Reserve Bank of Australia (RBA) Governor Glenn Stevens endorsed the current level of interest rates and said he would need to be confident the currency was “seriously overvalued” before considering intervention to weaken it.

“There is a good deal of interest rate stimulus in the pipeline,” he said yesterday in semi-annual testimony to a parliamentary panel in Canberra. “It is having an effect.”

The local currency and bond yields rose as Stevens said an overnight cash rate target at 3 percent was appropriate.

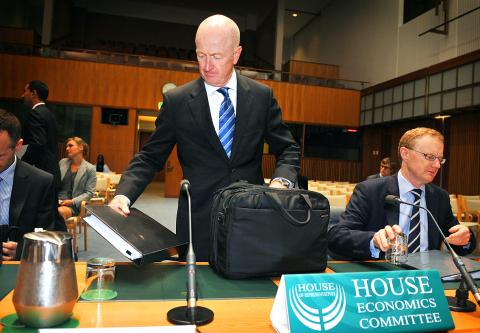

Photo: Bloomberg

Stevens — aiming to rebalance the two-speed economy where mining regions in the north and west thrive while manufacturers, builders and retailers in the south and east struggle — reiterated that rate cuts were more likely than increases.

The so-called Aussie’s almost 60 percent climb in the past four years has hurt exporters. While rate settings are not seeking a particular exchange rate response, “they are being set with a recognition of the exchange rate’s effect on the economy,” he said.

“The other tool that may be available is, of course, intervention, and I think the truth is that the power of forces at work here, you need to be pretty confident that it’s seriously overvalued or that the market’s behaving in some quite irrational way before you would launch a large-scale intervention,” Stevens said in response to a lawmaker’s question.

“It’s somewhat too high, but we’re not talking 50 percent or something like that,” he added.

The Australian central bank lowered its growth and inflation forecasts this month and has indicated a willingness to support demand in an economy where mining investment is predicted to crest this year. It reduced the benchmark rate in December last year to 3 percent, matching a half-century low set in 2009, as it seeks to boost industries including residential construction, before holding this month.

“Stevens’ comments are very firmly focused on what a strong currency means for inflation rather than including any threat of action,” said Sean Callow, a senior currency strategist in Sydney at Westpac Banking Corp. “The tone of his prepared comments indicate no great urgency to cut rates in the near term.”

The Australian dollar climbed for the first time in three days. The Australian dollar rose 0.7 percent to US$1.0314 as of 4:49pm yesterday in Sydney. It gained 0.1 percent since Feb. 15, when it completed a five-week decline, the longest streak since June last year.

The currency’s strength is slowing parts of the economy and forecast inflation.

The RBA, in a quarterly policy statement released on Feb. 8, predicted “below trend” growth of about 2.5 percent this year, compared with around 2.75 percent forecast in November last year. Consumer prices will rise 3 percent in the year to June this year, compared with the 3.25 percent increase it had forecast three months earlier.

“The high exchange rate has lowered prices for tradable goods and services and so helped to hold down measures of inflation over the past couple of years,” Stevens said.

Investors are pricing in a 39 percent chance Stevens will reduce rates by a quarter point to 2.75 percent at the meeting next month, swaps data compiled by Bloomberg show.

That would follow 175 basis points of cuts over the past 16 months.

Taiwan Transport and Storage Corp (TTS, 台灣通運倉儲) yesterday unveiled its first electric tractor unit — manufactured by Volvo Trucks — in a ceremony in Taipei, and said the unit would soon be used to transport cement produced by Taiwan Cement Corp (TCC, 台灣水泥). Both TTS and TCC belong to TCC International Holdings Ltd (台泥國際集團). With the electric tractor unit, the Taipei-based cement firm would become the first in Taiwan to use electric vehicles to transport construction materials. TTS chairman Koo Kung-yi (辜公怡), Volvo Trucks vice president of sales and marketing Johan Selven, TCC president Roman Cheng (程耀輝) and Taikoo Motors Group

Among the rows of vibrators, rubber torsos and leather harnesses at a Chinese sex toys exhibition in Shanghai this weekend, the beginnings of an artificial intelligence (AI)-driven shift in the industry quietly pulsed. China manufactures about 70 percent of the world’s sex toys, most of it the “hardware” on display at the fair — whether that be technicolor tentacled dildos or hyper-realistic personalized silicone dolls. Yet smart toys have been rising in popularity for some time. Many major European and US brands already offer tech-enhanced products that can enable long-distance love, monitor well-being and even bring people one step closer to

RECORD-BREAKING: TSMC’s net profit last quarter beat market expectations by expanding 8.9% and it was the best first-quarter profit in the chipmaker’s history Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), which counts Nvidia Corp as a key customer, yesterday said that artificial intelligence (AI) server chip revenue is set to more than double this year from last year amid rising demand. The chipmaker expects the growth momentum to continue in the next five years with an annual compound growth rate of 50 percent, TSMC chief executive officer C.C. Wei (魏哲家) told investors yesterday. By 2028, AI chips’ contribution to revenue would climb to about 20 percent from a percentage in the low teens, Wei said. “Almost all the AI innovators are working with TSMC to address the

Malaysia’s leader yesterday announced plans to build a massive semiconductor design park, aiming to boost the Southeast Asian nation’s role in the global chip industry. A prominent player in the semiconductor industry for decades, Malaysia accounts for an estimated 13 percent of global back-end manufacturing, according to German tech giant Bosch. Now it wants to go beyond production and emerge as a chip design powerhouse too, Malaysian Prime Minister Anwar Ibrahim said. “I am pleased to announce the largest IC (integrated circuit) Design Park in Southeast Asia, that will house world-class anchor tenants and collaborate with global companies such as Arm [Holdings PLC],”