A dramatic session on Wall Street ended with stocks slightly lower on Friday as they pared losses in late-afternoon trading after Republicans pulled their bill to overhaul the US healthcare system.

The benchmark S&P 500 shot up briefly into positive territory before falling back into the red as Republicans pulled the legislation due to a shortage of votes just before the markets closed, leaving investors to assess how the healthcare bill’s failure would affect US President Donald Trump’s broader economic agenda.

Investors had worried earlier this week that the failure of the bill, which would have dismantled the law known as Obamacare, would prove an ominous sign for Trump’s ability to push through his economic agenda, including tax reform.

However, some analysts and investors have seen a failure of the bill as a catalyst to bring forward action on tax reform in particular.

“Now that they’ve taken the healthcare issue off the table, I think the market is more optimistic that they can do other things that are more doable that are not so complicated, such as regulatory reform and lowering taxes,” said Margaret Patel, senior portfolio manager at Wells Fargo Asset Management in Boston.

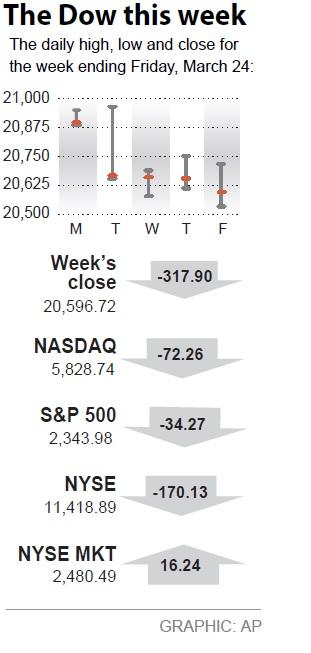

The Dow Jones Industrial Average on Friday fell 59.86 points, or 0.29 percent, to end at 20,596.72, the S&P 500 lost 1.98 points, or 0.08 percent, to 2,343.98 and the NASDAQ Composite added 11.05 points, or 0.19 percent, to 5,828.74.

The back-and-forth over the bill this week has led to some of the most volatile trading Wall Street has seen since Trump’s election in November last year.

For the week, the S&P 500 fell 1.4 percent, its worst weekly decline of the year, the Dow lost 1.5 percent and the NASDAQ Composite fell 1.2 percent.

“This is now an indication that the [US] president’s agenda is probably going to be more ambitious than Congress can manage,” said Peter Kenny, senior market strategist at Global Markets Advisory Group in New York. “It is probably going to mean that equity markets are going to have to factor in a degree of dysfunction that investors were hoping they wouldn’t have to.”

The S&P 500 has climbed 9.6 percent since Trump’s election, notching a series of record highs along the way.

However, the rally has stalled recently, and Tuesday’s 1.2 percent drop set off concerns about the beginning of a larger fall.

“The economy and earnings were doing better since before the election,” said Paul Zemsky, chief investment officer for multi-asset strategies and solutions at Voya Investment Management in New York. “If people want to drop the S&P by 300 points because this doesn’t pass, I and others will be down there to buy it.”

Shares of hospital operators finished sharply higher, with Tenet Healthcare Corp up 7.4 percent. The potential dismantling of Obamacare has pressured hospital stocks over concerns the benefits the companies gained from coverage expansion would diminish.

In corporate news, Micron Technology Inc jumped 7.4 percent after the chipmaker’s revenue and profit forecasts beat expectations. The stock was the biggest percentage gainer on the S&P and helped lift the NASDAQ.

GameStop Corp tumbled 13.6 percent after the company’s profit projection fell below estimates.

Advancing issues outnumbered declining ones on the New York Stock Exchange by a 1.07-to-1 ratio; on NASDAQ, a 1.30-to-1 ratio favored advancers.

The S&P 500 posted 19 new 52-week highs and three new lows; the NASDAQ Composite recorded 58 new highs and 40 new lows.

About 6.2 billion shares changed hands in US exchanges on Friday, below the 7.1 billion daily average over the past 20 sessions.

Stephen Garrett, a 27-year-old graduate student, always thought he would study in China, but first the country’s restrictive COVID-19 policies made it nearly impossible and now he has other concerns. The cost is one deterrent, but Garrett is more worried about restrictions on academic freedom and the personal risk of being stranded in China. He is not alone. Only about 700 American students are studying at Chinese universities, down from a peak of nearly 25,000 a decade ago, while there are nearly 300,000 Chinese students at US schools. Some young Americans are discouraged from investing their time in China by what they see

MAJOR DROP: CEO Tim Cook, who is visiting Hanoi, pledged the firm was committed to Vietnam after its smartphone shipments declined 9.6% annually in the first quarter Apple Inc yesterday said it would increase spending on suppliers in Vietnam, a key production hub, as CEO Tim Cook arrived in the country for a two-day visit. The iPhone maker announced the news in a statement on its Web site, but gave no details of how much it would spend or where the money would go. Cook is expected to meet programmers, content creators and students during his visit, online newspaper VnExpress reported. The visit comes as US President Joe Biden’s administration seeks to ramp up Vietnam’s role in the global tech supply chain to reduce the US’ dependence on China. Images on

New apartments in Taiwan’s major cities are getting smaller, while old apartments are increasingly occupied by older people, many of whom live alone, government data showed. The phenomenon has to do with sharpening unaffordable property prices and an aging population, property brokers said. Apartments with one bedroom that are two years old or older have gained a noticeable presence in the nation’s six special municipalities as well as Hsinchu county and city in the past five years, Evertrust Rehouse Co (永慶房產集團) found, citing data from the government’s real-price transaction platform. In Taipei, apartments with one bedroom accounted for 19 percent of deals last

Taiwan Transport and Storage Corp (TTS, 台灣通運倉儲) yesterday unveiled its first electric tractor unit — manufactured by Volvo Trucks — in a ceremony in Taipei, and said the unit would soon be used to transport cement produced by Taiwan Cement Corp (TCC, 台灣水泥). Both TTS and TCC belong to TCC International Holdings Ltd (台泥國際集團). With the electric tractor unit, the Taipei-based cement firm would become the first in Taiwan to use electric vehicles to transport construction materials. TTS chairman Koo Kung-yi (辜公怡), Volvo Trucks vice president of sales and marketing Johan Selven, TCC president Roman Cheng (程耀輝) and Taikoo Motors Group