Two weeks ago the great-and-good finance ministers of the European Monetary Union (EMU) gathered to consider the euro zone's economic condition. They ruminated over the most recent economic forecast, which projects annual GDP growth in the euro zone this year at a pathetically anemic 0.7 percent. Then, to a minister, without exception, they all but decided that their economies should suffer more of the same, if not worse.

They reiterated their commitment to the Stability and Growth Pact, which requires euro-zone countries to raise taxes and cut spending, putting even more downward pressure on their economies. The pact is already knocking Germany into recession, and Italy's government is struggling to revise its growth forecasts fast enough to keep up with falling output. But none of this is apparently enough to force officials to re-examine their priorities.

Some EU finance ministers still view the Stability Pact as the "cornerstone" of EMU. Others talk of the importance of obeying the "rules of the game." Still others say that while it is clearly essential to restore economic growth, the recovery must occur "within the spirit of the Pact."

From the American side of the Atlantic, all of these rationales seem utterly bizarre.

The last time an American government tried to ensure a balanced budget in the face of a recession was over seventy years ago, during the presidency of Herbert Hoover at the outset of the Great Depression. Since then the broad consensus in the US has been that cyclical economic distress requires the use of budget deficits to ameliorate suffering, stimulate aggregate demand, and hasten recovery.

Economists call these cyclical fiscal boosts "automatic stabilizers." When private incomes fall, so do public revenues. The reduction in tax collection can increase disposable income. But, more importantly, when private incomes fall, government social-welfare expenditures rise, sparking a recovery in demand, output, investment, and employment. The fall in taxes and the rise in spending do widen the budget deficit, but in a healthy and useful way.

On the American side of the Atlantic, the usefulness of these automatic fiscal stabilizers is unchallenged. On the contrary, whenever recession threatens, political debate revolves around whether they need to be reinforced by additional stimulus via discretionary fiscal policy. No one considers how to put further downward pressure on the economy by raising tax rates and cutting back on spending programs. Neither Democrats nor Republicans have an interest in choking off economic activity. This is not a partisan issue.

Nor is it even a fiscal discipline issue. Whenever proposals have surfaced for some sort of balanced-budget amendment to the US Constitution, proponents have typically included exemptions not just for war, but also for recessions.

We know the origins of the Stability and Growth Pact. Northern European countries -- particularly Germany and the Netherlands -- prided themselves on traditionally maintaining moderate debt-to-GDP ratios and relatively low interest rates. These countries saw that Southern European countries -- Italy and Greece were the biggest worries -- traditionally had high debt-to-GDP ratios and relatively high nominal interest rates because of their perceived tolerance of inflation.

The Northern European countries feared that deficit spending by the South might ultimately create pressure for partial monetization of their debt through inflation of the euro -- or, more precisely, their leaders feared that investors, fearing the same thing, would demand higher interest rates. The Stability and Growth Pact was intended to keep the public debts of southern Europe low, and thus keep interest rates low by reassuring investors that national debts would never be allowed to rise high enough to generate serious inflationary pressures.

But if you look at the euro zone's economic problems today, the danger of high long-term nominal interest rates does not even rank among investors' top 10 concerns. At the very least, investors clearly do not fear that high debt will lead governments to stoke inflation by printing more money. The EU's problems are stagnant output, high structural unemployment, weak productivity growth, the wasteful and unfair Common Agricultural Policy (CAP), and the forthcoming structural adjustments from the expansion of the EU itself.

From one perspective, it is good that the euro zone's finance ministers are eager to keep their national debts low in the long term: it is a sign that the victories over inflation won in the 1970s will not be casually thrown away.

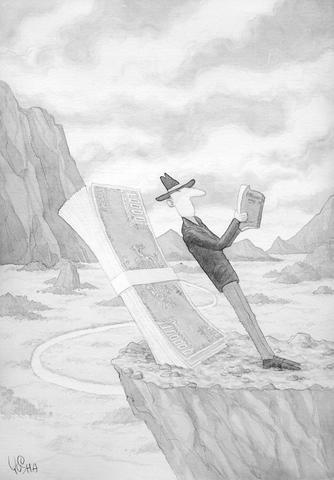

But it is dangerous to become obsessed with the past. There is no more certain route to economic disaster than to put on historical blinders. As Herbert Hoover could attest, when we see only the economic policy problems of a generation ago, we risk missing the hazards that lie directly in front of our eyes.

J. Bradford DeLong is professor of economics at the University of California at Berkeley and a former assistant US treasury secretary. Copyright: Project Syndicate

Recently, China launched another diplomatic offensive against Taiwan, improperly linking its “one China principle” with UN General Assembly Resolution 2758 to constrain Taiwan’s diplomatic space. After Taiwan’s presidential election on Jan. 13, China persuaded Nauru to sever diplomatic ties with Taiwan. Nauru cited Resolution 2758 in its declaration of the diplomatic break. Subsequently, during the WHO Executive Board meeting that month, Beijing rallied countries including Venezuela, Zimbabwe, Belarus, Egypt, Nicaragua, Sri Lanka, Laos, Russia, Syria and Pakistan to reiterate the “one China principle” in their statements, and assert that “Resolution 2758 has settled the status of Taiwan” to hinder Taiwan’s

Singaporean Prime Minister Lee Hsien Loong’s (李顯龍) decision to step down after 19 years and hand power to his deputy, Lawrence Wong (黃循財), on May 15 was expected — though, perhaps, not so soon. Most political analysts had been eyeing an end-of-year handover, to ensure more time for Wong to study and shadow the role, ahead of general elections that must be called by November next year. Wong — who is currently both deputy prime minister and minister of finance — would need a combination of fresh ideas, wisdom and experience as he writes the nation’s next chapter. The world that

The past few months have seen tremendous strides in India’s journey to develop a vibrant semiconductor and electronics ecosystem. The nation’s established prowess in information technology (IT) has earned it much-needed revenue and prestige across the globe. Now, through the convergence of engineering talent, supportive government policies, an expanding market and technologically adaptive entrepreneurship, India is striving to become part of global electronics and semiconductor supply chains. Indian Prime Minister Narendra Modi’s Vision of “Make in India” and “Design in India” has been the guiding force behind the government’s incentive schemes that span skilling, design, fabrication, assembly, testing and packaging, and

Can US dialogue and cooperation with the communist dictatorship in Beijing help avert a Taiwan Strait crisis? Or is US President Joe Biden playing into Chinese President Xi Jinping’s (習近平) hands? With America preoccupied with the wars in Europe and the Middle East, Biden is seeking better relations with Xi’s regime. The goal is to responsibly manage US-China competition and prevent unintended conflict, thereby hoping to create greater space for the two countries to work together in areas where their interests align. The existing wars have already stretched US military resources thin, and the last thing Biden wants is yet another war.