Arthur Andersen admits to making a lot of mistakes, but it refused to plead guilty to obstruction of justice. And so, on Thursday it was indicted in what the firm said was "a gross abuse of government power."

It is customary to say that a judge and jury will decide guilt. But in this case, the punishment may well come before the verdict. The maximum legal penalty, said Deputy Attorney General Larry D. Thompson in announcing the indictment, is a US$500,000 fine. In reality, many in the accounting business believe, the death penalty seems virtually certain.

PHOTO: THE NY TIMES

As Samuel Johnson once pointed out, the prospect of hanging concentrates the mind. Knowing it faces death if it dallies, Andersen may choose to demand an immediate trial and see if the Justice Department can prove that the firm -- as opposed to some of its partners -- is guilty.

PHOTO: THE NY TIMES

Conceivably, acquittal could give it a chance to survive. But this is a firm that was unable to find a merger partner because of its incalculable financial liabilities stemming from the problems at Enron and that is seeing more clients desert every day. Even though the Securities and Exchange Commission says it will still accept Andersen's audits, few companies want to risk telling their shareholders that they are hiring Andersen again. Even before the indictment, Andersen's reputation was in tatters.

Andersen does have some supporters. "They should survive," said David S. Ruder, a law professor at Northwestern University and a former SEC chairman. "Even the allegations at their worst," he added, make it appear that 95 percent of the firm was not involved. "I don't see any need to dissolve Andersen and force it into bankruptcy," he said, adding that the firm could be a very good auditor after it makes the reforms proposed by Paul A. Volcker, the former chairman of the Federal Reserve Board. On Thursday, Andersen pledged to make those reforms.

One government official involved in the case expressed concern about the indictment's consequences for Andersen. "The sentence does not fit the crime," said the official. He added that he feared reform efforts would be set back if Andersen did not survive to adopt Volcker's ideas. The other major accounting firms, now being called "The Final Four," have shown scant enthusiasm for the Volcker proposals.

Andersen's death, if it does come, could be messy. Others in the Final Four may try to pick off Andersen affiliates in foreign countries. There could be a scramble by companies to sign up new auditors before competing firms decide they have all the clients they can handle.

In recent weeks, there was talk of a global settlement in which Andersen would cut a deal with the Justice Department and resolve SEC charges with commitments for reform. Such an agreement might have provided the basis for Andersen's survival, either alone or with a dignified merger into another firm. But negotiations broke down, and the indictment followed.

In the current political environment, said Arthur Levitt, a former SEC chairman, it was impossible for government agencies "to broker the kind of settlement that might have preserved the best elements of Andersen" and kept it in business.

"This is a sad moment," Levitt added. "I hope the opportunity for reform will not be lost."

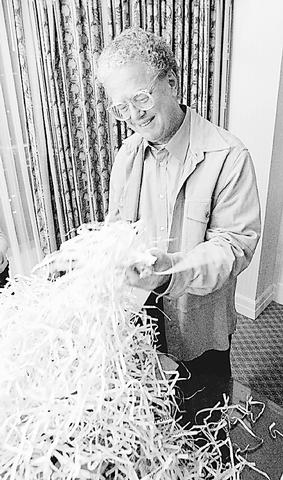

There is no doubt that Andersen employees shredded huge quantities of Enron documents after the SEC began its investigation. Andersen argued that its senior management did not authorize the destruction and presented a report by independent law firms to support its claims. If prosecutors have evidence to the contrary, they did not disclose it.

But even if top management did not know of the shredding, it did make some major errors in judgment. Last year, when Andersen became the first major accounting firm in decades to face a civil fraud complaint filed by the SEC, Andersen settled the case without admitting or denying the charges, which stemmed from fraudulent financial statements filed by Waste Management in the mid-1990s.

Andersen did not even appear contrite. There was no sense that the firm thought the Waste Management case showed it had a serious internal problem. The partners implicated in that case were not publicly disciplined, and one of them was even allowed to write the document retention policy that David B. Duncan, the fired Houston partner in charge of the Enron audit, cited as support for the shredding he ordered.

