They are a staple of consumer-complaint hotlines and Web sites: anguished tales about money stolen electronically from bank accounts, about unhelpful bank tellers and, finally, about unreimbursed losses.

But surely customers of the elite private banking operation at JPMorgan Chase, serving only the bank’s wealthiest clients, are safe from such problems, right?

Wrong, says Guy Wyser-Pratte, an activist investor on Wall Street for more than 40 years who uses his hedge fund’s war chest of roughly US$500 million to wage takeover fights and proxy battles in the US and Europe.

In May, Wyser-Pratte learned that someone had siphoned nearly US$300,000 from his personal account at the private bank through many small electronic transfers over a 15-month period.

Then he was told by the bank that he could stop the theft only by closing his account and opening a new one — an enormous hassle, he said. And finally, JPMorgan Chase told him that the bank would cover only US$50,000 of his losses.

“While this is an unfortunate situation, we believe our response has been entirely appropriate,” said Mary Sedarat, a spokeswoman for the private banking service at JPMorgan Chase.

Wyser-Pratte emphatically disagrees.

“They never should have approved that first transfer,” he said.

The wealthy financier “is getting a taste of what the rest of us have to deal with all the time,” said Gail Hillebrand, the senior staff lawyer for Consumers Union in San Francisco.

That sour taste is called automated clearing house fraud, theft involving unauthorized electronic transfers through the automated networks of the circulatory systems that connect the world’s bank accounts.

When a consumer writes a check, the merchant that accepts it is entitled to have the specified amount taken from the customer’s bank account and sent electronically to the merchant’s account.

But once someone has certain routing numbers for a customer’s account, fraudulent transfers become possible unless the customer carefully scrutinizes all of the transactions on the monthly account statement.

If the consumer reports a clearly unauthorized transaction within 60 days, federal banking rules require the bank to cover the loss, Hillebrand said. If not, and if the bank informed the customer in advance about the 60-day deadline, the bank has no liability.

Consumer advocates agree that online purchases and automatic bill-paying arrangements have greatly complicated the task of catching fraudulent transfers — particularly small ones — from busy accounts.

And Wyser-Pratte’s personal account was as busy as his life. Louis Morin, his chief operating officer, said his boss splits his time between Paris and New York and travels almost constantly.

“He is not someone who writes 30 checks a month — more like thousands a month,” Morin said.

And a retail bank statement is kindergarten arithmetic compared with the monthly statement for a private banking client. Indeed, Wyser-Pratte said that the statements had become so complicated that not even a Wall Street veteran like himself could detect the continuing theft.

“I kept complaining that the bank’s records showed I was overdrawn when I shouldn’t be,” he said.

Each time, he was assured that the statement was accurate, even if he could not decipher it.

As for the 60-day deadline for reporting a theft, “I never knew about it,” he said. “I opened that account eons ago, it must be 20 or 25 years now. I don’t think I ever signed anything agreeing to that policy.”

It all sounds sadly familiar to Hillebrand, who said all bank customers — even wealthy private banking customers — must know their rights and watch their monthly statements.

“It is easier than ever for people to steal money from your account,” she said.

Wyser-Pratte has filed a complaint with the New York City Police Department. A detective working on the case confirmed that an investigation was under way.

Morin said the money was sucked out of Wyser-Pratte’s personal account through dozens of unauthorized purchases of computer equipment from Dell. But so far, police investigators have been able to trace only a single US$1,600 shipment of equipment, delivered to a nonexistent business in Brooklyn.

Wyser-Pratte, understandably anxious to solve the mystery, complained that neither Dell nor his bankers were giving the police enough help.

“Dell is cooperating fully” with the police, said Jess Blackburn, a company spokesman. “We have been very responsive to all requests for information.”

JPMorgan Chase is also cooperating fully, said Sedarat, the bank spokeswoman.

“This is an important reminder that clients are responsible for monitoring activity in their accounts,” she said.

ROLLER-COASTER RIDE: More than five earthquakes ranging from magnitude 4.4 to 5.5 on the Richter scale shook eastern Taiwan in rapid succession yesterday afternoon Back-to-back weather fronts are forecast to hit Taiwan this week, resulting in rain across the nation in the coming days, the Central Weather Administration said yesterday, as it also warned residents in mountainous regions to be wary of landslides and rockfalls. As the first front approached, sporadic rainfall began in central and northern parts of Taiwan yesterday, the agency said, adding that rain is forecast to intensify in those regions today, while brief showers would also affect other parts of the nation. A second weather system is forecast to arrive on Thursday, bringing additional rain to the whole nation until Sunday, it

CONDITIONAL: The PRC imposes secret requirements that the funding it provides cannot be spent in states with diplomatic relations with Taiwan, Emma Reilly said China has been bribing UN officials to obtain “special benefits” and to block funding from countries that have diplomatic ties with Taiwan, a former UN employee told the British House of Commons on Tuesday. At a House of Commons Foreign Affairs Committee hearing into “international relations within the multilateral system,” former Office of the UN High Commissioner for Human Rights (OHCHR) employee Emma Reilly said in a written statement that “Beijing paid bribes to the two successive Presidents of the [UN] General Assembly” during the two-year negotiation of the Sustainable Development Goals. Another way China exercises influence within the UN Secretariat is

LANDSLIDES POSSIBLE: The agency advised the public to avoid visiting mountainous regions due to more expected aftershocks and rainfall from a series of weather fronts A series of earthquakes over the past few days were likely aftershocks of the April 3 earthquake in Hualien County, with further aftershocks to be expected for up to a year, the Central Weather Administration (CWA) said yesterday. Based on the nation’s experience after the quake on Sept. 21, 1999, more aftershocks are possible over the next six months to a year, the agency said. A total of 103 earthquakes of magnitude 4 on the local magnitude scale or higher hit Hualien County from 5:08pm on Monday to 10:27am yesterday, with 27 of them exceeding magnitude 5. They included two, of magnitude

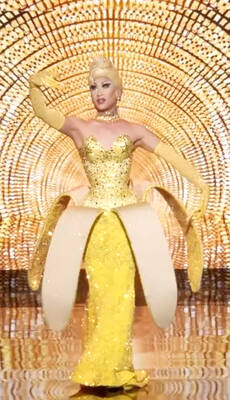

Taiwan’s first drag queen to compete on the internationally acclaimed RuPaul’s Drag Race, Nymphia Wind (妮妃雅), was on Friday crowned the “Next Drag Superstar.” Dressed in a sparkling banana dress, Nymphia Wind swept onto the stage for the final, and stole the show. “Taiwan this is for you,” she said right after show host RuPaul announced her as the winner. “To those who feel like they don’t belong, just remember to live fearlessly and to live their truth,” she said on stage. One of the frontrunners for the past 15 episodes, the 28-year-old breezed through to the final after weeks of showcasing her unique