Britain’s top stock index fell more than 1 percent on Friday, posting its biggest weekly drop in six months, as a strong US jobs report raised concerns of a widening selloff in global markets.

The export-oriented FTSE 100 index was hurt also by a stronger pound.

The British currency rallied by a quarter of a percent after EU Brexit negotiators said that a divorce deal with Britain was very close.

Strong US data and confident remarks by US policymakers had fueled a surge in US Treasury yields, which had spilled over into broader global stock markets as investors worried that policymakers might tighten policy more than expected.

“It is a strong jobs report, make no mistake,” said Kenneth Broux, an foreign-exchange strategist at Societe Generale SA in London. “An unemployment rate of 3.7 percent was what the Fed had forecasted for the fourth quarter, but we have got there sooner.”

US job growth slowed last month as Hurricane Florence depressed restaurant and retail payrolls, but the unemployment rate fell to near 49-year lows of 3.7 percent, indicating more tightening in labor market conditions.

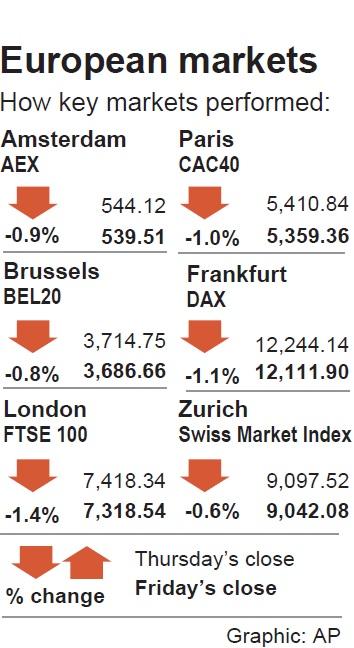

The FTSE 100 closed down 1.3 percent at 7,318 points and has fallen 2.5 percent on the week, its biggest weekly fall since the week of March 21.

The sell-off in US Treasuries rippled into bond markets in Europe and Britain, and pushed stock markets around the world lower.

Among major stock news, Unilever PLC’s decision on Friday to scrap plans to move its headquarters to the Netherlands in the face of a British shareholder revolt sent the stock down more than 0.5 percent.

Shares in Intu Properties PLC soared more than 27 percent after a consortium, including British billionaire John Whittaker and Canada’s Brookfield Asset Management Inc, said it was considering a bid for the shopping center owner.

Miners were the main drags on the index, with Anglo American PLC and Rio Tinto Ltd leading losses.

European shares also on Friday posted their biggest weekly loss in a month amid persistent fears that US interest rates might have to be raised quicker than expected to stop the economy from overheating.

“The strong level of job creation has provided the basis for a rise in US Treasury yields, putting fresh pressure on equities, particularly in Europe,” said Chris Beauchamp, chief market analyst at IG Ltd.

The pan-European STOXX 600 benchmark fell 0.9 percent to 376.41 points, down 1.8 percent for the week, and Germany’s DAX fell 1 percent to 12,112 points, down 1.1 percent for the week.

Among the top movers was Danske Bank A/S, which is facing a US criminal investigation into a 200 billion euro (US$230 billion) money laundering scandal at its Estonian branch.

Shares in Denmark’s biggest bank were down 6.2 percent after a rating cut by Credit Suisse Group AG.

The banking sector, which typically benefits from higher interest rates and rising yields, was nonetheless in the red, with a 0.9 percent decline.

There was no rebound for France’s Kering SA, down 2 percent after the European luxury sector fell on concerns about the Chinese market.

Separately, the head of the Gucci brand has reassured shop staff over a looming slowdown in the pace of sales growth according to an internal video message seen by reporters.

Stephen Garrett, a 27-year-old graduate student, always thought he would study in China, but first the country’s restrictive COVID-19 policies made it nearly impossible and now he has other concerns. The cost is one deterrent, but Garrett is more worried about restrictions on academic freedom and the personal risk of being stranded in China. He is not alone. Only about 700 American students are studying at Chinese universities, down from a peak of nearly 25,000 a decade ago, while there are nearly 300,000 Chinese students at US schools. Some young Americans are discouraged from investing their time in China by what they see

Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), the world’s largest contract chipmaker, yesterday reported record sales for the first quarter, which analysts attributed to solid demand for emerging technologies. Consolidated revenue totaled NT$592.64 billion (US$18.51 billion) in the January-to-March period, up 16.5 percent from a year earlier, but down 5.26 percent from the previous quarter, TSMC said in a statement. The first-quarter revenue beat analysts’ average projection of NT$579.5 billion, Bloomberg News reported. That performance lends weight to expectations that the world’s most valuable chipmaker would return to solid growth this year after weathering a post-COVID-19-pandemic cratering of smartphone and computer sales. TSMC is budgeting

MAJOR DROP: CEO Tim Cook, who is visiting Hanoi, pledged the firm was committed to Vietnam after its smartphone shipments declined 9.6% annually in the first quarter Apple Inc yesterday said it would increase spending on suppliers in Vietnam, a key production hub, as CEO Tim Cook arrived in the country for a two-day visit. The iPhone maker announced the news in a statement on its Web site, but gave no details of how much it would spend or where the money would go. Cook is expected to meet programmers, content creators and students during his visit, online newspaper VnExpress reported. The visit comes as US President Joe Biden’s administration seeks to ramp up Vietnam’s role in the global tech supply chain to reduce the US’ dependence on China. Images on

US CONSCULTANT: The US Department of Commerce’s Ursula Burns is a rarely seen US government consultant to be put forward to sit on the board, nominated as an independent director Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), the world’s largest contract chipmaker, yesterday nominated 10 candidates for its new board of directors, including Ursula Burns from the US Department of Commerce. It is rare that TSMC has nominated a US government consultant to sit on its board. Burns was nominated as one of seven independent directors. She is vice chair of the department’s Advisory Council on Supply Chain Competitiveness. Burns is to stand for election at TSMC’s annual shareholders’ meeting on June 4 along with the rest of the candidates. TSMC chairman Mark Liu (劉德音) was not on the list after in December last