US stocks gained, pushing the Standard & Poor's 500 Index to its third straight weekly advance, after a government report showed the economy lost fewer jobs than expected in April even as the unemployment rate rose.

The report was "not as bad as people might have feared; the market's looking at the glass half-full rather than half-empty," said Peter Coolidge, a money manager for Deltec Asset Management LLC. "It sort of goes with the postwar trend of people coming back into stocks."

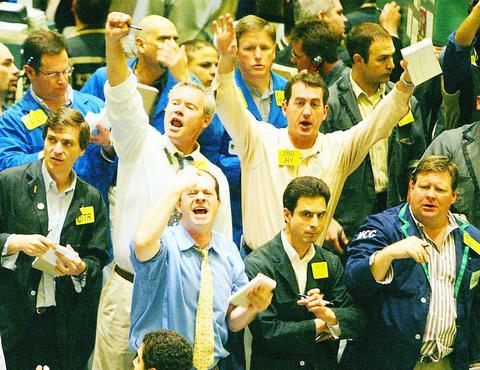

PHOTO: AP

Computer-related shares including Microsoft Corp and Intel Corp lifted the Nasdaq Composite Index to a 10-month high amid analyst expectations that earnings will accelerate. Energy companies rose after ChevronTexaco Corp followed Exxon Mobil Corp in reporting a surge in profit because of higher oil and natural-gas prices.

PHOTO: AFP

The S&P 500 rose 13.78, or 1.5 percent, to 930.08, the highest level since Jan. 14. The Dow Jones Industrial Average added 128.43, or 1.5 percent, to 8582.68. The Nasdaq climbed 30.32, or 2.1 percent, to 1502.88, its highest since June 18.

Both the S&P 500 and Nasdaq, which also climbed for a third week, completed their longest weekly winning streaks since November, amid optimism that economic and profit growth will pick up following the end of the war with Iraq. The S&P 500 gained 3.5 percent, the Nasdaq jumped 4.8 percent and the Dow advanced 3.3 percent in the week.

More than three stocks rose for every one that fell on the New York Stock Exchange, the broadest rally since Jan. 2. Five stocks gained for every two that dropped on the Nasdaq Stock Market. Some 1.5 billion shares traded on the Big Board, a 12 percent increase over the three-month daily average.

US businesses cut 48,000 jobs last month as the unemployment rate rose to 6 percent, matching an eight-year high, the Labor Department said. Economists predicted a loss of 60,000 jobs and a jobless rate of 5.9 percent, according to a < "The market was discounting the worst," said David Briggs, head of trading at Federated Investors Inc, which manages US$185 billion in Pittsburgh. "People seem to be willing to wait a little longer to see if things continue to improve." Technology shares contributed the most to the S&P 500's gain. Analysts predict profit at these companies will rise 33 percent this quarter and 67 percent next quarter, according to Thomson Financial. The third-quarter figure is the highest among the benchmark's 10 industry groups. Microsoft, the world's largest software maker, rose US$0.42 to US$26.13. Intel, the No. 1 semiconductor maker, added US$0.50 to US$19.05. Sun Microsystems Inc, a maker of server computers that run corporate networks, climbed US$0.41 to US$3.75, and was the most active stock. Speculation that Dell Computer Corp., International Business Machines Corp. or Hewlett-Packard Co. may acquire the company led to the gain, said Giga Information Group analyst Rob Enderle. Sun shares have lost more than 90 percent of their value during the past three years. Sun and IBM spokespeople declined to comment. Dell and Hewlett-Packard spokespeople didn't return calls. Cypress Semiconductor Corp. jumped US$1.12 to US$10.60. The maker of chips used in Sony Corp.'s PlayStation 2 video-game machine said second-quarter sales will fall to US$200 million from US$202.1 million a year ago. Analysts were expecting a steeper drop, according to Thomson Financial. BEA Systems Inc, whose software runs Web-based programs, rose US$1.09 to US$11.87. Lehman Brothers Inc analyst Neil Herman said the company had a "very solid" first quarter and may have beaten his earnings estimate of US$0.07 a share by a penny. ChevronTexaco, the No. 2 US oil company, rose US$2.35 to US$65.35. Its first-quarter profit excluding certain items more than doubled to US$1.99 a share. On that basis, analysts surveyed by Thomson Financial had expected US$1.81 on average. Earnings were the highest since Chevron Corp bought Texaco Inc in 2001. Exxon Mobil, the world's biggest publicly traded oil company, gained US$0.56 to US$36.04. The company yesterday said its profit tripled last quarter as oil prices rose 56 percent on average and gas prices doubled in the period. Airline stocks surged after Merrill Lynch & Co analyst Michael Lindenberg said their losses may narrow in 2003 and the threat of bankruptcy for some companies has diminished. He boosted his rating on five carriers, propelling the Amex Airline Index to a 11 percent gain -- its biggest in more than a month. Alaska Air Group Inc gained US$2.06 to US$19.77, Continental Airlines Inc surged US$1.94 to US$11.80, Delta Air Lines Inc climbed US$1.75 to US$14.75, Frontier Airlines Inc added US$1.36 to US$7.62 and Northwest Airlines Corp rallied US$1.30 to US$9.85. Lindenberg upgraded them to "buy" from "neutral." United Technologies Corp, the maker of Pratt & Whitney jet engines, added US$1.74 to US$63.40. Boeing Co, the world's largest planemaker, rose US$1.51 to US$28.62. The two stocks, along with IBM, accounted for a quarter of the Dow average's advance. Cigna Corp, the third-largest US health insurer, dropped US$2.87 to US$50.78. It said profit declined 14 percent last quarter as premiums rose less than medical costs. The company also lost customers. Unilever NV's US shares tumbled US$6.22 to US$57.07. The world's biggest maker of household products said first-quarter sales of its top brands, such as Knorr soups, grew less than it had forecast. S&P 500 futures expiring in June gained 12.40 to 927.40 on the Chicago Mercantile Exchange. June futures on the Nasdaq-100 Index jumped 25.50 to 1139.00. The index, a benchmark for Nasdaq's largest companies, rose 23.30 to 1136.51. Nasdaq-100 tracking shares, known by their QQQ ticker, gained 59 cents to US$28.28. The S&P 500 shares known as Spiders added US$1.31 to US$93.21. The Russell 2000 Index of smaller stocks rose 8.84, or 2.2 percent, to 407.67. The Wilshire 5000 Total Market Index, the broadest measure of US shares, gained 135.66, or 1.6 percent, to 8834.06. Based on changes in the Wilshire, the total value of US stocks increased by US$162.8 billion.

