European stocks failed to stage a recovery on Friday, posting their worst week since a market correction last February as a new sell-off hit bourses across the globe, amid worries about protectionism and fast-rising US interest rates.

Euro zone stocks initially jumped one percent, but rapidly shed all of their gains despite Wall Street opening higher.

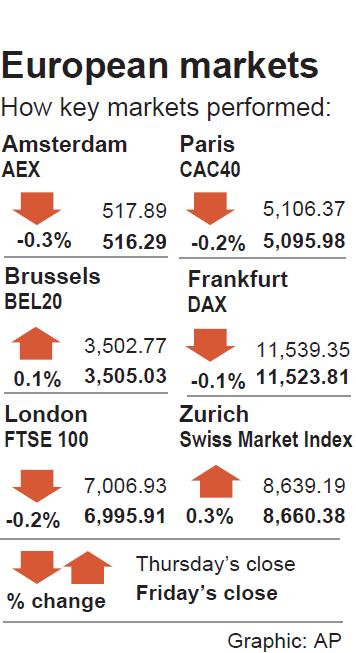

All major bourses closed in negative territory and the STOXX 600 benchmark fell 0.3 percent to 358.95 recording a weekly loss of 4.6 percent.

That is just below the 5.1 percent fallback experienced last February when a sudden scare about rising inflation and interest rates caused a global market correction.

UK shares fared similarly, with the FTSE 100 closing down 0.16 percent at 6,995.91 points, posting a weekly loss of 4.4 percent.

OUTPERFORMED

There is “a rotten trend” in Europe, a trader complained, saying that US shares have outperformed their European peers since the beginning of the year with fiscal cuts by US President Donald Trump’s administration boosting earnings.

Europe lags far behind the US in terms of earnings growth, and stronger results will be critical in luring back some of the billions that have been pulled out of European stocks this year.

Third-quarter results are beginning to trickle in from European firms as Wall Street banks formally kicked off the earnings season.

Tech stocks — the worst hit by this week’s sudden drop — made a modest comeback, up 0.5 percent, along with the growth-sensitive auto sector.

Among the rows of vibrators, rubber torsos and leather harnesses at a Chinese sex toys exhibition in Shanghai this weekend, the beginnings of an artificial intelligence (AI)-driven shift in the industry quietly pulsed. China manufactures about 70 percent of the world’s sex toys, most of it the “hardware” on display at the fair — whether that be technicolor tentacled dildos or hyper-realistic personalized silicone dolls. Yet smart toys have been rising in popularity for some time. Many major European and US brands already offer tech-enhanced products that can enable long-distance love, monitor well-being and even bring people one step closer to

Malaysia’s leader yesterday announced plans to build a massive semiconductor design park, aiming to boost the Southeast Asian nation’s role in the global chip industry. A prominent player in the semiconductor industry for decades, Malaysia accounts for an estimated 13 percent of global back-end manufacturing, according to German tech giant Bosch. Now it wants to go beyond production and emerge as a chip design powerhouse too, Malaysian Prime Minister Anwar Ibrahim said. “I am pleased to announce the largest IC (integrated circuit) Design Park in Southeast Asia, that will house world-class anchor tenants and collaborate with global companies such as Arm [Holdings PLC],”

Thousands of parents in Singapore are furious after a Cordlife Group Ltd (康盛人生集團), a major operator of cord blood banks in Asia, irreparably damaged their children’s samples through improper handling, with some now pursuing legal action. The ongoing case, one of the worst to hit the largely untested industry, has renewed concerns over companies marketing themselves to anxious parents with mostly unproven assurances. This has implications across the region, given Cordlife’s operations in Hong Kong, Macau, Indonesia, the Philippines and India. The parents paid for years to have their infants’ cord blood stored, with the understanding that the stem cells they contained

Sales in the retail, and food and beverage sectors last month continued to rise, increasing 0.7 percent and 13.6 percent respectively from a year earlier, setting record highs for the month of March, the Ministry of Economic Affairs said yesterday. Sales in the wholesale sector also grew last month by 4.6 annually, mainly due to the business opportunities for emerging applications related to artificial intelligence (AI) and high-performance computing technologies, the ministry said in a report. The ministry forecast that retail, and food and beverage sales this month would retain their growth momentum as the former would benefit from Tomb Sweeping Day