European shares on Friday ended with the best monthly gain this year, helped by a weakening euro, but uncertainty over the Catalan crisis weighed on Spanish stocks.

A weakening euro has taken pressure off Europe’s equities, especially the exporter-heavy DAX, helping investors find renewed enthusiasm for the asset class after the slow summer months.

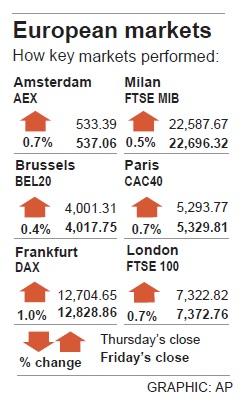

The pan-European STOXX 600 on Friday ended at a three-month high, rising 0.5 percent to close at 388.16, a weekly increase of 1.3 percent from 383.22 on Sept. 22 and a quarterly gain after falling in the second quarter.

“Europe is ticking more and more boxes,” Coutts & Co director of global markets Monique Wong said. “It’s slightly slowed down with the appreciation of the currency, but the euro is still a long way below previous highs.”

Deutsche Bank AG analysts forecast earnings for the STOXX to grow 11 percent this year, with the pickup in global growth and rebound in commodities more than offsetting the negative effect of the stronger euro.

On Friday, Volkswagen AG was in the spotlight after the latest twist in the automaker’s long-running diesel cheating scandal, when it said it was increasing provisions for settlements in North America.

Its shares fell as much as 4 percent before paring most losses and end down just 0.3 percent.

Porsche AG, Volkswagen’s controlling shareholder, also recovered, ending up 0.2 percent.

Investors have been weighing the pros and cons of investing in the auto sector, which is being hit as consumers begin to shun diesel and investments into electric vehicles gather pace.

However, depressed valuations are tempting to some, including Goldman Sachs Group Inc, which upgraded autos to overweight early last month.

“It’s a very unloved sector, at a 60 percent discount on price to earnings to the rest of Europe,” Goldman Sachs head of European equity strategy Sharon Bell said. “The sector has been hit by the strength of the euro as well, given its export focus.”

Spain’s IBEX on Friday rose 0.5 percent to end at 10,381.50, an increase of 0.7 percent from a close of 10,305 on Sept. 22, as some brokers said worries over Catalonia were overdone, although uncertainty remained.

Catalonia’s leader made clear his government was determined to go ahead with a vote on independence today, but Madrid insisted the referendum it has declared is illegal.

“The Catalan story confounds and worries us,” Swissquote Group Holding Ltd analyst Yann Quellen said in a note. “All things are possible: a win for ‘Catalexit’ or even a shutdown of voting by angry officials in Madrid... Ole! Markets are not pricing in any risk for Sunday.”

The Spanish blue chip index has gained 0.8 percent this month, underperforming the STOXX’s 3.8 percent gain.

Taiwan Transport and Storage Corp (TTS, 台灣通運倉儲) yesterday unveiled its first electric tractor unit — manufactured by Volvo Trucks — in a ceremony in Taipei, and said the unit would soon be used to transport cement produced by Taiwan Cement Corp (TCC, 台灣水泥). Both TTS and TCC belong to TCC International Holdings Ltd (台泥國際集團). With the electric tractor unit, the Taipei-based cement firm would become the first in Taiwan to use electric vehicles to transport construction materials. TTS chairman Koo Kung-yi (辜公怡), Volvo Trucks vice president of sales and marketing Johan Selven, TCC president Roman Cheng (程耀輝) and Taikoo Motors Group

Among the rows of vibrators, rubber torsos and leather harnesses at a Chinese sex toys exhibition in Shanghai this weekend, the beginnings of an artificial intelligence (AI)-driven shift in the industry quietly pulsed. China manufactures about 70 percent of the world’s sex toys, most of it the “hardware” on display at the fair — whether that be technicolor tentacled dildos or hyper-realistic personalized silicone dolls. Yet smart toys have been rising in popularity for some time. Many major European and US brands already offer tech-enhanced products that can enable long-distance love, monitor well-being and even bring people one step closer to

New apartments in Taiwan’s major cities are getting smaller, while old apartments are increasingly occupied by older people, many of whom live alone, government data showed. The phenomenon has to do with sharpening unaffordable property prices and an aging population, property brokers said. Apartments with one bedroom that are two years old or older have gained a noticeable presence in the nation’s six special municipalities as well as Hsinchu county and city in the past five years, Evertrust Rehouse Co (永慶房產集團) found, citing data from the government’s real-price transaction platform. In Taipei, apartments with one bedroom accounted for 19 percent of deals last

RECORD-BREAKING: TSMC’s net profit last quarter beat market expectations by expanding 8.9% and it was the best first-quarter profit in the chipmaker’s history Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), which counts Nvidia Corp as a key customer, yesterday said that artificial intelligence (AI) server chip revenue is set to more than double this year from last year amid rising demand. The chipmaker expects the growth momentum to continue in the next five years with an annual compound growth rate of 50 percent, TSMC chief executive officer C.C. Wei (魏哲家) told investors yesterday. By 2028, AI chips’ contribution to revenue would climb to about 20 percent from a percentage in the low teens, Wei said. “Almost all the AI innovators are working with TSMC to address the