Taiwan Transport and Storage Corp (TTS, 台灣通運倉儲) yesterday unveiled its first electric tractor unit — manufactured by Volvo Trucks — in a ceremony in Taipei, and said the unit would soon be used to transport cement produced by Taiwan Cement Corp (TCC, 台灣水泥). Both TTS and TCC belong to TCC International Holdings Ltd (台泥國際集團). With the electric tractor unit, the Taipei-based cement firm would become the first in Taiwan to use electric vehicles to transport construction materials. TTS chairman Koo Kung-yi (辜公怡), Volvo Trucks vice president of sales and marketing Johan Selven, TCC president Roman Cheng (程耀輝) and Taikoo Motors Group

Among the rows of vibrators, rubber torsos and leather harnesses at a Chinese sex toys exhibition in Shanghai this weekend, the beginnings of an artificial intelligence (AI)-driven shift in the industry quietly pulsed. China manufactures about 70 percent of the world’s sex toys, most of it the “hardware” on display at the fair — whether that be technicolor tentacled dildos or hyper-realistic personalized silicone dolls. Yet smart toys have been rising in popularity for some time. Many major European and US brands already offer tech-enhanced products that can enable long-distance love, monitor well-being and even bring people one step closer to

RECORD-BREAKING: TSMC’s net profit last quarter beat market expectations by expanding 8.9% and it was the best first-quarter profit in the chipmaker’s history Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), which counts Nvidia Corp as a key customer, yesterday said that artificial intelligence (AI) server chip revenue is set to more than double this year from last year amid rising demand. The chipmaker expects the growth momentum to continue in the next five years with an annual compound growth rate of 50 percent, TSMC chief executive officer C.C. Wei (魏哲家) told investors yesterday. By 2028, AI chips’ contribution to revenue would climb to about 20 percent from a percentage in the low teens, Wei said. “Almost all the AI innovators are working with TSMC to address the

Malaysia’s leader yesterday announced plans to build a massive semiconductor design park, aiming to boost the Southeast Asian nation’s role in the global chip industry. A prominent player in the semiconductor industry for decades, Malaysia accounts for an estimated 13 percent of global back-end manufacturing, according to German tech giant Bosch. Now it wants to go beyond production and emerge as a chip design powerhouse too, Malaysian Prime Minister Anwar Ibrahim said. “I am pleased to announce the largest IC (integrated circuit) Design Park in Southeast Asia, that will house world-class anchor tenants and collaborate with global companies such as Arm [Holdings PLC],”