European shares on Friday fell for a second straight day on reports that US President Donald Trump is planning more tariffs on China, with Europe’s STOXX posting its worst monthly performance since February.

The pan-European STOXX 600 on Friday ended the session down 3.1 points, or 0.8 percent, at 382.26, a decline of 0.3 percent from a close of 383.56 on Aug. 24.

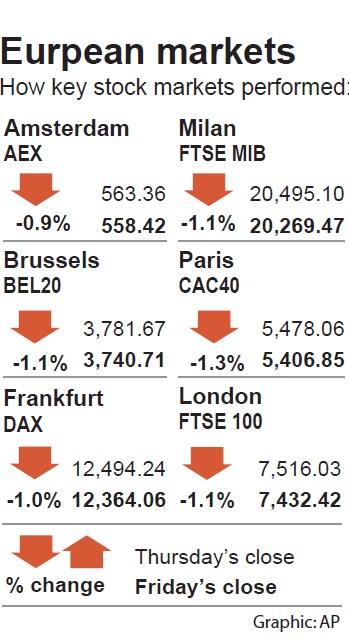

Germany’s DAX, heavier in trade-sensitive industrial stocks, on Friday fell 130.18 points, or 1 percent, to 12,364.06, falling 0.2 percent from 12,394.52 a week earlier.

All sectors, except one, were in negative territory.

Sparring over trade between Trump and the EU weighed on automakers’ stocks, the worst-performing sector, which fell 1.6 percent.

Trump reportedly rejected an EU offer to eliminate tariffs on cars, saying that the bloc’s trade policies are “almost as bad as China.”

European Commission President Jean-Claude Juncker said that the EU would respond in kind if the US imposed tariffs on cars.

“It’s very hard to see a decisive resuscitation of risk appetite until these tensions are resolved,” Janus Henderson Investors multi-asset team head Paul O’Connor said. “We have learned to underreact to some of the individual headlines, because if you try to extrapolate from any of them you could find yourself in big trouble.”

Daimler AG, Volkswagen AG, BMW AG and Continental AG were among the biggest weights on the DAX, each falling 1.4 to 1.9 percent.

In contrast, Whitbread PLC soared as much as 19 percent after the British company agreed to sell its Costa Coffee chain to Coca-Cola Co for £3.9 billion (US$5.1 billion).

The deal’s value exceeded the market’s expectations by £500 million to £900 million and was wrapped up more quickly than expected, traders said.

Most of the cash is to be returned to shareholders.

Sage Group PLC tumbled nearly 8 percent, one of the biggest decliners among European stocks, after the British software developer surprised the market by announcing that CEO Stephen Kelly would step down in May next year.

“This will leave a hole and raise further questions about reaching such targets,” Mirabaud Securities LLP global thematic group cohead Neil Campling said. “This is one we wouldn’t be bottom-fishing right now.”

While trade disputes have caused uncertainty and volatility, investors drew comfort from strong earnings.

“Concerns around trade are not significantly affecting macro and market fundamentals at this stage. There’s still a fairly strong global recovery; earnings forecasts remain resilient across the board,” O’Connor said. “It limits the upside, but isn’t something that is changing our perception of broader market fundamentals.”

However, analysts have adjusted their earnings expectations for auto stocks since the trade war broke out.

Additional reporting by staff writer

Taiwan Transport and Storage Corp (TTS, 台灣通運倉儲) yesterday unveiled its first electric tractor unit — manufactured by Volvo Trucks — in a ceremony in Taipei, and said the unit would soon be used to transport cement produced by Taiwan Cement Corp (TCC, 台灣水泥). Both TTS and TCC belong to TCC International Holdings Ltd (台泥國際集團). With the electric tractor unit, the Taipei-based cement firm would become the first in Taiwan to use electric vehicles to transport construction materials. TTS chairman Koo Kung-yi (辜公怡), Volvo Trucks vice president of sales and marketing Johan Selven, TCC president Roman Cheng (程耀輝) and Taikoo Motors Group

Among the rows of vibrators, rubber torsos and leather harnesses at a Chinese sex toys exhibition in Shanghai this weekend, the beginnings of an artificial intelligence (AI)-driven shift in the industry quietly pulsed. China manufactures about 70 percent of the world’s sex toys, most of it the “hardware” on display at the fair — whether that be technicolor tentacled dildos or hyper-realistic personalized silicone dolls. Yet smart toys have been rising in popularity for some time. Many major European and US brands already offer tech-enhanced products that can enable long-distance love, monitor well-being and even bring people one step closer to

RECORD-BREAKING: TSMC’s net profit last quarter beat market expectations by expanding 8.9% and it was the best first-quarter profit in the chipmaker’s history Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), which counts Nvidia Corp as a key customer, yesterday said that artificial intelligence (AI) server chip revenue is set to more than double this year from last year amid rising demand. The chipmaker expects the growth momentum to continue in the next five years with an annual compound growth rate of 50 percent, TSMC chief executive officer C.C. Wei (魏哲家) told investors yesterday. By 2028, AI chips’ contribution to revenue would climb to about 20 percent from a percentage in the low teens, Wei said. “Almost all the AI innovators are working with TSMC to address the

FUTURE PLANS: Although the electric vehicle market is getting more competitive, Hon Hai would stick to its goal of seizing a 5 percent share globally, Young Liu said Hon Hai Precision Industry Co (鴻海精密), a major iPhone assembler and supplier of artificial intelligence (AI) servers powered by Nvidia Corp’s chips, yesterday said it has introduced a rotating chief executive structure as part of the company’s efforts to cultivate future leaders and to enhance corporate governance. The 50-year-old contract electronics maker reported sizable revenue of NT$6.16 trillion (US$189.67 billion) last year. Hon Hai, also known as Foxconn Technology Group (富士康科技集團), has been under the control of one man almost since its inception. A rotating CEO system is a rarity among Taiwanese businesses. Hon Hai has given leaders of the company’s six