European stock markets on Friday ended the week higher on bargain hunting, shrugging off weakness on Wall Street where tough talk on trade from US President Donald Trump’s administration revived concerns about a global trade war.

In London, stock prices sagged under pressure from South Africa’s political turmoil, which hit mining stocks on the FTSE 100.

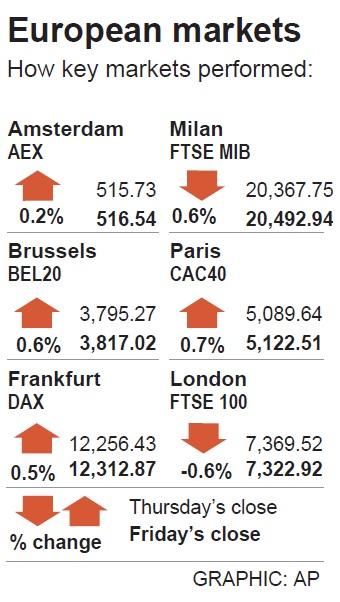

However, prices in Frankfurt and Paris, which had started the day in negative territory, ended the session higher as investors snapped up cheap bargains before they closed their books on the final day of the first quarter.

BMO Private Bank chief investment officer Jack Ablin said investors frequently engage in “window dressing” at the end of a quarter, selling off stocks that have not performed well and boosting holdings that have outperformed.

The STOXX Europe 600 rose 0.2 percent to close at 381.14 on Friday, widening its first-quarter advance to 5.5 percent and rising 1.22 percent from 376.51 a week earlier.

The gauge also posted its best March performance since 2010, as easing concern over a win for France’s anti-euro candidate in the country’s upcoming elections boosted lenders.

“As first quarters, go it’s been a solid start to the year for 2017,” London-based CMC Markets market analyst Michael Hewson wrote in a client note. “Economic data by and large has been pretty good across the board from the US, UK, Europe and Asia, while rising inflation has prompted some optimism that we could see some trickle-down effects into higher wages.”

The STOXX Europe 600 rose for a third consecutive quarter, its longest run since a streak of five quarterly gains in 2014. A chorus of strategists and investors say the reflation rally in Europe has more to go, boosted by those seeking sanctuary from lofty US stock valuations.

Investors are also assessing the US Federal Reserve’s rate trajectory. Some officials this week turned more hawkish after the central bank last month raised rates and maintained its forecast for further increases this year.

The weakness on Wall Street was put down to the fact Trump signed an executive order tasking staff to pinpoint countries and goods responsible for the US’ nearly US$50 billion monthly trade deficit. The move was accompanied by a series of aggressive comments from administration officials on trade, much of it aimed at China.

Still, some analysts believe the concrete actions from the Trump administration might be more moderate than the rhetoric suggests.

In London, investors digested unrevised data, which showed the British economy expanded by 0.7 percent in the final three months of last year, despite jitters over Brexit.

The rand plunged after South African President Jacob Zuma fired minister of finance Pravin Gordhan. The news sent shares in miner Anglo American PLC down by 2.9 percent, while finance group Old Mutual PLC topped the fallers’ board with a 7.3 percent tumble.

“Stocks with exposure to South Africa plunged amid deep fears about the state of the country’s government following the sacking of respected finance minister Pravin Gordhan,” ETX Capital analyst Neil Wilson said.

Miners also were hit by softer metal prices, with Antofagasta PLC down 0.7 percent, BHP Billiton PLC shedding 2.9 percent and Rio Tinto PLC losing 2.5 percent.

Stephen Garrett, a 27-year-old graduate student, always thought he would study in China, but first the country’s restrictive COVID-19 policies made it nearly impossible and now he has other concerns. The cost is one deterrent, but Garrett is more worried about restrictions on academic freedom and the personal risk of being stranded in China. He is not alone. Only about 700 American students are studying at Chinese universities, down from a peak of nearly 25,000 a decade ago, while there are nearly 300,000 Chinese students at US schools. Some young Americans are discouraged from investing their time in China by what they see

MAJOR DROP: CEO Tim Cook, who is visiting Hanoi, pledged the firm was committed to Vietnam after its smartphone shipments declined 9.6% annually in the first quarter Apple Inc yesterday said it would increase spending on suppliers in Vietnam, a key production hub, as CEO Tim Cook arrived in the country for a two-day visit. The iPhone maker announced the news in a statement on its Web site, but gave no details of how much it would spend or where the money would go. Cook is expected to meet programmers, content creators and students during his visit, online newspaper VnExpress reported. The visit comes as US President Joe Biden’s administration seeks to ramp up Vietnam’s role in the global tech supply chain to reduce the US’ dependence on China. Images on

New apartments in Taiwan’s major cities are getting smaller, while old apartments are increasingly occupied by older people, many of whom live alone, government data showed. The phenomenon has to do with sharpening unaffordable property prices and an aging population, property brokers said. Apartments with one bedroom that are two years old or older have gained a noticeable presence in the nation’s six special municipalities as well as Hsinchu county and city in the past five years, Evertrust Rehouse Co (永慶房產集團) found, citing data from the government’s real-price transaction platform. In Taipei, apartments with one bedroom accounted for 19 percent of deals last

US CONSCULTANT: The US Department of Commerce’s Ursula Burns is a rarely seen US government consultant to be put forward to sit on the board, nominated as an independent director Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), the world’s largest contract chipmaker, yesterday nominated 10 candidates for its new board of directors, including Ursula Burns from the US Department of Commerce. It is rare that TSMC has nominated a US government consultant to sit on its board. Burns was nominated as one of seven independent directors. She is vice chair of the department’s Advisory Council on Supply Chain Competitiveness. Burns is to stand for election at TSMC’s annual shareholders’ meeting on June 4 along with the rest of the candidates. TSMC chairman Mark Liu (劉德音) was not on the list after in December last