Ben who?

BenQ (明基), a new and almost unknown supplier of liquid-crystal-display televisions, hopes consumers will know the company's name in the next few months. Along with lesser-known brands like Norcent and Syntax, BenQ has jumped on the flat-panel TV bandwagon. All are attempting to capture market share from well-established consumer electronics manufacturers like Panasonic, Philips, RCA and Sony by using the same tactic: low prices.

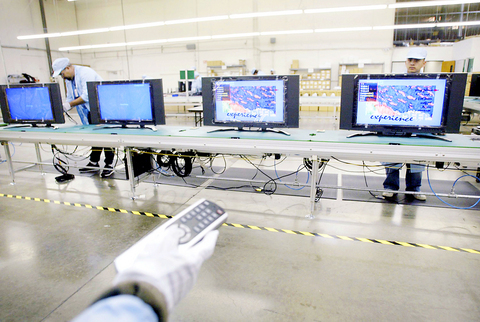

PHOTO: THE NEW YORK TIMES

But the second-tier companies -- including some using better-known brand names such as Polaroid and Westinghouse -- have a long way to go.

None of the new brands appear in the Top 10 list of flat-panel TV unit sales or revenue; according to DisplaySearch, a research firm, even the best-performing second-tier LCD company, Syntax, captured just 4 percent of sales in the third quarter of last year. BenQ held 1 percent.

As flat-panel televisions remain costly, these companies have chosen to compete at the bottom of the scale, hoping to attract buyers who lust after the latest technology but are unable to afford units made by the better-established brands.

In contrast to early analog picture tube companies that manufactured their own sets and did not share their technology, display panels and integrated chips for digital TV are made by various companies for sale to virtually anyone.

Yet despite such availability, established TV makers contend that their brand recognition and reliability will allow them to dominate the market.

"A consumer spending US$2,500 for a TV will take a careful view of how long it will last and how long it will be supported," said Jeff Cove, a vice president at Panasonic.

He cited his company's distribution and service networks as reasons it does not expect to lose market share to new, low-cost entrants.

Bharath Rajagopalan, an executive with RCA's parent, TCL-Thompson Electronics, said that all televisions were not created equal. Each top-tier manufacturer adds its own "secret sauce" to the mix -- algorithms and filters that reduce visual noise, plus other technologies that smooth out images, he said.

But James Li, chief executive of Syntax, which sells televisions under the Olevia brand, argued that such so-called secrets are only marketing gimmicks.

"The fundamental components that make the picture are the panel and the chipsets," he said.

Syntax gets those items from the same suppliers that some of the brand names use, he noted.

Few of these companies' products are available at the larger mass merchants. Instead, they tend to be sold through Internet retailers, regional electronics stores and specialty stores.

"This is absolutely a price play," said Glenn Cunningham, director of electronics at Amazon.com.

The Internet retailer sells second-tier flat-panel brands, including Westinghouse and Olevia.

"When I look at the customer reviews, they say `Great TV for the money,"' Cunningham said.

"People purchase no-name brands opportunistically," said Ross Rubin, director of marketing analysis for the NPD Group. "They say, `I just need something flat and sexy-looking in a room."'

Experience with PC monitors has given some entrepreneurs the impetus to make televisions.

William Wang, the former head of Princeton Graphics, began V Inc in 2003. The company employs just 28 workers in the US, using contractors in Asia to assemble plasma and LCD displays.

It sells TVs in such stores as Costco, where its 107cm plasma HDTV is priced at US$2,500. Models of the same size from Panasonic and Sony typically cost US$4,000 to US$4,500.

About the same time that Wang created V, Doug Woo, his former colleague at Princeton Graphics, started his own company and licensed the Westinghouse name from its owner, Viacom.

"Younger people know the Westinghouse brand," Woo said. "They have a vague recollection of it; they don't know what the brand does. But under-35-year-olds are now beginning to recognize it as a TV brand."

Westinghouse has positioned itself as one of the least expensive suppliers of LCD televisions. During the holiday season, it cut the price of its 76.2cm model to US$1,700, 23 percent less than in the summer. Today the model is available for US$1,500 at such retailers as Best Buy and Amazon.com. The same-size set from Philips is priced US$400 higher.

