European shares on Friday rose, with surging shares of Thyssenkrupp AG and robust defensive stocks helping equities on the continent avert the losses seen among their US peers, which slid on persisting worries about US-China trade.

US President Donald Trump said that he was in no hurry to sign a trade deal with China as a new set of US tariffs on Chinese goods kicked in, dashing hopes the world’s top two economies would salvage a last-minute trade deal.

European investors shuffled their equity holdings as they braced for more volatility on the second day of US-China trade talks, with defensive stocks gaining popularity over the course of the session.

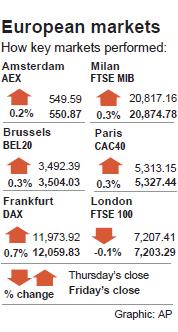

The pan-European STOXX 600 on Friday gained 1.90 points, or 0.3 percent, to 377.48, lifting off an about one-and-a-half-month closing low clocked on Thursday, but falling 3.3 percent from a close of 390.37 a week earlier.

“If things do escalate, then this will have an impact of around 0.5 percentage points of global GDP and that would not be inconsiderable,” investment management firm Fiera Capital chief investment strategist Julian Mayo said.

Germany’s DAX on Friday rose 85.91 points, or 0.7 percent, to 12,059.83, but dropped 2.8 percent from 12,412.75 on May 3.

Thyssenkrupp — also the STOXX 600’s top gainer — was lifted 28.2 percent by short-covering on news that it would list its successful elevator business and embark on a fresh restructuring.

The level of short interest on Thursday was 38.3 million shares, the largest amount in more than four years, FIS Astec Analytics data showed.

About 6.1 percent of Thyssenkrupp’s outstanding shares were out on loan.

Thyssenkrupp shares’ barnstorming performance on Friday helped trim the degree to which they have underperformed industrial goods and services stocks in the year to date.

French and Italian stocks each tacked on 0.3 percent, while their London-traded peers eased marginally.

Defensive stocks, such as those in the real-estate and utilities sectors, rose 0.3 percent and 1.1 percent respectively.

With yields on German bonds maturing up to 10 years from now in negative territory, according to Refinitiv Eikon data, European investors also favor defensive stocks for their dividend yields, relatively secure in a “lower-for-longer” position held by the European Central Bank.

Chemicals stocks gained 1.3 percent, with Linde PLC leading the sector index with a 4.1 percent rise.

The firm’s chief financial officer said that it would hit the upper end of this year’s earnings per share guidance if the current business environment holds up.

Stocks of automakers and their suppliers slid 1 percent to their lowest closing level in more than a month, with Daimler AG falling 3.2 percent. The sector is relatively exposed to global trade ructions.

“A trade deal getting less likely in Q2 after Trump’s moves today... Hopefully we can get a short break from Trump’s tweets and enjoy springtime instead,” Danske Bank A/S chief analyst and China economist Allan von Mehren wrote in a note.

LafargeHolcim Ltd gained 2.8 percent as the world’s top cement maker agreed to sell its Philippine operations.

Credit Suisse Group AG also raised its price target on the stock.

Additional reporting by staff writer

Stephen Garrett, a 27-year-old graduate student, always thought he would study in China, but first the country’s restrictive COVID-19 policies made it nearly impossible and now he has other concerns. The cost is one deterrent, but Garrett is more worried about restrictions on academic freedom and the personal risk of being stranded in China. He is not alone. Only about 700 American students are studying at Chinese universities, down from a peak of nearly 25,000 a decade ago, while there are nearly 300,000 Chinese students at US schools. Some young Americans are discouraged from investing their time in China by what they see

Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), the world’s largest contract chipmaker, yesterday reported record sales for the first quarter, which analysts attributed to solid demand for emerging technologies. Consolidated revenue totaled NT$592.64 billion (US$18.51 billion) in the January-to-March period, up 16.5 percent from a year earlier, but down 5.26 percent from the previous quarter, TSMC said in a statement. The first-quarter revenue beat analysts’ average projection of NT$579.5 billion, Bloomberg News reported. That performance lends weight to expectations that the world’s most valuable chipmaker would return to solid growth this year after weathering a post-COVID-19-pandemic cratering of smartphone and computer sales. TSMC is budgeting

MAJOR DROP: CEO Tim Cook, who is visiting Hanoi, pledged the firm was committed to Vietnam after its smartphone shipments declined 9.6% annually in the first quarter Apple Inc yesterday said it would increase spending on suppliers in Vietnam, a key production hub, as CEO Tim Cook arrived in the country for a two-day visit. The iPhone maker announced the news in a statement on its Web site, but gave no details of how much it would spend or where the money would go. Cook is expected to meet programmers, content creators and students during his visit, online newspaper VnExpress reported. The visit comes as US President Joe Biden’s administration seeks to ramp up Vietnam’s role in the global tech supply chain to reduce the US’ dependence on China. Images on

US CONSCULTANT: The US Department of Commerce’s Ursula Burns is a rarely seen US government consultant to be put forward to sit on the board, nominated as an independent director Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), the world’s largest contract chipmaker, yesterday nominated 10 candidates for its new board of directors, including Ursula Burns from the US Department of Commerce. It is rare that TSMC has nominated a US government consultant to sit on its board. Burns was nominated as one of seven independent directors. She is vice chair of the department’s Advisory Council on Supply Chain Competitiveness. Burns is to stand for election at TSMC’s annual shareholders’ meeting on June 4 along with the rest of the candidates. TSMC chairman Mark Liu (劉德音) was not on the list after in December last