Major US stock indices ended little changed on Friday even as Amazon.com Inc’s US$13.7 billion deal to buy upscale grocer Whole Foods Market Inc roiled the retail sector and rocked shares of an array of companies, including Wal-Mart Stores Inc and Target Corp.

Energy sector shares helped buoy the S&P 500 and the Dow industrials, while Apple Inc dragged on the NASDAQ.

The deal by Amazon, a proven retail disruptor, marked a major step by the Internet retailer into the brick-and-mortar retail sector.

Photo: AP

Wal-Mart shares sank 4.7 percent, weighing the most on the Dow. Shares of Target, Walgreen Boots Alliance Inc and Costco Wholesale Corp fell between 5 and 7 percent.

“It’s going to send a shock wave across the board and this represents the true utmost in market disruption,” said Burns McKinney, chief investment officer with the Dallas investment team for Allianz Global Investors. “There’s big winners and big losers.”

Amazon shares gained 2.4 percent, making the stock the biggest boost to the S&P 500. Whole Foods shares surged 29.1 percent.

The S&P consumer staples sector fell 1 percent, by far the worst performing major sector. The S&P 500 food and staples retailing index dropped 4.2 percent.

Grocery chain Kroger Co was the biggest loser on the S&P 500, falling 9.2 percent, while Supervalu Inc dropped 14.4 percent.

“I would not like to be somebody playing in the grocery space right now,” said Jan Rogers Kniffen, chief executive of retail consultancy firm J. Rogers Kniffen WWE in New York.

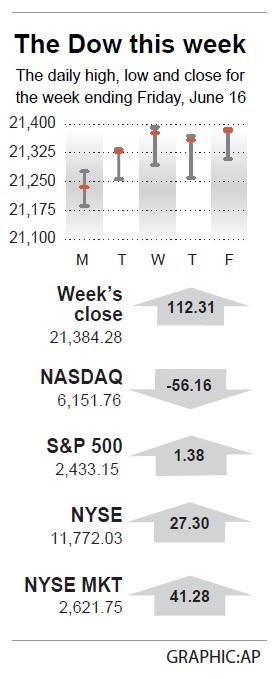

The Dow Jones Industrial Average on Friday rose 24.38 points, or 0.11 percent, to end at 21,384.28, the S&P 500 gained 0.69 point, or 0.03 percent, to 2,433.15 and the NASDAQ Composite dropped 13.74 points, or 0.22 percent, to 6,151.76.

For the week, the Dow rose 0.53 percent from 21,271.97 points and S&P inched up 0.06 percent from 2,431.77, while the NASDAQ fell 0.9 percent from 6,207.92.

The technology sector fell 0.2 percent on Friday, continuing its slump. Apple shares closed down 1.4 percent.

Tech has led the S&P 500’s 8.7 percent rally this year, but posted its second week of declines, prompting questions over whether investors are moving money into other sectors.

“I think we need to see more of a pullback to say there is a serious rotation going on as opposed to just some profits coming off the top,” said Chuck Carlson, chief executive officer at Horizon Investment Services in Hammond, Indiana.

Energy shares rose 1.7 percent, propping up the S&P 500. Oil prices bounced off the year’s lows as some producers reduced exports and US rig additions slowed.

US homebuilding fell for a third straight month last month to the lowest in eight months as construction activity declined broadly.

Investors were continuing to digest the US Federal Reserve’s interest rate hike on Wednesday, with some concerned about the economy’s ability to absorb higher rates.

Booz Allen Hamilton Inc shares dropped 19 percent after news of a US Department of Justice investigation.

About 9.7 billion shares changed hands in US exchanges on Friday, well above the 6.8 billion daily average over the past 20 sessions.

Among the rows of vibrators, rubber torsos and leather harnesses at a Chinese sex toys exhibition in Shanghai this weekend, the beginnings of an artificial intelligence (AI)-driven shift in the industry quietly pulsed. China manufactures about 70 percent of the world’s sex toys, most of it the “hardware” on display at the fair — whether that be technicolor tentacled dildos or hyper-realistic personalized silicone dolls. Yet smart toys have been rising in popularity for some time. Many major European and US brands already offer tech-enhanced products that can enable long-distance love, monitor well-being and even bring people one step closer to

Malaysia’s leader yesterday announced plans to build a massive semiconductor design park, aiming to boost the Southeast Asian nation’s role in the global chip industry. A prominent player in the semiconductor industry for decades, Malaysia accounts for an estimated 13 percent of global back-end manufacturing, according to German tech giant Bosch. Now it wants to go beyond production and emerge as a chip design powerhouse too, Malaysian Prime Minister Anwar Ibrahim said. “I am pleased to announce the largest IC (integrated circuit) Design Park in Southeast Asia, that will house world-class anchor tenants and collaborate with global companies such as Arm [Holdings PLC],”

Sales in the retail, and food and beverage sectors last month continued to rise, increasing 0.7 percent and 13.6 percent respectively from a year earlier, setting record highs for the month of March, the Ministry of Economic Affairs said yesterday. Sales in the wholesale sector also grew last month by 4.6 annually, mainly due to the business opportunities for emerging applications related to artificial intelligence (AI) and high-performance computing technologies, the ministry said in a report. The ministry forecast that retail, and food and beverage sales this month would retain their growth momentum as the former would benefit from Tomb Sweeping Day

Thousands of parents in Singapore are furious after a Cordlife Group Ltd (康盛人生集團), a major operator of cord blood banks in Asia, irreparably damaged their children’s samples through improper handling, with some now pursuing legal action. The ongoing case, one of the worst to hit the largely untested industry, has renewed concerns over companies marketing themselves to anxious parents with mostly unproven assurances. This has implications across the region, given Cordlife’s operations in Hong Kong, Macau, Indonesia, the Philippines and India. The parents paid for years to have their infants’ cord blood stored, with the understanding that the stem cells they contained