it doesn't matter."

So he began collecting data on the sale price of works by Warhol, Jackson Pollock and other US artists and he discovered a pattern. Most of them produced their most valuable work either very early in their career, like Warhol, or very late, like Pollock. When he expanded his research to European painters, he found the same pattern.

Not only that, but the two groups tended to approach art, and to talk about it, in strikingly different ways. The young geniuses, like Gauguin, Picasso and Van Gogh were conceptual innovators whose paintings broke sharply from previous work. They typically had a precise goal in mind when they started a piece and didn't need long to finish it.

"Above all, don't sweat over a painting," Gauguin once told a friend. "A great sentiment can be rendered immediately."

The old masters, on the other hand, arrived at their innovations gradually, through trial and error, making their major contributions late in life. They painted the same subject again and again, experimenting on the canvas, often reluctant to say that a painting was finished. Cezanne, who did his most valuable and celebrated work in his 60s, signed few of his paintings.

Galenson has extended the theory to novelists, poets and beyond, arguing that most creative people fall on one end or the other of the spectrum, and he has earned a fair bit of attention. Malcolm Gladwell, in a speech at Columbia University, described Old Masters and Young Geniuses, which Galenson published this year, as "a really wonderful book." Wired magazine recently profiled him under the headline, "What Kind of Genius Are You?"

But there are also a lot of people who consider him to be a bit of a kook. He has taken arguably the least scientific of all human endeavors and tried to fit it into a grand system. An art critic writing in the Chicago Tribune accused Galenson of applying statistical analysis to an inherently unquantifiable field and said his work "reads like a quirky little journal article that blithely ingested steroids."

As Galenson himself says: "The art historians and art critics won't look at my work. They just assume I'm an idiot."

When Gladwell submitted an article about Galenson's ideas to the New Yorker, he suffered his first rejection from the magazine.

"You buy this Galenson stuff?" Gladwell recalled his editor saying to him. "What are you, crazy?"

Obviously, Galenson's theory can't explain all of art history. There are clear exceptions, like Guernica, which Picasso painted when he was 55, decades after much of his greatest work.

But they are exceptions nonetheless. If you look through the prices from the current auction season, or walk through any major museum, you can't help but notice that Galenson is onto something. When a still life that Cezanne painted at the age of 56, for instance, fetched US$37 million at Sotheby's last week, art experts cited the rarity of Cezanne still lifes. The next night at Christie's, another Cezanne still life -- one painted when he was 34 -- sold for just US$1.1 million.

So I don't think that the exceptions to the Galenson theory of creativity are the main reason it faces so much opposition. Its real problem is that it's not what we want to hear. We like to believe that human judgment is too complex and nuanced -- too magical -- to be captured by something as clinical as statistics.

While Galenson has been studying the art world over the last five years, all sorts of other fields have been engaged in their own debate about judgment and rules. Some doctors have been resisting a push toward "evidence-based medicine" because they believe their clinical judgment trumps the data. In Major League Baseball, scouts who have been watching games for decades roll their eyes at a group of young executives who prefer numbers to descriptions.

When the traditionalists in these fields describe their skepticism of statistics, they sometimes make the argument that their craft is as much art as it is science. That's a nice line, but the next time you hear it, think back to Galenson's work. Even art, it turns out, has a good bit of science to it.

Could Asia be on the verge of a new wave of nuclear proliferation? A look back at the early history of the North Atlantic Treaty Organization (NATO), which recently celebrated its 75th anniversary, illuminates some reasons for concern in the Indo-Pacific today. US Secretary of Defense Lloyd Austin recently described NATO as “the most powerful and successful alliance in history,” but the organization’s early years were not without challenges. At its inception, the signing of the North Atlantic Treaty marked a sea change in American strategic thinking. The United States had been intent on withdrawing from Europe in the years following

My wife and I spent the week in the interior of Taiwan where Shuyuan spent her childhood. In that town there is a street that functions as an open farmer’s market. Walk along that street, as Shuyuan did yesterday, and it is next to impossible to come home empty-handed. Some mangoes that looked vaguely like others we had seen around here ended up on our table. Shuyuan told how she had bought them from a little old farmer woman from the countryside who said the mangoes were from a very old tree she had on her property. The big surprise

The issue of China’s overcapacity has drawn greater global attention recently, with US Secretary of the Treasury Janet Yellen urging Beijing to address its excess production in key industries during her visit to China last week. Meanwhile in Brussels, European Commission President Ursula von der Leyen last week said that Europe must have a tough talk with China on its perceived overcapacity and unfair trade practices. The remarks by Yellen and Von der Leyen come as China’s economy is undergoing a painful transition. Beijing is trying to steer the world’s second-largest economy out of a COVID-19 slump, the property crisis and

The past few months have seen tremendous strides in India’s journey to develop a vibrant semiconductor and electronics ecosystem. The nation’s established prowess in information technology (IT) has earned it much-needed revenue and prestige across the globe. Now, through the convergence of engineering talent, supportive government policies, an expanding market and technologically adaptive entrepreneurship, India is striving to become part of global electronics and semiconductor supply chains. Indian Prime Minister Narendra Modi’s Vision of “Make in India” and “Design in India” has been the guiding force behind the government’s incentive schemes that span skilling, design, fabrication, assembly, testing and packaging, and