Europe’s major stock markets eased on Friday, weighed down by a firmer euro after inflation data in the US showed that price pressures remained subdued in the world’s biggest economy, dealers said.

After holding steady for most of the session, all of Europe’s main stock indices fell into the red in the afternoon following the release of new inflation data in the US.

On the face of it, soaring fuel prices drove US inflation to an eight-month high last month, but the spike in gasoline prices was likely tied to Hurricane Harvey.

Stripped of such volatile factors, core inflation remained tame, the data showed.

The US dollar fell as a result, pushing stock prices on Wall Street tentatively higher.

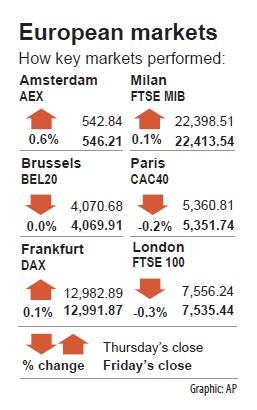

However, in Frankfurt, Germany, the blue-chip DAX, which topped the 13,000-point mark on Thursday, was flat on Friday, closing at 12,991.87. That was an increase of 0.3 percent from a close of 12,955.94 on Oct. 6.

In Paris, the CAC 40 on Friday shed 0.2 percent to close at 5,351.74, falling 0.15 percent from 5,359.90 a week earlier.

London’s benchmark FTSE 100 lost 0.3 percent, after hitting a record closing peak the previous day with traders gripped by Brexit news. It closed at 7,535.44 on Friday, rising 0.2 percent from 7,522.87 on Oct. 6.

“The tired [US] dollar collapsed like a house of cards on Friday, after US CPI [consumer price index] figures and retail sales for September failed to pack a punch,” FXTM analyst Lukman Otunuga said.

“Although US consumer prices rose 0.5 percent, the largest increase seen in eight months on the back of rising gasoline prices, underlying inflation remained subdued. While markets are still expecting the [US] Federal Reserve to raise interest rates in December, concerns over prolonged periods of depressed inflation may cloud the prospect of higher US interest rates in 2018,” the expert said.

London stocks had been catapulted on Thursday to an all-time high on the weak pound, which boosts earnings of exporters.

Sterling initially sank after European Chief Negotiator for the UK Exiting the EU Michel Barnier warned that Britain and Brussels are stuck in a “disturbing” deadlock over a Brexit divorce bill.

However, the currency then rebounded as German newspaper Handelsblatt reported that Britain could be given a two-year extension to complete Brexit.

The British unit continued to regain its composure on Friday.

Stephen Garrett, a 27-year-old graduate student, always thought he would study in China, but first the country’s restrictive COVID-19 policies made it nearly impossible and now he has other concerns. The cost is one deterrent, but Garrett is more worried about restrictions on academic freedom and the personal risk of being stranded in China. He is not alone. Only about 700 American students are studying at Chinese universities, down from a peak of nearly 25,000 a decade ago, while there are nearly 300,000 Chinese students at US schools. Some young Americans are discouraged from investing their time in China by what they see

Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), the world’s largest contract chipmaker, yesterday reported record sales for the first quarter, which analysts attributed to solid demand for emerging technologies. Consolidated revenue totaled NT$592.64 billion (US$18.51 billion) in the January-to-March period, up 16.5 percent from a year earlier, but down 5.26 percent from the previous quarter, TSMC said in a statement. The first-quarter revenue beat analysts’ average projection of NT$579.5 billion, Bloomberg News reported. That performance lends weight to expectations that the world’s most valuable chipmaker would return to solid growth this year after weathering a post-COVID-19-pandemic cratering of smartphone and computer sales. TSMC is budgeting

MAJOR DROP: CEO Tim Cook, who is visiting Hanoi, pledged the firm was committed to Vietnam after its smartphone shipments declined 9.6% annually in the first quarter Apple Inc yesterday said it would increase spending on suppliers in Vietnam, a key production hub, as CEO Tim Cook arrived in the country for a two-day visit. The iPhone maker announced the news in a statement on its Web site, but gave no details of how much it would spend or where the money would go. Cook is expected to meet programmers, content creators and students during his visit, online newspaper VnExpress reported. The visit comes as US President Joe Biden’s administration seeks to ramp up Vietnam’s role in the global tech supply chain to reduce the US’ dependence on China. Images on

New apartments in Taiwan’s major cities are getting smaller, while old apartments are increasingly occupied by older people, many of whom live alone, government data showed. The phenomenon has to do with sharpening unaffordable property prices and an aging population, property brokers said. Apartments with one bedroom that are two years old or older have gained a noticeable presence in the nation’s six special municipalities as well as Hsinchu county and city in the past five years, Evertrust Rehouse Co (永慶房產集團) found, citing data from the government’s real-price transaction platform. In Taipei, apartments with one bedroom accounted for 19 percent of deals last