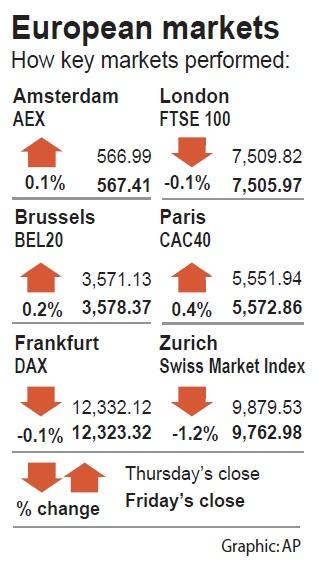

European markets edged higher on Friday, lifted by financial and mining stocks, with uncertainty over a US-China trade deal limiting gains fueled by dovish signals from the US Federal Reserve this week.

Fed Chair Jerome Powell confirmed that the US economy was still under threat from disappointing factory activity, tame inflation and a simmering trade dispute, and said the Fed stood ready to “act as appropriate.”

The pan-European STOXX 600 edged up 0.04 percent to 386.85, lifted by an increase in basic resources stocks as China iron ore logged its best week since about the middle of last month. Banks rose 0.7 percent.

Meanwhile, data out of China showed that Beijing’s exports fell last month as the US ramped up trade pressure, while imports shrank more than expected, pointing to further strains on the world’s second-largest economy.

“The export data was really weak, and it’s one signal that the trade war has started to bite Chinese exporters and that companies are starting to reroute their supply chains,” said Stefan Koopman, senior market economist at Rabobank NV in Utrecht, the Netherlands.

“European markets are waiting for a cue on what is happening between the United States and China on trade,” he said.

Regional markets have regained their footing after a huge sell-off in May due to an escalation in US-China trade tensions on expectations of rate cuts by major central banks.

Friday’s moves capped a tepid week and set the main index to post its first weekly loss in six weeks, in contrast to world stocks that are on course to end the week higher.

The STOXX 600 fell 0.8 from last week’s 390.11.

Putting a damper on trade deal hopes, US President Donald Trump on Thursday said that China was not living up to promises it made on buying agricultural products from US farmers.

Among stocks, Daimler AG slipped 0.8 percent after the luxury automaker warned investors that it expected to swing to a second-quarter loss before interest and taxes of 1.6 billion euros (US$1.81 billion).

“It’s highly indicative on what is happening on trade over the last couple of months. We’ve seen carmakers have difficulty, with Chinese car sales dropping over the past six to 12 months,” Koopman said.

Healthcare stocks slipped as drugmakers resumed their slide after the White House said it was ditching a key plan to lower US drug prices, raising the possibility of new measures focused on drugmakers.

Taiwan Transport and Storage Corp (TTS, 台灣通運倉儲) yesterday unveiled its first electric tractor unit — manufactured by Volvo Trucks — in a ceremony in Taipei, and said the unit would soon be used to transport cement produced by Taiwan Cement Corp (TCC, 台灣水泥). Both TTS and TCC belong to TCC International Holdings Ltd (台泥國際集團). With the electric tractor unit, the Taipei-based cement firm would become the first in Taiwan to use electric vehicles to transport construction materials. TTS chairman Koo Kung-yi (辜公怡), Volvo Trucks vice president of sales and marketing Johan Selven, TCC president Roman Cheng (程耀輝) and Taikoo Motors Group

Among the rows of vibrators, rubber torsos and leather harnesses at a Chinese sex toys exhibition in Shanghai this weekend, the beginnings of an artificial intelligence (AI)-driven shift in the industry quietly pulsed. China manufactures about 70 percent of the world’s sex toys, most of it the “hardware” on display at the fair — whether that be technicolor tentacled dildos or hyper-realistic personalized silicone dolls. Yet smart toys have been rising in popularity for some time. Many major European and US brands already offer tech-enhanced products that can enable long-distance love, monitor well-being and even bring people one step closer to

RECORD-BREAKING: TSMC’s net profit last quarter beat market expectations by expanding 8.9% and it was the best first-quarter profit in the chipmaker’s history Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), which counts Nvidia Corp as a key customer, yesterday said that artificial intelligence (AI) server chip revenue is set to more than double this year from last year amid rising demand. The chipmaker expects the growth momentum to continue in the next five years with an annual compound growth rate of 50 percent, TSMC chief executive officer C.C. Wei (魏哲家) told investors yesterday. By 2028, AI chips’ contribution to revenue would climb to about 20 percent from a percentage in the low teens, Wei said. “Almost all the AI innovators are working with TSMC to address the

FUTURE PLANS: Although the electric vehicle market is getting more competitive, Hon Hai would stick to its goal of seizing a 5 percent share globally, Young Liu said Hon Hai Precision Industry Co (鴻海精密), a major iPhone assembler and supplier of artificial intelligence (AI) servers powered by Nvidia Corp’s chips, yesterday said it has introduced a rotating chief executive structure as part of the company’s efforts to cultivate future leaders and to enhance corporate governance. The 50-year-old contract electronics maker reported sizable revenue of NT$6.16 trillion (US$189.67 billion) last year. Hon Hai, also known as Foxconn Technology Group (富士康科技集團), has been under the control of one man almost since its inception. A rotating CEO system is a rarity among Taiwanese businesses. Hon Hai has given leaders of the company’s six