European shares on Friday slipped as mining and oil stocks sold off and weak results from Thyssenkrupp AG and Compagnie Financiere Richemont SA weighed on sentiment.

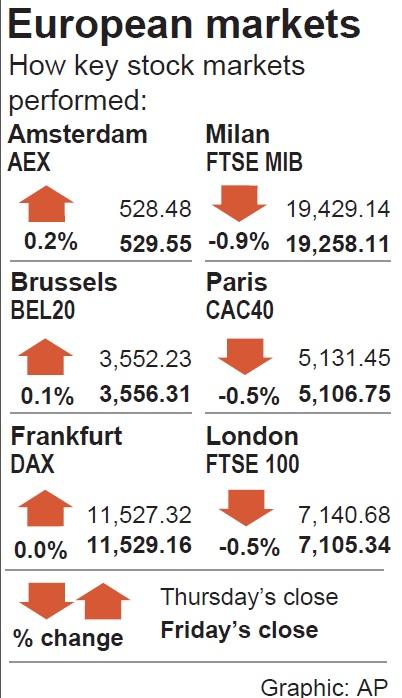

The pan-European STOXX 600 fell 1.56 points, or 0.4 percent, to 365.52, but held on to a small gain of 0.4 percent for the week, its second in the black after a harsh sell-off last month.

The end-week slide in Europe joined a global market retreat after the US Federal Reserve appeared to remain on track to raise its key interest rate next month and warned the growth of business investment had dipped.

“Just as the feel-good factor was beginning to return to the markets, buoyed by the result of the US midterms, the Fed swooped in and brought everyone back down to earth,” Oanda Corp senior market analyst Craig Erlam said in a note.

Disappointing corporate earnings in Europe weighed on the market on Friday, as Germany’s Thyssenkrupp fell 9.2 percent to its lowest levels since July 2016 after cutting its profit outlook for the second time this year.

“A second guidance cut in as many quarters will further weaken confidence that Thyssenkrupp has the quality of assets that merit a higher multiple, while continued poor free cash flow is unlikely to give assurance that balance sheet risks are behind it,” Jefferies Group LLC analysts wrote.

Thyssenkrupp helped drag down the basic resources sector, which fell 3.4 percent as metals sold off.

The energy sector also acted as a drag, down 1.4 percent with oil majors weighing on indices, as rising supply and concerns of an economic slowdown pressured prices.

French oil storage and distribution group Rubis SCA led losers with an 11 percent fall after a disappointing trading update, with brokers lowering their recommendation for the stock.

Another blow for investors was luxury goods group Richemont, whose shares fell 6.4 percent after it said sales growth slowed and management struck a cautious note.

The sales numbers were negatively affected by moves to combat the gray market and efforts by the Chinese government to discourage consumers from spending overseas.

The results knocked Swiss peer Swatch Ltd, which fell 5.1 percent, and French luxury group Kering SA, the worst performer on the Paris CAC 40 with a 3.5 percent decline. Italy’s Moncler SpA also fell 3.6 percent.

Italian state-controlled defense group Leonardo SpA was another big loser, tumbling 8.9 percent after a disappointing trading update.

Italian shipbuilder Fincantieri SpA also sank 15.7 percent, its worst day ever, after its results.

Europe’s banking sector also fell sharply, with Banco Bilbao Vizcaya Argentaria SA (BBVA) the worst-performing. Shares in the Spanish lender tumbled 5.9 percent in the fallout from an unexpected bill in Mexico proposing to limit bank commissions, which triggered the stock market’s biggest fall in more than seven years on Thursday.

Santander Group SA fell 1.6 percent and Banco de Sabadell SA was down 2.2 percent, but BBVA suffered the biggest tumble as Mexico is its biggest market, accounting for 41 percent of the bank’s overall profits.

Shares in Danish bioscience company Chr Hansen A/S suffered their worst day since June, falling 6.3 percent, after major shareholder Novo Holdings A/S sold 4.85 million shares at an about 9 percent discount to Thursday’s closing price.

With disappointing earnings frustrating investors’ hopes for a results-driven boost to sentiment on European stocks, Emerging Portfolio Fund Research Inc data showed that outflows of US$2.6 billion from the region this week.

Additional reporting by staff writer

Taiwan Transport and Storage Corp (TTS, 台灣通運倉儲) yesterday unveiled its first electric tractor unit — manufactured by Volvo Trucks — in a ceremony in Taipei, and said the unit would soon be used to transport cement produced by Taiwan Cement Corp (TCC, 台灣水泥). Both TTS and TCC belong to TCC International Holdings Ltd (台泥國際集團). With the electric tractor unit, the Taipei-based cement firm would become the first in Taiwan to use electric vehicles to transport construction materials. TTS chairman Koo Kung-yi (辜公怡), Volvo Trucks vice president of sales and marketing Johan Selven, TCC president Roman Cheng (程耀輝) and Taikoo Motors Group

Among the rows of vibrators, rubber torsos and leather harnesses at a Chinese sex toys exhibition in Shanghai this weekend, the beginnings of an artificial intelligence (AI)-driven shift in the industry quietly pulsed. China manufactures about 70 percent of the world’s sex toys, most of it the “hardware” on display at the fair — whether that be technicolor tentacled dildos or hyper-realistic personalized silicone dolls. Yet smart toys have been rising in popularity for some time. Many major European and US brands already offer tech-enhanced products that can enable long-distance love, monitor well-being and even bring people one step closer to

RECORD-BREAKING: TSMC’s net profit last quarter beat market expectations by expanding 8.9% and it was the best first-quarter profit in the chipmaker’s history Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), which counts Nvidia Corp as a key customer, yesterday said that artificial intelligence (AI) server chip revenue is set to more than double this year from last year amid rising demand. The chipmaker expects the growth momentum to continue in the next five years with an annual compound growth rate of 50 percent, TSMC chief executive officer C.C. Wei (魏哲家) told investors yesterday. By 2028, AI chips’ contribution to revenue would climb to about 20 percent from a percentage in the low teens, Wei said. “Almost all the AI innovators are working with TSMC to address the

Malaysia’s leader yesterday announced plans to build a massive semiconductor design park, aiming to boost the Southeast Asian nation’s role in the global chip industry. A prominent player in the semiconductor industry for decades, Malaysia accounts for an estimated 13 percent of global back-end manufacturing, according to German tech giant Bosch. Now it wants to go beyond production and emerge as a chip design powerhouse too, Malaysian Prime Minister Anwar Ibrahim said. “I am pleased to announce the largest IC (integrated circuit) Design Park in Southeast Asia, that will house world-class anchor tenants and collaborate with global companies such as Arm [Holdings PLC],”