"Today our major benefit is pricing," Woo said. "That's how we'll become a major player. We're not ashamed of that."

Westinghouse Digital has formed a partnership with Chi Mei Optoelectronics (奇美電子) in Taiwan, its sole supplier of displays.

"This relationship is the bedrock of our company's future," Wang said. "We source only from them. We can release products in sync with their supply, and we can take advantage of whatever cost efficiencies there are, and bring lower costs to the street really quickly."

And because these new start-up manufacturers are selling in small volumes, they are able to ship merchandise soon after they buy it.

"They offer an attractive time to market," said Ross Young, president of DisplaySearch.

By ordering 50,000 units, a company can receive a shipment soon after payment, keeping prices in line with costs.

"Sony's December product could have been paid for in June," Young said, when parts prices were higher.

Sony recently cited rapidly falling flat-panel TV prices as one reason that its consumer electronics division's operating income fell in the third quarter.

Yet there is the danger that if low-cost brands do gain significant market share, the larger players, with deeper pockets, will reduce prices to compete.

"As soon as Samsung, Sony and Sharp see a viable threat from these guys, they'll do something about it," said Chris Chinnock, of Insight Media, a research firm. "I can't see all these competitors surviving even five years from now."

Li said his company was in for the long term. To dispel customer concerns about buying the Olevia brand, the company offers in-home service for its LCD televisions during the first year of ownership at no extra charge.

Once available only through the Internet, the company's sets are now sold at regional retailers like ABC Warehouse and Fry's, as well as some Staples stores.

In its first full year of operation, the company sold 95,000 TVs. It expects to double its revenue this year. In April it will introduce a 42-inch LCD television, with a 47-inch model following by the fall.

But Young said he believed the success of the second-tier brands would be confined to the smaller screens.

"If you are buying a large TV, you want that to be a recognizable, prestige name,"he said. "If you buy a knockoff TV, your friends will ask you why."

Taiwan Transport and Storage Corp (TTS, 台灣通運倉儲) yesterday unveiled its first electric tractor unit — manufactured by Volvo Trucks — in a ceremony in Taipei, and said the unit would soon be used to transport cement produced by Taiwan Cement Corp (TCC, 台灣水泥). Both TTS and TCC belong to TCC International Holdings Ltd (台泥國際集團). With the electric tractor unit, the Taipei-based cement firm would become the first in Taiwan to use electric vehicles to transport construction materials. TTS chairman Koo Kung-yi (辜公怡), Volvo Trucks vice president of sales and marketing Johan Selven, TCC president Roman Cheng (程耀輝) and Taikoo Motors Group

Stephen Garrett, a 27-year-old graduate student, always thought he would study in China, but first the country’s restrictive COVID-19 policies made it nearly impossible and now he has other concerns. The cost is one deterrent, but Garrett is more worried about restrictions on academic freedom and the personal risk of being stranded in China. He is not alone. Only about 700 American students are studying at Chinese universities, down from a peak of nearly 25,000 a decade ago, while there are nearly 300,000 Chinese students at US schools. Some young Americans are discouraged from investing their time in China by what they see

MAJOR DROP: CEO Tim Cook, who is visiting Hanoi, pledged the firm was committed to Vietnam after its smartphone shipments declined 9.6% annually in the first quarter Apple Inc yesterday said it would increase spending on suppliers in Vietnam, a key production hub, as CEO Tim Cook arrived in the country for a two-day visit. The iPhone maker announced the news in a statement on its Web site, but gave no details of how much it would spend or where the money would go. Cook is expected to meet programmers, content creators and students during his visit, online newspaper VnExpress reported. The visit comes as US President Joe Biden’s administration seeks to ramp up Vietnam’s role in the global tech supply chain to reduce the US’ dependence on China. Images on

New apartments in Taiwan’s major cities are getting smaller, while old apartments are increasingly occupied by older people, many of whom live alone, government data showed. The phenomenon has to do with sharpening unaffordable property prices and an aging population, property brokers said. Apartments with one bedroom that are two years old or older have gained a noticeable presence in the nation’s six special municipalities as well as Hsinchu county and city in the past five years, Evertrust Rehouse Co (永慶房產集團) found, citing data from the government’s real-price transaction platform. In Taipei, apartments with one bedroom accounted for 19 percent of deals last