US stocks on Friday dipped as investors were cautious ahead of the first round of the closely contested French presidential election, but the S&P 500 managed to notch its first weekly gain in three.

The first round of France’s presidential election might be too close to call when polls close today, because initial projections will not be available as early as in the past, pollsters and their watchdog said.

Most polls see centrist Emmanuel Macron and far-right leader Marine Le Pen qualifying for a May 7 runoff, but conservative Francois Fillon and leftist Jean-Luc Melenchon are not far behind and within the margin of error.

Photo: Bloomberg

“Nobody is taking anything for granted after the big swing and miss in Britain and the big swing and a miss here,” Chicago-based BMO Private Bank chief investment officer Jack Ablin said. “I don’t think anyone wants to stick their neck out for this one.”

US President Donald Trump said he would have a major tax reform announcement on Wednesday.

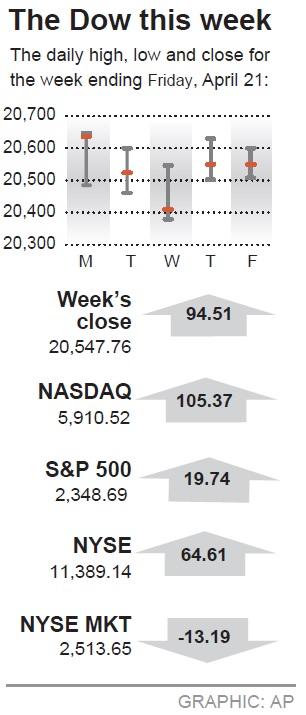

The Dow Jones Industrial Average on Friday fell 30.95 points, or 0.15 percent, to 20,547.76, the S&P 500 lost 7.15 points, or 0.3 percent, to 2,348.69 and the NASDAQ Composite dropped 6.26 points, or 0.11 percent, to 5,910.52.

For the week, the Dow rose 0.5 percent, the S&P gained 0.8 percent and the NASDAQ advanced 1.8 percent in what was the first weekly gain for the top indices over the past three weeks.

A steady stream of strong earnings through the week helped to buoy market sentiment.

Of the 95 companies in the S&P 500 that have reported earnings through Friday morning, about 75 percent have topped expectations, according to Thomson Reuters data, above the 71 percent average for the past four quarters.

Overall, profits of S&P 500 companies are estimated to have risen 11.2 percent in the quarter, the most since 2011.

Shares of General Electric Co fell 2.4 percent to US$29.55 after the company reported negative cash flow from its industrial operations in the first quarter. The stock was the biggest drag on the S&P 500.

Schlumberger Ltd lost 2.2 percent to US$74.84. The oilfield services provider said that margins would remain under pressure as it spends more to bring back idled equipment.

Mattel Inc tumbled after the toymaker reported a bigger-than-expected quarterly loss. The stock closed near its session low, down 13.6 percent at US$21.79.

US Federal Reserve Vice Chair Stanley Fischer told CNBC that the central bank remains on track for two more interest rate increases this year, despite some soft economic data.

Declining issues outnumbered advancing ones on the New York Stock Exchange by a 1.19-to-1 ratio; on NASDAQ, a 1.4-to-1 ratio favored decliners.

The S&P 500 posted 28 new 52-week highs and one new low; the NASDAQ Composite recorded 92 new highs and 39 new lows.

About 6.4 billion shares changed hands in US exchanges, slightly above the 6.31 billion daily average over the past 20 sessions.

Taiwan Transport and Storage Corp (TTS, 台灣通運倉儲) yesterday unveiled its first electric tractor unit — manufactured by Volvo Trucks — in a ceremony in Taipei, and said the unit would soon be used to transport cement produced by Taiwan Cement Corp (TCC, 台灣水泥). Both TTS and TCC belong to TCC International Holdings Ltd (台泥國際集團). With the electric tractor unit, the Taipei-based cement firm would become the first in Taiwan to use electric vehicles to transport construction materials. TTS chairman Koo Kung-yi (辜公怡), Volvo Trucks vice president of sales and marketing Johan Selven, TCC president Roman Cheng (程耀輝) and Taikoo Motors Group

Among the rows of vibrators, rubber torsos and leather harnesses at a Chinese sex toys exhibition in Shanghai this weekend, the beginnings of an artificial intelligence (AI)-driven shift in the industry quietly pulsed. China manufactures about 70 percent of the world’s sex toys, most of it the “hardware” on display at the fair — whether that be technicolor tentacled dildos or hyper-realistic personalized silicone dolls. Yet smart toys have been rising in popularity for some time. Many major European and US brands already offer tech-enhanced products that can enable long-distance love, monitor well-being and even bring people one step closer to

RECORD-BREAKING: TSMC’s net profit last quarter beat market expectations by expanding 8.9% and it was the best first-quarter profit in the chipmaker’s history Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), which counts Nvidia Corp as a key customer, yesterday said that artificial intelligence (AI) server chip revenue is set to more than double this year from last year amid rising demand. The chipmaker expects the growth momentum to continue in the next five years with an annual compound growth rate of 50 percent, TSMC chief executive officer C.C. Wei (魏哲家) told investors yesterday. By 2028, AI chips’ contribution to revenue would climb to about 20 percent from a percentage in the low teens, Wei said. “Almost all the AI innovators are working with TSMC to address the

Malaysia’s leader yesterday announced plans to build a massive semiconductor design park, aiming to boost the Southeast Asian nation’s role in the global chip industry. A prominent player in the semiconductor industry for decades, Malaysia accounts for an estimated 13 percent of global back-end manufacturing, according to German tech giant Bosch. Now it wants to go beyond production and emerge as a chip design powerhouse too, Malaysian Prime Minister Anwar Ibrahim said. “I am pleased to announce the largest IC (integrated circuit) Design Park in Southeast Asia, that will house world-class anchor tenants and collaborate with global companies such as Arm [Holdings PLC],”