Had Andersen's management appeared to be vigilant about bringing change, perhaps the Justice Department would have been less eager to prosecute now. Or perhaps one of the many Andersen employees involved in the shredding would have notified senior management when it started, thus perhaps stopping it quickly.

"It is sad about Andersen, because there are thousands of good people there who do not deserve what is going to happen to them," one former federal regulator said on Thursday. "But they should have thought about this possibility."

There was plenty of sadness on Thursday. "I find it impossible to believe this happened," said Karen Andersen, whose grandfather, Walter, was Arthur Andersen's brother and first partner in the firm when it began in 1913. "They were such a good firm for so long."

One Andersen partner, reached at his desk on Thursday night, said auditors were trying to carry on. "We're working like we'll be here," he said. "I guess we're optimistic, or maybe we are naive. I'm still proud to be associated with this firm. I think the firm should get a chance to survive. It is worth saving."

Andersen's corporate motto, "Think straight, talk straight," was translated from the Norwegian by Arthur Andersen, said Karen Andersen, who now lives in St. Paul, and works as a publications coordinator for a nonprofit organization. She said it came from her great-grandmother, Marie Kathinka Aaby Andersen, an immigrant from Norway.

Perhaps the Andersen family history provides some hope. Arthur's father nearly died when a ship he was on sank in the Atlantic as he was traveling from Norway to America. He was rescued by the SS Missouri and wound up in Chicago. To some, survival for his son's namesake firm would now seem no less miraculous.

ROLLER-COASTER RIDE: More than five earthquakes ranging from magnitude 4.4 to 5.5 on the Richter scale shook eastern Taiwan in rapid succession yesterday afternoon Back-to-back weather fronts are forecast to hit Taiwan this week, resulting in rain across the nation in the coming days, the Central Weather Administration said yesterday, as it also warned residents in mountainous regions to be wary of landslides and rockfalls. As the first front approached, sporadic rainfall began in central and northern parts of Taiwan yesterday, the agency said, adding that rain is forecast to intensify in those regions today, while brief showers would also affect other parts of the nation. A second weather system is forecast to arrive on Thursday, bringing additional rain to the whole nation until Sunday, it

CONDITIONAL: The PRC imposes secret requirements that the funding it provides cannot be spent in states with diplomatic relations with Taiwan, Emma Reilly said China has been bribing UN officials to obtain “special benefits” and to block funding from countries that have diplomatic ties with Taiwan, a former UN employee told the British House of Commons on Tuesday. At a House of Commons Foreign Affairs Committee hearing into “international relations within the multilateral system,” former Office of the UN High Commissioner for Human Rights (OHCHR) employee Emma Reilly said in a written statement that “Beijing paid bribes to the two successive Presidents of the [UN] General Assembly” during the two-year negotiation of the Sustainable Development Goals. Another way China exercises influence within the UN Secretariat is

LANDSLIDES POSSIBLE: The agency advised the public to avoid visiting mountainous regions due to more expected aftershocks and rainfall from a series of weather fronts A series of earthquakes over the past few days were likely aftershocks of the April 3 earthquake in Hualien County, with further aftershocks to be expected for up to a year, the Central Weather Administration (CWA) said yesterday. Based on the nation’s experience after the quake on Sept. 21, 1999, more aftershocks are possible over the next six months to a year, the agency said. A total of 103 earthquakes of magnitude 4 on the local magnitude scale or higher hit Hualien County from 5:08pm on Monday to 10:27am yesterday, with 27 of them exceeding magnitude 5. They included two, of magnitude

Taiwan’s first drag queen to compete on the internationally acclaimed RuPaul’s Drag Race, Nymphia Wind (妮妃雅), was on Friday crowned the “Next Drag Superstar.” Dressed in a sparkling banana dress, Nymphia Wind swept onto the stage for the final, and stole the show. “Taiwan this is for you,” she said right after show host RuPaul announced her as the winner. “To those who feel like they don’t belong, just remember to live fearlessly and to live their truth,” she said on stage. One of the frontrunners for the past 15 episodes, the 28-year-old breezed through to the final after weeks of showcasing her unique