The UK’s top share index on Friday held its ground, slightly outperforming a broadly negative European market, as global trade uncertainty and political troubles closer to home spurred demand for defensive stocks and earnings filtered through.

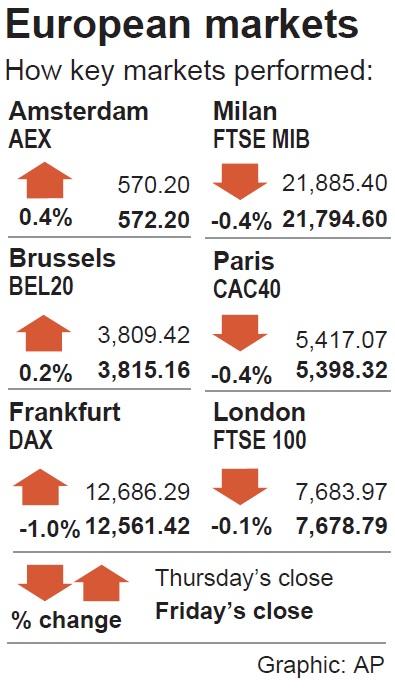

The blue chip FTSE 100 on Friday shed 5.18 points, or 0.07 percent, to 7,678.79 points. It scored its second week of straight gains, up 0.2 percent from 7,661.87 on July 13.

The FTSE, dominated by companies with large foreign currency earnings, has found support from weakness in the pound, which has been on the back foot this week amid signs of discord in British Prime Minister Theresa May’s party over her Brexit strategy.

Sterling rebounded on Friday from 10-month lows.

“The FTSE’s got the better set of exposures to the current set of conditions,” City Index market analyst Ken Odeluga said.

“The FTSE is hugely exposed to a lot of cyclicals and risky factors like commodities ... but again, of course, it does have a huge set of consumer staples and noncyclical businesses, which are the really large ones, and don’t forget the [US] dollar exposure as well,” Odeluga added.

Tensions over global trade have been a prominent worry in markets over the summer and have kept the FTSE 100 trading in a narrow range since the end of May.

While concerns over tariffs have hit European sectors such as autos, the more defensive makeup of the FTSE has shielded it somewhat.

Consumer staples stocks such as British American Tobacco PLC, Imperial Brands PLC and Unilever PLC were among the biggest gainers, all up between 0.4 percent and 2.5 percent.

“In view of the uncertainty caused by both existing and possible new trade tariffs, we currently prefer a balanced position between defensive and growth stocks,” Credit Suisse Wealth Management analysts said in a note. “We therefore favor Swiss, UK and emerging-market equities.”

Earnings were also in focus, especially among smaller companies.

Shares in insurer Beazley PLC fell 1.5 percent after the company reported a steep fall in pretax profit as rising US interest rates took their toll on investment returns.

Unilever also benefited from a number of target price upgrades from brokers, including Barclays PLC, Jefferies Group LLC and Joh. Berenberg, Gossler & Co KG, after the consumer giant’s earnings topped earnings estimates in the previous session.

“The market appears to have taken relief from the better-than-expected H1 margin outturn, which has added renewed credibility to the savings-driven bottom-line growth story at Unilever,” Barclays analysts said in a note.

Elsewhere, European stocks plunged, led by the auto sector, as US President Donald Trump said a new round of tariffs on Chinese goods was “ready to go” and that China and the EU were manipulating their currencies.

The pan-European STOXX 600 on Friday fell 0.56 points, or 0.2 percent, to 385.62, led by cyclical sectors, including auto and mining. That was a 0.2 percent increase from a close of 385.03 on July 13.

Trump said on Twitter that the EU was among those that had been manipulating their currencies, after earlier saying in an interview on CNBC that the US is ready to impose levies on all US$505 billion of Chinese imports into the US.

The president’s remarks indicated his willingness to escalate the US’ trade war with China, dashing hopes the two sides would arrive at a compromise before more tariffs were imposed.

Meanwhile, German Chancellor Angela Merkel said the EU is ready to retaliate against any US auto tariffs as it prepares to meet with Trump to discuss the possibility of cutting car duties.

The comments came just as global markets were starting to enjoy a reprieve from trade headlines, with attention shifting to the earnings season.

French auto parts maker Faurecia led declines in the auto sector, which has been whipsawed lately by Trump’s threats of raising tariffs on European cars.

Peugeot SA fell 3.4 percent, while Volkswagen AG lost 3.7 percent.

“In such a conflict situation, no one can buy auto stocks, or even hold them,” Evercore ISI analyst Arndt Ellinghorst said. “If you’re an auto exec now, getting customers and orders is the least of your worries. You’re only focused on politicians.”

Additional reporting by staff writer

Taiwan Transport and Storage Corp (TTS, 台灣通運倉儲) yesterday unveiled its first electric tractor unit — manufactured by Volvo Trucks — in a ceremony in Taipei, and said the unit would soon be used to transport cement produced by Taiwan Cement Corp (TCC, 台灣水泥). Both TTS and TCC belong to TCC International Holdings Ltd (台泥國際集團). With the electric tractor unit, the Taipei-based cement firm would become the first in Taiwan to use electric vehicles to transport construction materials. TTS chairman Koo Kung-yi (辜公怡), Volvo Trucks vice president of sales and marketing Johan Selven, TCC president Roman Cheng (程耀輝) and Taikoo Motors Group

Among the rows of vibrators, rubber torsos and leather harnesses at a Chinese sex toys exhibition in Shanghai this weekend, the beginnings of an artificial intelligence (AI)-driven shift in the industry quietly pulsed. China manufactures about 70 percent of the world’s sex toys, most of it the “hardware” on display at the fair — whether that be technicolor tentacled dildos or hyper-realistic personalized silicone dolls. Yet smart toys have been rising in popularity for some time. Many major European and US brands already offer tech-enhanced products that can enable long-distance love, monitor well-being and even bring people one step closer to

RECORD-BREAKING: TSMC’s net profit last quarter beat market expectations by expanding 8.9% and it was the best first-quarter profit in the chipmaker’s history Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), which counts Nvidia Corp as a key customer, yesterday said that artificial intelligence (AI) server chip revenue is set to more than double this year from last year amid rising demand. The chipmaker expects the growth momentum to continue in the next five years with an annual compound growth rate of 50 percent, TSMC chief executive officer C.C. Wei (魏哲家) told investors yesterday. By 2028, AI chips’ contribution to revenue would climb to about 20 percent from a percentage in the low teens, Wei said. “Almost all the AI innovators are working with TSMC to address the

Malaysia’s leader yesterday announced plans to build a massive semiconductor design park, aiming to boost the Southeast Asian nation’s role in the global chip industry. A prominent player in the semiconductor industry for decades, Malaysia accounts for an estimated 13 percent of global back-end manufacturing, according to German tech giant Bosch. Now it wants to go beyond production and emerge as a chip design powerhouse too, Malaysian Prime Minister Anwar Ibrahim said. “I am pleased to announce the largest IC (integrated circuit) Design Park in Southeast Asia, that will house world-class anchor tenants and collaborate with global companies such as Arm [Holdings PLC],”